Over the last year, I’ve had strategy sessions with over 400 Amazon and Shopify sellers.

I get asked a LOT of questions about taxes, bookkeeping, and finances.

I’ve broken down the most common questions I receive on these strategy sessions, which may answer most (if not all) of your questions!

Let’s dig in!

Table of Contents:

- How do I handle bookkeeping for Amazon FBA? How about Shopify or other platforms?

- What Can I Write Off On My Taxes As An eCommerce Seller?

- Do I Have to Do My Business and Personal Taxes Separate?

- What if I put all my business expenses on personal cards or bank accounts?

- Should I use Cash or Accrual Method for Inventory?

- What if I sell on other selling channels like Mercari, Etsy, Stadium Goods, or GOAT?

- What should I do with receipts for my business purchases?

- Is the cashback I receive in my eCom business taxable?

- Why should I use an accountant that is familiar with eCommerce?

- I use discounted gift cards in my Amazon FBA business. How do I account for those?

- How do I handle Kohl’s Cash for Bookkeeping and Taxes?

- How do I get a sales tax exemption as a reseller? I don’t want to pay sales tax on my inventory.

Have even more questions? We have even more FAQ’s.

How do I handle bookkeeping for Amazon FBA? How about Shopify or other platforms?

There are multiple ways you can handle bookkeeping for eCom:

- DIY method for taxes. Use our business tax worksheet and inventory management tracking / profit analyzer tools. Tools like Seller Board, Inventory Lab, Accelerist, Shopkeeper, Triple Whale, Cin7, Extensiv, and Linnworks are all good options depending on the size of your business. This isn’t a perfect method by any stretch of the imagination, but it’s usually good enough for taxes for smaller eCom businesses.

- DIY method for sellers that understand accounting. Use accounting software like QuickBooks or Xero, inventory management / profit analyzer tools, and software to link your selling platforms with accounting software. Our company uses Link My Books for linking software, but A2X and Taxomate are also solid options.

- Hire Tall Oak Advisors to handle your bookkeeping. We are the bookkeeping experts for eCom. We can do a historical bookkeeping clean up, or start you with a fresh set of books. Schedule a strategy session today!

If you have no clue where to start, watch this video:

What Can I Write Off On My Taxes As An eCommerce Seller?

Here is a list of common expense categories and examples of things you can write off while running an eCommerce business such as Amazon FBA, Shopify, eBay, Walmart, Etsy, Mercari, or other reselling businesses taken directly from our FREE business tax worksheet:

- Advertising. Examples: PPC, business cards, websites, influencers, SEO, print ads, and online ads.

- Bank Fees. Examples: Monthly fees from banks, late fees, foreign exchange fees, and ATM Fees.

- Business Insurance. Examples: Liability, errors and omissions, and property.

- Business Repairs or Maintenance. Examples: HVAC maintenance plan for warehouse, and repairs on equipment such as computers, pallet jacks, or forklifts.

- Business Utilities. Examples: Electricity, gas, and water. You may be able to write some of these off for your home using the business use of home deduction.

- Commission and Fees. Examples: Commissions for a wholesale salesperson, real estate agent, or business agent.

- Continuing Education. Examples: Courses, books, and seminars.

- Contract Labor (United States). Examples: Independent contractors that are in the United States.

- Contract Labor (Foreign). Examples: Workers from outside of the US. This could be places like the Philippines, Pakistan, India, and Mexico. Virtual assistants are the most common.

- Ecom Platform Charges. Examples: Amazon fees (subscription, FBA, shipping labels, commissions), eBay fees (transaction fees, final value, etc), Shopify fees (transaction fees, merchant fees)

- Employee Benefit Programs. Examples: Accident and health plans, group life insurance, and dependent care assistance.

- Equipment. Examples: Pallet jack, pallet racking, pallet wrapping machine, packaging machine, and tape dispensing machine.

- Interest on Loans. Examples: Amazon loan, Marcus loan, Paypal loan, bank line of credit, and credit card interest.

- Internet. Examples: Comcast, Spectrum, AT&T, and Google Fiber.

- Inventory. Examples: Inventory purchased for resale. Includes sales tax and shipping paid when you bought the items.

- Inventory Loss / Disposal. Examples: Expired or damaged items you can no longer resell, inventory lost in a warehouse, or stolen inventory.

- Inventory Prep Service / 3PL. Examples: Prep centers, and logistics warehouse for storage.

- Legal and Professional Services. Examples: Tax preparation, bookkeeping, lawyers, and LLC filing.

- Meals. Examples: Business meeting meals, and meals while traveling.

- Mortgage Interest for Commercial Buildings. Examples: Mortgage interest you paid on a commercial building you own for your business. This does not include your personal residence.

- Office Expenses. Examples: Staplers, printers, computers, headphones, desks, and monitors.

- Other Expenses. Examples: Business expenses you believe don’t fit elsewhere.

- Rent/Lease of Office/Warehouse. Examples: Storage locker, warehouse, and co-working space. This does not include your home.

- Shipping Costs. Examples: UPS, FedEx, USPS, and PirateShip.

- Software. Examples: Keepa, Selleramp, Inventory Lab, Helium 10, Jungle Scout, Data Dive, Seller Snap, Quickbooks, and Xero.

- Startup Costs. Examples: Costs you incurred before you started your business. (LLC creation, travel, courses, advertising).

- Subscription Services. Examples: Lead lists, Linkedin Premium, MDS, Seller Basics, and Discord Groups like Arbitrage Ops, Divine, and the Amazon Wholesale Community.

- Supplies. Examples: Boxes, tape, labels, paper, staples, and pens.

- Taxes and licenses. Examples: Business property taxes, business franchise taxes, payroll taxes, and business licenses. This does not include the normal income taxes you paid to the IRS that are due with your personal tax return.

- Telephone. Examples: Cell phone, landline phone at a business, and VOIP service. Landline phones at your home are not included.

- Travel. Examples: Airfare, Uber, Lyft, rental car, hotel, and AirBNB.

- Vehicle Expenses. Examples: Lease, car payment, gas, oil changes, and repairs. However, you only write these off if your business owns the vehicle.

- Vehicle Mileage. Driving your personal vehicle for business use. Examples: Sourcing trips, UPS drop-offs, and visiting suppliers.

- Vehicle Incidentals. Examples: Parking, tolls, car washes, and DMV for business-owned vehicles.

- Wages (Payroll for W-2). Examples: Payroll for W-2 employees.

I explain these in more detail and show more in this video:

| Pro Tip! Download our Business Tax Worksheet to track your expenses! |

Do I Have to Do My Business and Personal Taxes Separate?

This is pretty simple and depends on the type of business you operate:

- Sole Proprietor or LLC: Your business taxes are added to your personal taxes. There is a Schedule C that will be completed for every business. This means when your business taxes are being completed, your personal are done at the same time. These returns are typically due in April.

- Married to a Partner: If you are married filing jointly, and have a multi-member LLC, it’s treated the same way as an LLC above. If you are married but filing separately, generally we recommend filing a Partnership return. This is a separate business return that will issue K-1’s for each partner. Those K-1’s are similar to W-2’s you would receive from a regular 9-5 job, and are used on your personal return. The partnership returns are typically due in March, a month earlier than personal returns.

- Partnerships: If you are not married to a partner, a partnership return is required. This is a separate business return that will issue K-1’s for each partner. Those K-1’s are similar to W-2’s you would receive from a regular 9-5 job, and are used on your personal return. The partnership returns are typically due in March, a month earlier than personal returns.

- S-Corps: You will file an S-Corp Business tax return. This is a separate business return that will issue K-1’s for each shareholder of the S-Corp. Those K-1’s are similar to W-2’s you would receive from a regular 9-5 job, and are used on your personal return. The S-Corp returns are typically due in March, a month earlier than personal returns.

- C-Corps: You will file a C-Corp Business tax return. C-Corp returns are taxed at a business level, and do not impact your personal taxes. The C-Corp returns are typically due in April.

What if I put all my business expenses on personal cards or bank accounts?

A situation we see a lot with new eCom sellers is they use their personal credit cards and personal bank accounts to start their business. In a lot of cases, it’s just kind of a side hustle and they have no idea whether it’s going to work or not.

Ideally, you want to put all business transactions on business credit cards and business bank accounts.

If you didn’t do this, and you need to get ready for taxes, here’s our recommendation:

- Identify which transactions are business and which are personal. Use our business tax worksheet, and only log the business transactions. You should be ignoring your personal transactions.

- Stop commingling your business and personal transactions immediately. If you have to use personal credit cards, use one card for ONLY personal transactions, and use the other cards for business. Never use the personal transaction card for business purchases, and never use the business transaction card for personal purchases.

I go a little more in-depth into this topic, along with recommendations for business cards here:

Should I use Cash or Accrual Method for Inventory?

If you have no clue what cash or accrual method of accounting is, here’s the quick basics:

- Cash Method: Purchases are deducted for tax purposes when you purchase them. This means you write off all inventory the moment you buy it, not when you sell it.

- Accrual Method: Purchases are deducted for tax purposes when you sell them. This means you do NOT write off inventory when you buy it. It’s considered an asset until you sell it. Once you sell the inventory, you can write it off.

This has huge tax implications short term and long term.

The first year you are in business, you have an option to choose cash or accrual. It’s an important decision because once you’ve made that decision, it’s difficult to switch to the other option. If you’ve already done taxes and chosen an option, typically we will stick with the same option since it’s so difficult to change.

If you have the option, how do you choose?

If you didn’t track your inventory buy costs throughout the year, or have no inventory tracking, the cash method is the only option you can choose for taxes.

However, if you’ve been tracking your inventory, you can choose!

Most accountants will recommend the cash option. It gives you the biggest deduction when you file your taxes, which means you may have zero taxes your first year in your eCommerce business.

However, this could impact your business long term.

Watch this video as I debate cash vs. accrual method and describe how it can impact your business:

What if I sell on other selling channels like Mercari, Etsy, Stadium Goods, or GOAT?

The major selling channels most eCom businesses sell on are Amazon, eBay, Shopify, and Walmart. These selling channels are pretty sophisticated with the reporting they give, and there are integrations available for them. This makes accounting significantly easier for these platforms.

But, what if you sell on other selling channels?

Accounting is slightly more difficult with these platforms, but it’s doable!

Reports can be generated from each of these selling platforms for tax purposes. When you work with us for taxes, we’ll let you know which reports are needed, and give you instructions to download them.

No matter the selling platform, if you have sold over $20,000 with 200 transactions, you’ll receive a 1099-K from each platform. This is submitted to the IRS, and describes the revenue you received from those platforms.

Watch this video for a little more detail on this subject:

What should I do with receipts for my business purchases?

Well, you should keep them.

No one, literally no one likes holding on to receipts. But, the IRS likes it, so it is something that we have to think about.

You should keep receipts for up to three years for all of your purchases. What this means is that if you were to get audited, they likely would look at your bank statements, credit card statements, and may ask for some proof of each individual item that was purchased.

The real question you have to ask yourself:

If I got audited how would I be able to prove the deduction?

In this video, I discuss what to do with those receipts:

| Pro Tip! Stay organized while running your business. Keeping documentation for your tax deductions ensures you are always prepared in case of a tax audit. |

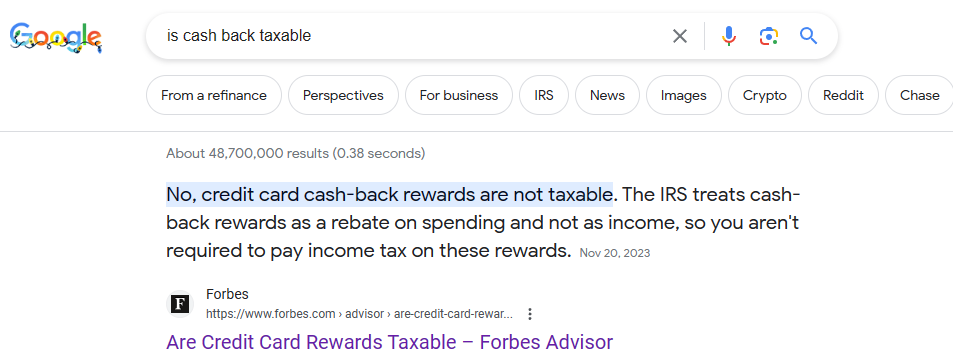

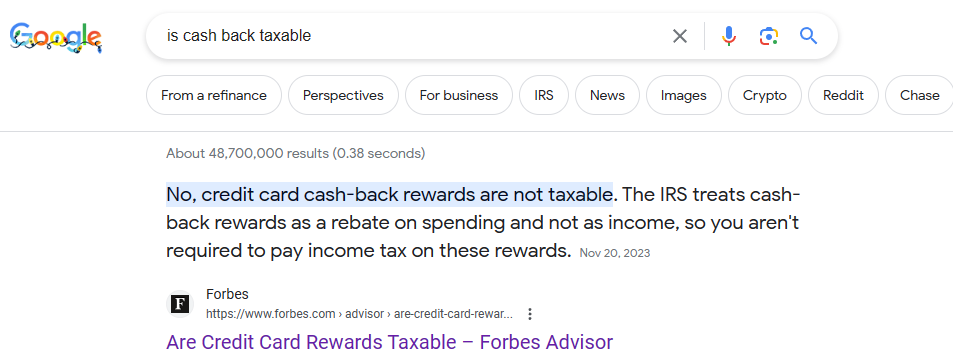

Is the cashback I receive in my eCom business taxable?

This is an extremely hot topic and heavily debated by Amazon FBA sellers and other eCom owners.

The reason why it’s debated is because even many CPA’s and accountants are confused about the subject.

Do a google search for “is cash back taxable?” and the featured snippet by Forbes says no.

But…..

The context being shown here is for CONSUMERS, not business owners.

Cash back is taxable if it’s in your business.

Watch this video to find out why:

| Pro Tip! Use mileage or gift cards instead of cash back. These options are proven by the IRS to not be taxable. |

Why should I use an accountant that is familiar with eCommerce?

The biggest difference between Tall Oak Advisors and local accounting firms is expertise. Most accounting firms are “jack of all trade” type of firms, where they will have clients in multiple industries. That’s right, the same person working on Suzy’s Nail Salon, John’s Trucking Service, Bob’s Construction Company, and Anna’s Sandwich Shop is working on your eCommerce business. Let’s be honest here – eCommerce is tricky and there are a lot of moving parts. They just don’t understand your business. We do. Both of our founders have operated eight-figure eCommerce businesses. We know the eCommerce industry better than your local accounting firm, which means we can spot inaccuracies others can’t. In addition, we know where to look to find the missing money and improve profitability.

There are many other reasons to choose Tall Oak Advisors over a local accounting firm:

- We have multiple people on our team that can work on your account. When your local accountant or bookkeeper goes on vacation, is sick, or is overwhelmed with work – your financials are not done on time. This means you can’t make decisions quickly enough, which costs you money. Your sales taxes might not get paid on time, and the reports you need for the bank aren’t ready. Absolute chaos!

- Our bookkeeping team is comprised of Quickbooks Certified ProAdvisors and go through rigorous training. How much training has your local bookkeeper gone through? You want everything to be rock solid in your business. Our team goes through rigorous training before they ever touch your business. The person doing your books locally might have spent 3 hours on YouTube to figure out bookkeeping.

- We focus on making you more profitable. Most CPAs only focus on the numbers. They make sure the numbers are right for tax purposes, but give business owners minimal value outside of compliance. Not only do we make sure the numbers are right, but we also look for ways to improve the profitability of your business.

This year, we helped a client save $13,000 in taxes they overpaid due to improper work done by a CPA that didn’t understand eCommerce.

Learn more in this video:

| Pro Tip! Only hire an accountant that fully understands your business. Why pay more in taxes than you should? |

I use discounted gift cards in my Amazon FBA business. How do I account for those?

Many arbitrage sellers buy gift cards for sites like Raise and Card Cash to improve their margins.

But, this can be a headache for accounting purposes.

In this video, I describe how to handle them:

How do I handle Kohl’s Cash for Bookkeeping and Taxes?

Many arbitrage sellers use Kohl’s as a source of inventory.

This means they receive a lot of Kohl’s Cash!

But, how do you account for it?

Watch this quick video to find out:

Over the last year, I’ve had strategy sessions with over 400 Amazon and Shopify sellers.

I get asked a LOT of questions about taxes, bookkeeping, and finances.

I’ve broken down the most common questions I receive on these strategy sessions, which may answer most (if not all) of your questions!

Let’s dig in!

Table of Contents:

- How do I handle bookkeeping for Amazon FBA? How about Shopify or other platforms?

- What Can I Write Off On My Taxes As An eCommerce Seller?

- Do I Have to Do My Business and Personal Taxes Separate?

- What if I put all my business expenses on personal cards or bank accounts?

- Should I use Cash or Accrual Method for Inventory?

- What if I sell on other selling channels like Mercari, Etsy, Stadium Goods, or GOAT?

- What should I do with receipts for my business purchases?

- Is the cashback I receive in my eCom business taxable?

- Why should I use an accountant that is familiar with eCommerce?

- I use discounted gift cards in my Amazon FBA business. How do I account for those?

- How do I handle Kohl’s Cash for Bookkeeping and Taxes?

- How do I get a sales tax exemption as a reseller? I don’t want to pay sales tax on my inventory.

Have even more questions? We have even more FAQ’s.

How do I handle bookkeeping for Amazon FBA? How about Shopify or other platforms?

There are multiple ways you can handle bookkeeping for eCom:

- DIY method for taxes. Use our business tax worksheet and inventory management tracking / profit analyzer tools. Tools like Seller Board, Inventory Lab, Accelerist, Shopkeeper, Triple Whale, Cin7, Extensiv, and Linnworks are all good options depending on the size of your business. This isn’t a perfect method by any stretch of the imagination, but it’s usually good enough for taxes for smaller eCom businesses.

- DIY method for sellers that understand accounting. Use accounting software like QuickBooks or Xero, inventory management / profit analyzer tools, and software to link your selling platforms with accounting software. Our company uses Link My Books for linking software, but A2X and Taxomate are also solid options.

- Hire Tall Oak Advisors to handle your bookkeeping. We are the bookkeeping experts for eCom. We can do a historical bookkeeping clean up, or start you with a fresh set of books. Schedule a strategy session today!

If you have no clue where to start, watch this video:

What Can I Write Off On My Taxes As An eCommerce Seller?

Here is a list of common expense categories and examples of things you can write off while running an eCommerce business such as Amazon FBA, Shopify, eBay, Walmart, Etsy, Mercari, or other reselling businesses taken directly from our FREE business tax worksheet:

- Advertising. Examples: PPC, business cards, websites, influencers, SEO, print ads, and online ads.

- Bank Fees. Examples: Monthly fees from banks, late fees, foreign exchange fees, and ATM Fees.

- Business Insurance. Examples: Liability, errors and omissions, and property.

- Business Repairs or Maintenance. Examples: HVAC maintenance plan for warehouse, and repairs on equipment such as computers, pallet jacks, or forklifts.

- Business Utilities. Examples: Electricity, gas, and water. You may be able to write some of these off for your home using the business use of home deduction.

- Commission and Fees. Examples: Commissions for a wholesale salesperson, real estate agent, or business agent.

- Continuing Education. Examples: Courses, books, and seminars.

- Contract Labor (United States). Examples: Independent contractors that are in the United States.

- Contract Labor (Foreign). Examples: Workers from outside of the US. This could be places like the Philippines, Pakistan, India, and Mexico. Virtual assistants are the most common.

- Ecom Platform Charges. Examples: Amazon fees (subscription, FBA, shipping labels, commissions), eBay fees (transaction fees, final value, etc), Shopify fees (transaction fees, merchant fees)

- Employee Benefit Programs. Examples: Accident and health plans, group life insurance, and dependent care assistance.

- Equipment. Examples: Pallet jack, pallet racking, pallet wrapping machine, packaging machine, and tape dispensing machine.

- Interest on Loans. Examples: Amazon loan, Marcus loan, Paypal loan, bank line of credit, and credit card interest.

- Internet. Examples: Comcast, Spectrum, AT&T, and Google Fiber.

- Inventory. Examples: Inventory purchased for resale. Includes sales tax and shipping paid when you bought the items.

- Inventory Loss / Disposal. Examples: Expired or damaged items you can no longer resell, inventory lost in a warehouse, or stolen inventory.

- Inventory Prep Service / 3PL. Examples: Prep centers, and logistics warehouse for storage.

- Legal and Professional Services. Examples: Tax preparation, bookkeeping, lawyers, and LLC filing.

- Meals. Examples: Business meeting meals, and meals while traveling.

- Mortgage Interest for Commercial Buildings. Examples: Mortgage interest you paid on a commercial building you own for your business. This does not include your personal residence.

- Office Expenses. Examples: Staplers, printers, computers, headphones, desks, and monitors.

- Other Expenses. Examples: Business expenses you believe don’t fit elsewhere.

- Rent/Lease of Office/Warehouse. Examples: Storage locker, warehouse, and co-working space. This does not include your home.

- Shipping Costs. Examples: UPS, FedEx, USPS, and PirateShip.

- Software. Examples: Keepa, Selleramp, Inventory Lab, Helium 10, Jungle Scout, Data Dive, Seller Snap, Quickbooks, and Xero.

- Startup Costs. Examples: Costs you incurred before you started your business. (LLC creation, travel, courses, advertising).

- Subscription Services. Examples: Lead lists, Linkedin Premium, MDS, Seller Basics, and Discord Groups like Arbitrage Ops, Divine, and the Amazon Wholesale Community.

- Supplies. Examples: Boxes, tape, labels, paper, staples, and pens.

- Taxes and licenses. Examples: Business property taxes, business franchise taxes, payroll taxes, and business licenses. This does not include the normal income taxes you paid to the IRS that are due with your personal tax return.

- Telephone. Examples: Cell phone, landline phone at a business, and VOIP service. Landline phones at your home are not included.

- Travel. Examples: Airfare, Uber, Lyft, rental car, hotel, and AirBNB.

- Vehicle Expenses. Examples: Lease, car payment, gas, oil changes, and repairs. However, you only write these off if your business owns the vehicle.

- Vehicle Mileage. Driving your personal vehicle for business use. Examples: Sourcing trips, UPS drop-offs, and visiting suppliers.

- Vehicle Incidentals. Examples: Parking, tolls, car washes, and DMV for business-owned vehicles.

- Wages (Payroll for W-2). Examples: Payroll for W-2 employees.

I explain these in more detail and show more in this video:

| Pro Tip! Download our Business Tax Worksheet to track your expenses! |

Do I Have to Do My Business and Personal Taxes Separate?

This is pretty simple and depends on the type of business you operate:

- Sole Proprietor or LLC: Your business taxes are added to your personal taxes. There is a Schedule C that will be completed for every business. This means when your business taxes are being completed, your personal are done at the same time. These returns are typically due in April.

- Married to a Partner: If you are married filing jointly, and have a multi-member LLC, it’s treated the same way as an LLC above. If you are married but filing separately, generally we recommend filing a Partnership return. This is a separate business return that will issue K-1’s for each partner. Those K-1’s are similar to W-2’s you would receive from a regular 9-5 job, and are used on your personal return. The partnership returns are typically due in March, a month earlier than personal returns.

- Partnerships: If you are not married to a partner, a partnership return is required. This is a separate business return that will issue K-1’s for each partner. Those K-1’s are similar to W-2’s you would receive from a regular 9-5 job, and are used on your personal return. The partnership returns are typically due in March, a month earlier than personal returns.

- S-Corps: You will file an S-Corp Business tax return. This is a separate business return that will issue K-1’s for each shareholder of the S-Corp. Those K-1’s are similar to W-2’s you would receive from a regular 9-5 job, and are used on your personal return. The S-Corp returns are typically due in March, a month earlier than personal returns.

- C-Corps: You will file a C-Corp Business tax return. C-Corp returns are taxed at a business level, and do not impact your personal taxes. The C-Corp returns are typically due in April.

What if I put all my business expenses on personal cards or bank accounts?

A situation we see a lot with new eCom sellers is they use their personal credit cards and personal bank accounts to start their business. In a lot of cases, it’s just kind of a side hustle and they have no idea whether it’s going to work or not.

Ideally, you want to put all business transactions on business credit cards and business bank accounts.

If you didn’t do this, and you need to get ready for taxes, here’s our recommendation:

- Identify which transactions are business and which are personal. Use our business tax worksheet, and only log the business transactions. You should be ignoring your personal transactions.

- Stop commingling your business and personal transactions immediately. If you have to use personal credit cards, use one card for ONLY personal transactions, and use the other cards for business. Never use the personal transaction card for business purchases, and never use the business transaction card for personal purchases.

I go a little more in-depth into this topic, along with recommendations for business cards here:

Should I use Cash or Accrual Method for Inventory?

If you have no clue what cash or accrual method of accounting is, here’s the quick basics:

- Cash Method: Purchases are deducted for tax purposes when you purchase them. This means you write off all inventory the moment you buy it, not when you sell it.

- Accrual Method: Purchases are deducted for tax purposes when you sell them. This means you do NOT write off inventory when you buy it. It’s considered an asset until you sell it. Once you sell the inventory, you can write it off.

This has huge tax implications short term and long term.

The first year you are in business, you have an option to choose cash or accrual. It’s an important decision because once you’ve made that decision, it’s difficult to switch to the other option. If you’ve already done taxes and chosen an option, typically we will stick with the same option since it’s so difficult to change.

If you have the option, how do you choose?

If you didn’t track your inventory buy costs throughout the year, or have no inventory tracking, the cash method is the only option you can choose for taxes.

However, if you’ve been tracking your inventory, you can choose!

Most accountants will recommend the cash option. It gives you the biggest deduction when you file your taxes, which means you may have zero taxes your first year in your eCommerce business.

However, this could impact your business long term.

Watch this video as I debate cash vs. accrual method and describe how it can impact your business:

What if I sell on other selling channels like Mercari, Etsy, Stadium Goods, or GOAT?

The major selling channels most eCom businesses sell on are Amazon, eBay, Shopify, and Walmart. These selling channels are pretty sophisticated with the reporting they give, and there are integrations available for them. This makes accounting significantly easier for these platforms.

But, what if you sell on other selling channels?

Accounting is slightly more difficult with these platforms, but it’s doable!

Reports can be generated from each of these selling platforms for tax purposes. When you work with us for taxes, we’ll let you know which reports are needed, and give you instructions to download them.

No matter the selling platform, if you have sold over $20,000 with 200 transactions, you’ll receive a 1099-K from each platform. This is submitted to the IRS, and describes the revenue you received from those platforms.

Watch this video for a little more detail on this subject:

What should I do with receipts for my business purchases?

Well, you should keep them.

No one, literally no one likes holding on to receipts. But, the IRS likes it, so it is something that we have to think about.

You should keep receipts for up to three years for all of your purchases. What this means is that if you were to get audited, they likely would look at your bank statements, credit card statements, and may ask for some proof of each individual item that was purchased.

The real question you have to ask yourself:

If I got audited how would I be able to prove the deduction?

In this video, I discuss what to do with those receipts:

| Pro Tip! Stay organized while running your business. Keeping documentation for your tax deductions ensures you are always prepared in case of a tax audit. |

Is the cashback I receive in my eCom business taxable?

This is an extremely hot topic and heavily debated by Amazon FBA sellers and other eCom owners.

The reason why it’s debated is because even many CPA’s and accountants are confused about the subject.

Do a google search for “is cash back taxable?” and the featured snippet by Forbes says no.

But…..

The context being shown here is for CONSUMERS, not business owners.

Cash back is taxable if it’s in your business.

Watch this video to find out why:

| Pro Tip! Use mileage or gift cards instead of cash back. These options are proven by the IRS to not be taxable. |

Why should I use an accountant that is familiar with eCommerce?

The biggest difference between Tall Oak Advisors and local accounting firms is expertise. Most accounting firms are “jack of all trade” type of firms, where they will have clients in multiple industries. That’s right, the same person working on Suzy’s Nail Salon, John’s Trucking Service, Bob’s Construction Company, and Anna’s Sandwich Shop is working on your eCommerce business. Let’s be honest here – eCommerce is tricky and there are a lot of moving parts. They just don’t understand your business. We do. Both of our founders have operated eight-figure eCommerce businesses. We know the eCommerce industry better than your local accounting firm, which means we can spot inaccuracies others can’t. In addition, we know where to look to find the missing money and improve profitability.

There are many other reasons to choose Tall Oak Advisors over a local accounting firm:

- We have multiple people on our team that can work on your account. When your local accountant or bookkeeper goes on vacation, is sick, or is overwhelmed with work – your financials are not done on time. This means you can’t make decisions quickly enough, which costs you money. Your sales taxes might not get paid on time, and the reports you need for the bank aren’t ready. Absolute chaos!

- Our bookkeeping team is comprised of Quickbooks Certified ProAdvisors and go through rigorous training. How much training has your local bookkeeper gone through? You want everything to be rock solid in your business. Our team goes through rigorous training before they ever touch your business. The person doing your books locally might have spent 3 hours on YouTube to figure out bookkeeping.

- We focus on making you more profitable. Most CPAs only focus on the numbers. They make sure the numbers are right for tax purposes, but give business owners minimal value outside of compliance. Not only do we make sure the numbers are right, but we also look for ways to improve the profitability of your business.

This year, we helped a client save $13,000 in taxes they overpaid due to improper work done by a CPA that didn’t understand eCommerce.

Learn more in this video:

| Pro Tip! Only hire an accountant that fully understands your business. Why pay more in taxes than you should? |

I use discounted gift cards in my Amazon FBA business. How do I account for those?

Many arbitrage sellers buy gift cards for sites like Raise and Card Cash to improve their margins.

But, this can be a headache for accounting purposes.

In this video, I describe how to handle them:

How do I handle Kohl’s Cash for Bookkeeping and Taxes?

Many arbitrage sellers use Kohl’s as a source of inventory.

This means they receive a lot of Kohl’s Cash!

But, how do you account for it?

Watch this quick video to find out: