A new analysis shows most arbitrage businesses confuse Amazon payouts with profit — and the IRS is cashing in on their mistakes.

key points

If you’re running retail or online arbitrage, the buying and flipping of products might feel simple — hunt a deal, list it on Amazon, make a sale. But when it comes to Amazon Arbitrage accounting, most sellers quickly discover it’s a completely different game. Amazon’s payout system is messy, margins are razor-thin, and tax season can feel like a nightmare without the right systems in place.

This guide breaks down how to set up accounting for Amazon arbitrage sellers, why accurate bookkeeping separates winners from hobbyists, and which tools and workflows make it sustainable long-term.

Table of Contents

Why Most Amazon Arbitrage Sellers Lose Money

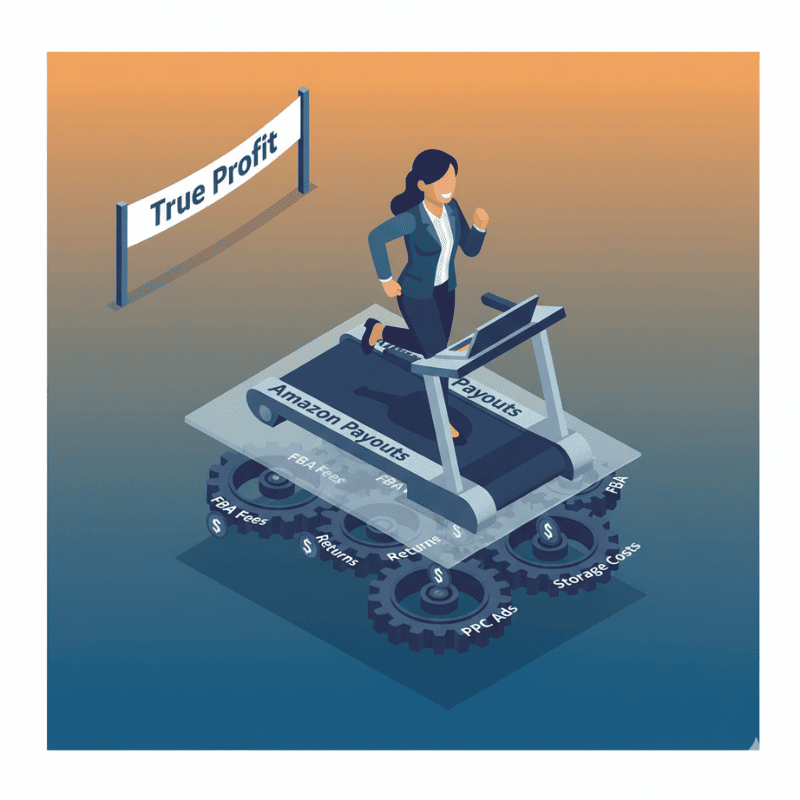

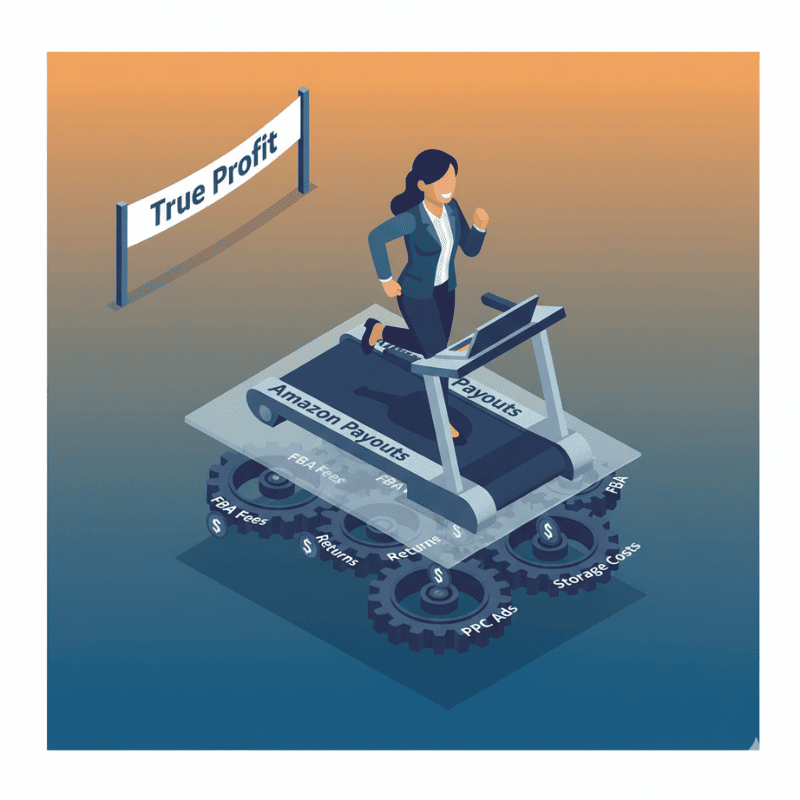

Many arbitrage sellers assume Amazon’s deposits equal profit. But those deposits hide seller fees, FBA charges, PPC ad costs, returns, and storage deductions. On the surface, it might look like you’re turning a profit, but once you reconcile fees, you may be barely breaking even — or worse, losing money.

💡 Think of it like running a marathon without ever checking the distance. You feel like you’re moving fast, but you don’t actually know if you’re anywhere near the finish line.

The First Step to Looking Like a Real Amazon Arbitrage Business

Even if you’re only moving $10K/month, having proper books signals discipline and readiness to scale. Plus, the cost of setup? 100% deductible.

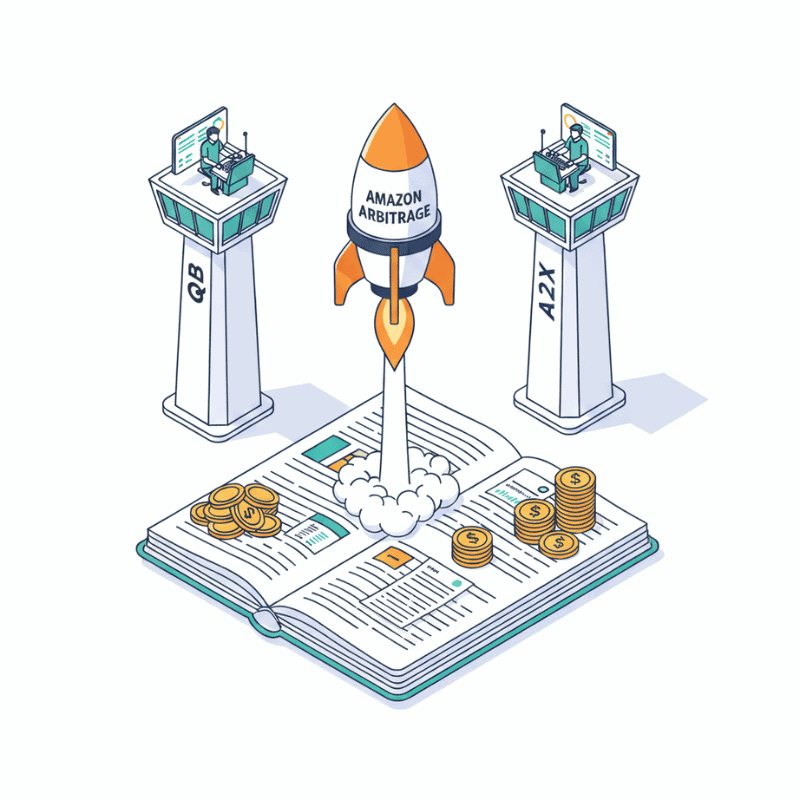

🚀 Small rockets still need strong launchpads. Amazon Arbitrage accounting is your launchpad. Without it, you’ll never truly lift off.

The Core Accounting Stack for Amazon Arbitrage Sellers

So how do you actually do accounting for arbitrage? You don’t need to become a CPA — you just need the right stack of tools.

Bookkeeping Software For Arbitrage Selling

This is your financial control center. It:

- Tracks income and expenses

- Produces Profit & Loss statements

- Syncs with your bank and credit cards for reconciliation

- Helps with invoicing, bill pay, and basic inventory tracking

QuickBooks tends to be best for U.S. arbitrage sellers thanks to tax integrations.

Amazon Arbitrage Accounting Sync Tool

Amazon payouts are notoriously confusing. Sync tools like Link My Books break them into sales, fees, returns, and reimbursements — so you see the real numbers instead of just a lump deposit.

Without this step, arbitrage sellers are flying blind.

Sellerboard Helps You Track Your Inventory Costs And Overall Value (Balance Sheet Item)

Sellerboard is an all-in-one profit analytics and expense tracking tool built specifically for Amazon sellers. It goes beyond surface-level revenue reporting by breaking down real profits per SKU after Amazon fees, shipping, PPC, and refunds.

Taxes and Amazon Arbitrage Deductions

Here’s where most arbitrage sellers overpay: they fail to track legitimate deductions. With margins already thin, every dollar matters. Common seller tax deductions include:

- Mileage to retail stores for RA sourcing

- Shipping supplies and prep center fees

- Home office expenses

- Amazon PPC spend

- Inventory write-offs for damaged or unsellable items

Done right, Amazon Arbitrage accounting can save you thousands at tax time.

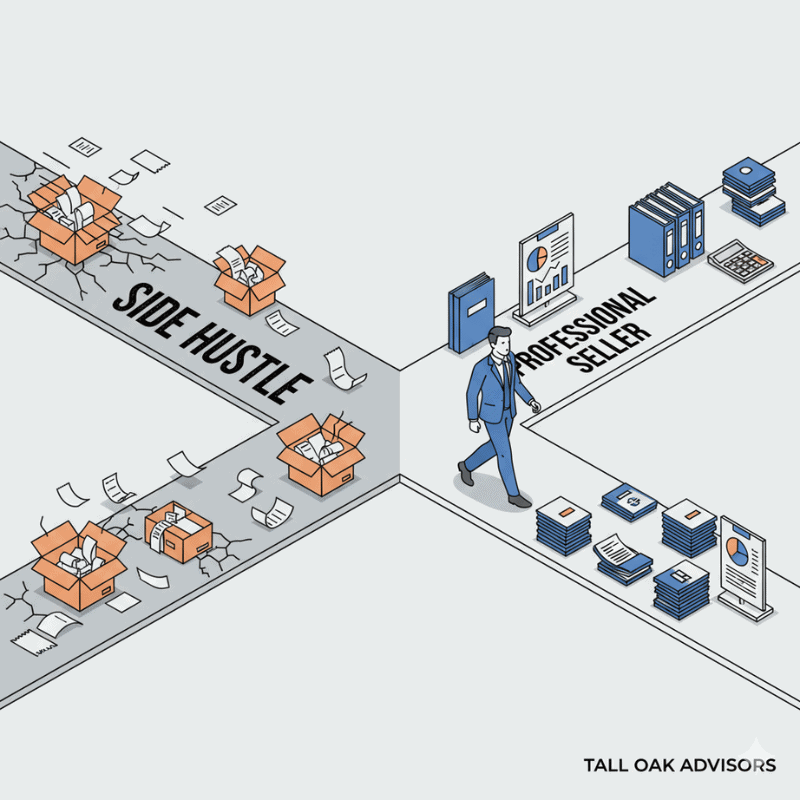

Scaling Beyond Amazon Arbitrage with Professional Books

If you want to move beyond flipping clearance deals, you’ll need:

- Clean P&Ls to secure wholesale accounts

- Balance sheets to get bank funding

- Tax-ready books to survive IRS scrutiny

Your accounting isn’t just compliance — it’s leverage. The sellers who track every dollar are the ones who win wholesale accounts, build brands, and actually scale.

Conclusion: Why Amazon Arbitrage Accounting Is Non-Negotiable

Retail and online arbitrage can generate fast sales — but without disciplined accounting, it’s almost impossible to know if you’re actually profitable. Clean books protect your margins, lower your taxes, and give you the leverage to grow into wholesale, private label, or beyond.

In short: you can hustle your way into sales, but only accounting gets you into profits.

Ready to Stop Guessing and Start Growing?

Let’s be real: Amazon arbitrage is brutal on margins. One missed deduction, one sloppy set of books, and you’re not just losing money—you’re sabotaging your own growth. The truth is, you can hustle your way into sales, but you can’t hustle your way into profits without clean accounting.

That’s where we come in. At Tall Oak Advisors, we specialize in bookkeeping and tax services for Amazon sellers who are serious about treating their business like a business. We’ll help you track every dollar, protect your margins, and keep the IRS off your back—so you can focus on sourcing, selling, and scaling.

Take two minutes to fill out our short survey to see if we are a good fit for you. You’ll walk away knowing exactly where your finances stand—and how we can turn chaos into clarity.

Affiliate Disclaimer

Some of the links in this article are affiliate links, which means we may earn a small commission if you click through and make a purchase. This comes at no additional cost to you. We only recommend products and services we genuinely believe could benefit Amazon sellers and enhance their business efficiency. Thank you for supporting us and helping keep our content free.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

A new analysis shows most arbitrage businesses confuse Amazon payouts with profit — and the IRS is cashing in on their mistakes.

key points

If you’re running retail or online arbitrage, the buying and flipping of products might feel simple — hunt a deal, list it on Amazon, make a sale. But when it comes to Amazon Arbitrage accounting, most sellers quickly discover it’s a completely different game. Amazon’s payout system is messy, margins are razor-thin, and tax season can feel like a nightmare without the right systems in place.

This guide breaks down how to set up accounting for Amazon arbitrage sellers, why accurate bookkeeping separates winners from hobbyists, and which tools and workflows make it sustainable long-term.

Table of Contents

Why Most Amazon Arbitrage Sellers Lose Money

Many arbitrage sellers assume Amazon’s deposits equal profit. But those deposits hide seller fees, FBA charges, PPC ad costs, returns, and storage deductions. On the surface, it might look like you’re turning a profit, but once you reconcile fees, you may be barely breaking even — or worse, losing money.

💡 Think of it like running a marathon without ever checking the distance. You feel like you’re moving fast, but you don’t actually know if you’re anywhere near the finish line.

The First Step to Looking Like a Real Amazon Arbitrage Business

Even if you’re only moving $10K/month, having proper books signals discipline and readiness to scale. Plus, the cost of setup? 100% deductible.

🚀 Small rockets still need strong launchpads. Amazon Arbitrage accounting is your launchpad. Without it, you’ll never truly lift off.

The Core Accounting Stack for Amazon Arbitrage Sellers

So how do you actually do accounting for arbitrage? You don’t need to become a CPA — you just need the right stack of tools.

Bookkeeping Software For Arbitrage Selling

This is your financial control center. It:

- Tracks income and expenses

- Produces Profit & Loss statements

- Syncs with your bank and credit cards for reconciliation

- Helps with invoicing, bill pay, and basic inventory tracking

QuickBooks tends to be best for U.S. arbitrage sellers thanks to tax integrations.

Amazon Arbitrage Accounting Sync Tool

Amazon payouts are notoriously confusing. Sync tools like Link My Books break them into sales, fees, returns, and reimbursements — so you see the real numbers instead of just a lump deposit.

Without this step, arbitrage sellers are flying blind.

Sellerboard Helps You Track Your Inventory Costs And Overall Value (Balance Sheet Item)

Sellerboard is an all-in-one profit analytics and expense tracking tool built specifically for Amazon sellers. It goes beyond surface-level revenue reporting by breaking down real profits per SKU after Amazon fees, shipping, PPC, and refunds.

Taxes and Amazon Arbitrage Deductions

Here’s where most arbitrage sellers overpay: they fail to track legitimate deductions. With margins already thin, every dollar matters. Common seller tax deductions include:

- Mileage to retail stores for RA sourcing

- Shipping supplies and prep center fees

- Home office expenses

- Amazon PPC spend

- Inventory write-offs for damaged or unsellable items

Done right, Amazon Arbitrage accounting can save you thousands at tax time.

Scaling Beyond Amazon Arbitrage with Professional Books

If you want to move beyond flipping clearance deals, you’ll need:

- Clean P&Ls to secure wholesale accounts

- Balance sheets to get bank funding

- Tax-ready books to survive IRS scrutiny

Your accounting isn’t just compliance — it’s leverage. The sellers who track every dollar are the ones who win wholesale accounts, build brands, and actually scale.

Conclusion: Why Amazon Arbitrage Accounting Is Non-Negotiable

Retail and online arbitrage can generate fast sales — but without disciplined accounting, it’s almost impossible to know if you’re actually profitable. Clean books protect your margins, lower your taxes, and give you the leverage to grow into wholesale, private label, or beyond.

In short: you can hustle your way into sales, but only accounting gets you into profits.

Ready to Stop Guessing and Start Growing?

Let’s be real: Amazon arbitrage is brutal on margins. One missed deduction, one sloppy set of books, and you’re not just losing money—you’re sabotaging your own growth. The truth is, you can hustle your way into sales, but you can’t hustle your way into profits without clean accounting.

That’s where we come in. At Tall Oak Advisors, we specialize in bookkeeping and tax services for Amazon sellers who are serious about treating their business like a business. We’ll help you track every dollar, protect your margins, and keep the IRS off your back—so you can focus on sourcing, selling, and scaling.

Take two minutes to fill out our short survey to see if we are a good fit for you. You’ll walk away knowing exactly where your finances stand—and how we can turn chaos into clarity.

Affiliate Disclaimer

Some of the links in this article are affiliate links, which means we may earn a small commission if you click through and make a purchase. This comes at no additional cost to you. We only recommend products and services we genuinely believe could benefit Amazon sellers and enhance their business efficiency. Thank you for supporting us and helping keep our content free.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.