Misreporting gross vs. net sales leaves sellers owing thousands — accountants urge urgent fixes before penalties stack.

key points

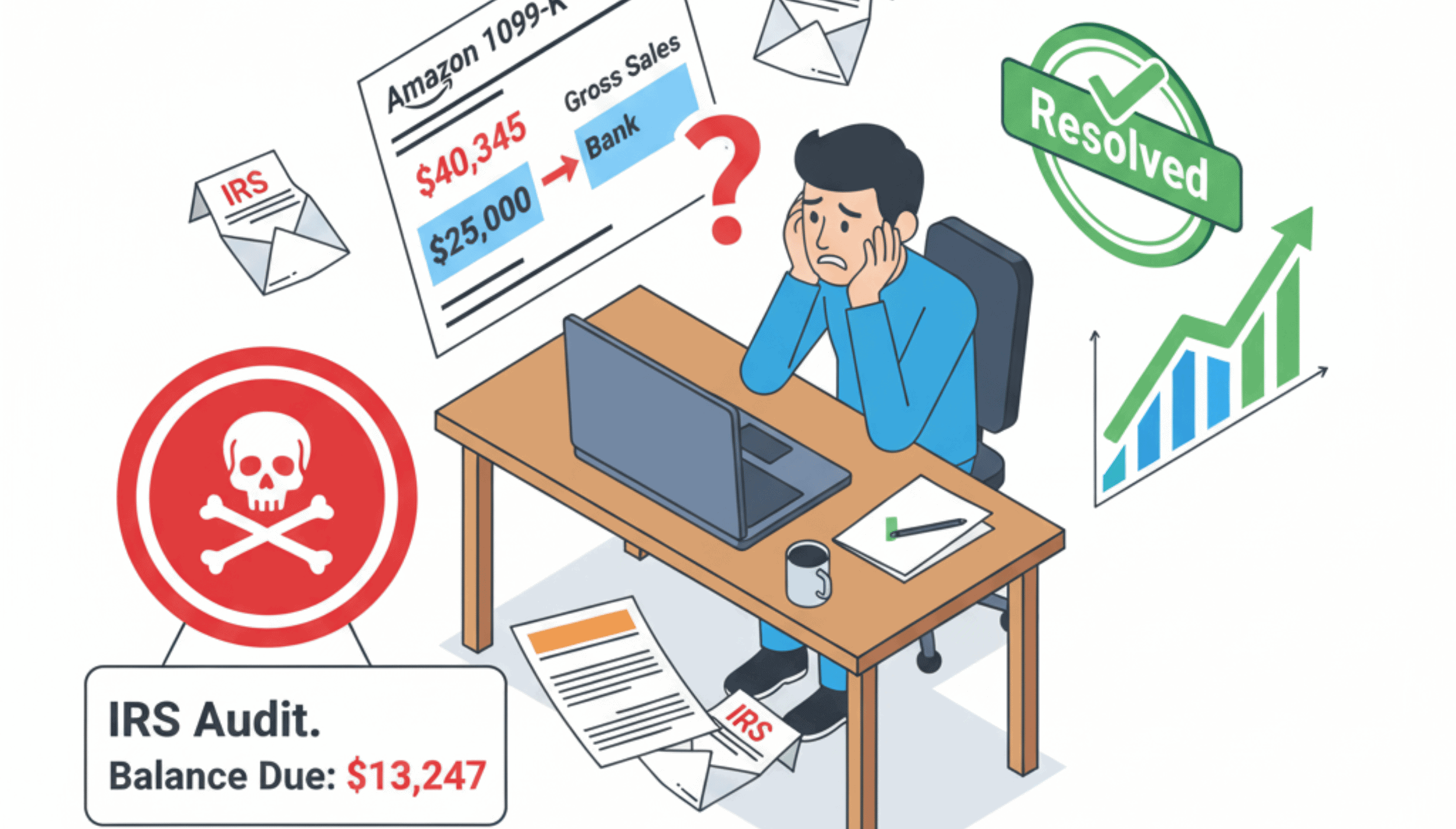

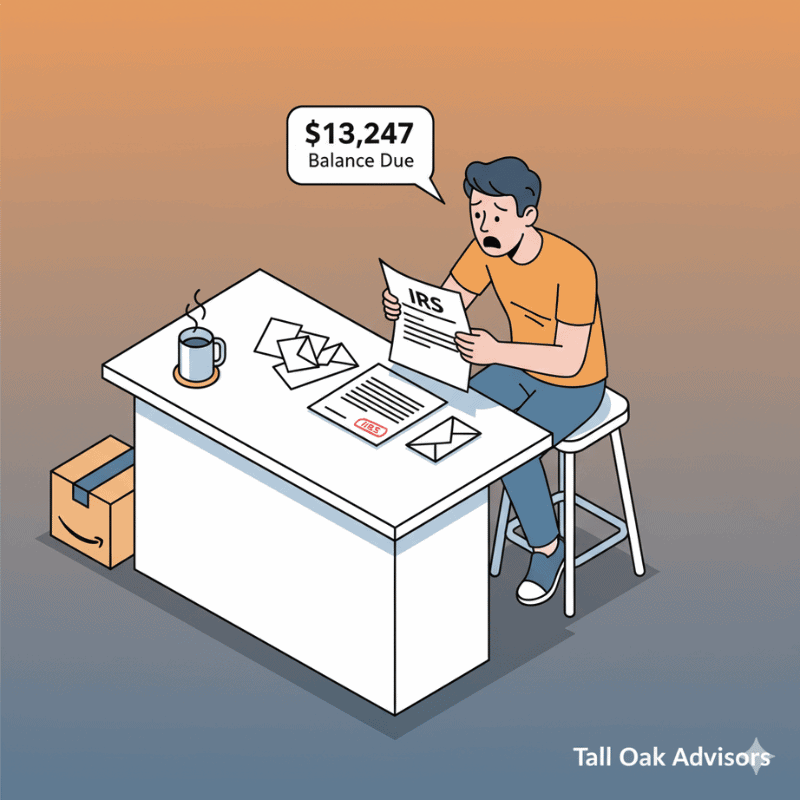

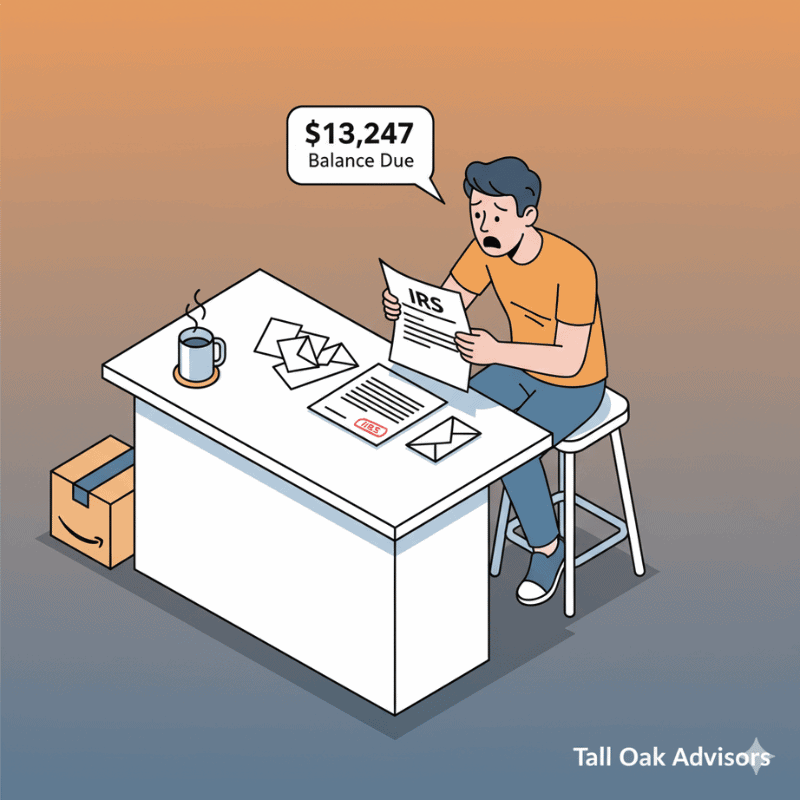

Yesterday I got a call from a client who was drowning in Amazon 1099-K confusion.

He hadn’t even thrown out his junk mail when he saw a letter stamped Internal Revenue Service. The kind of envelope that makes your stomach knot before you even open it.

Inside: Balance Due: $13,247.

He froze. Coffee still sitting untouched, mail scattered across the counter. His wife asked what was wrong. All he could say was:

“Thirteen thousand… they say I owe thirteen thousand. But I don’t even have thirteen thousand.”

This is the nightmare scenario many Amazon sellers face when they don’t understand how the Amazon 1099-K form really works.

Table of Contents

How Amazon 1099-K Taxes Create Hidden Traps

Here’s what happened to my client:

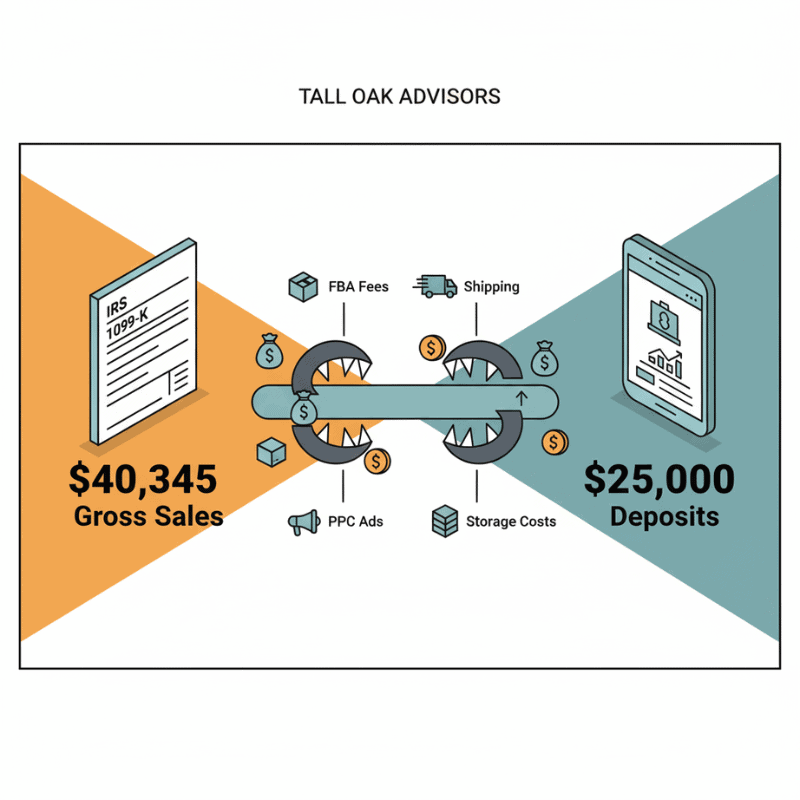

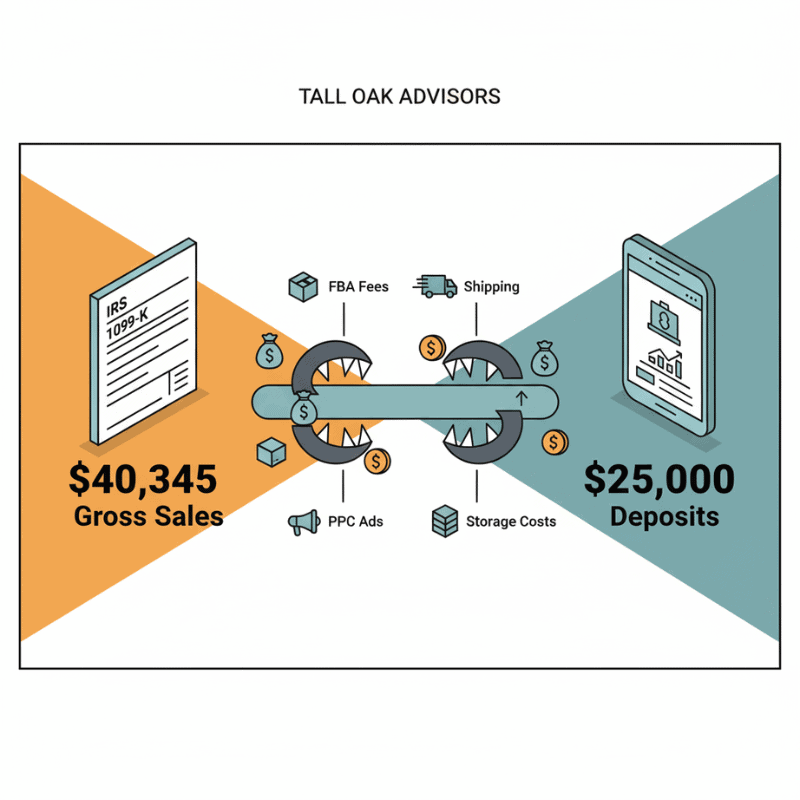

In 2023, it was his first year selling on Amazon. He generated $165,734 in gross sales — the exact figure Amazon reported to the IRS on Form 1099-K.

But on his tax return, he only reported $110k — because that’s what was deposited into his bank account. He didn’t realize those deposits were already shaved down by storage fees, fulfillment charges, and hidden costs.

To the IRS, it looked like he underreported $55k in income.

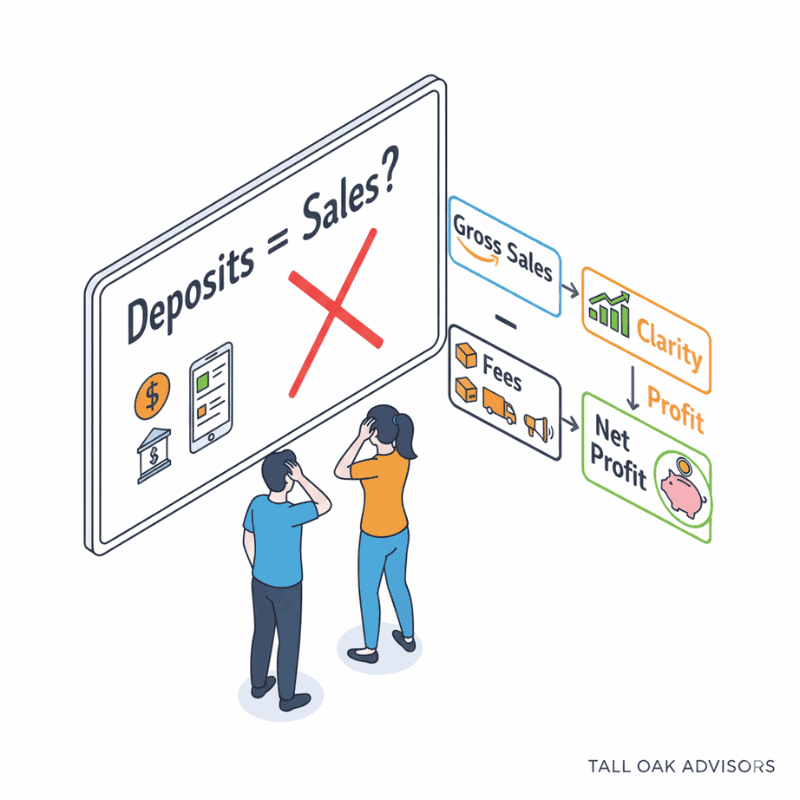

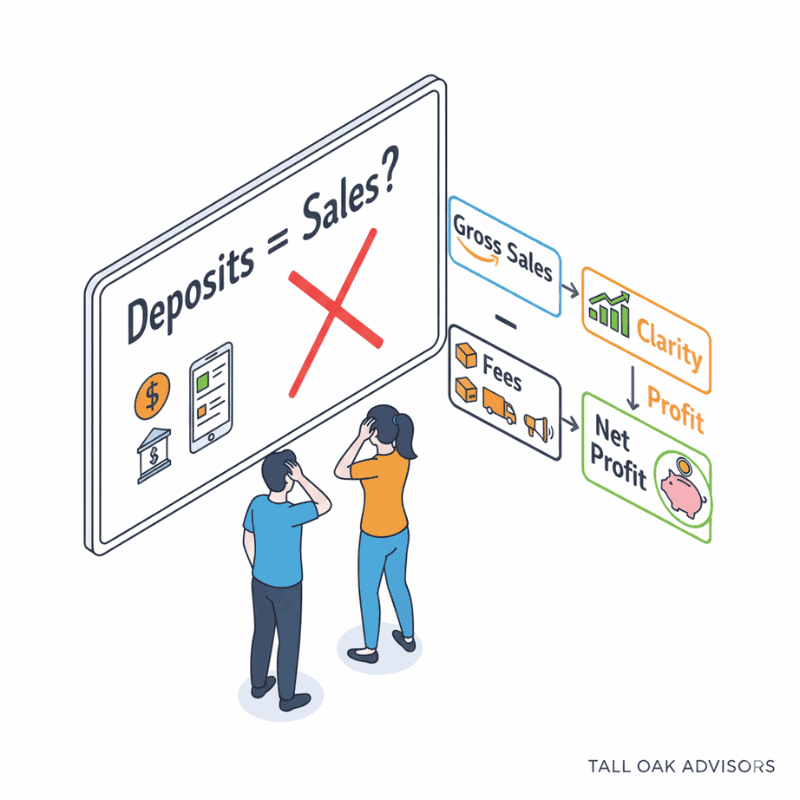

That’s the core of Amazon 1099-K confusion: gross vs. net.

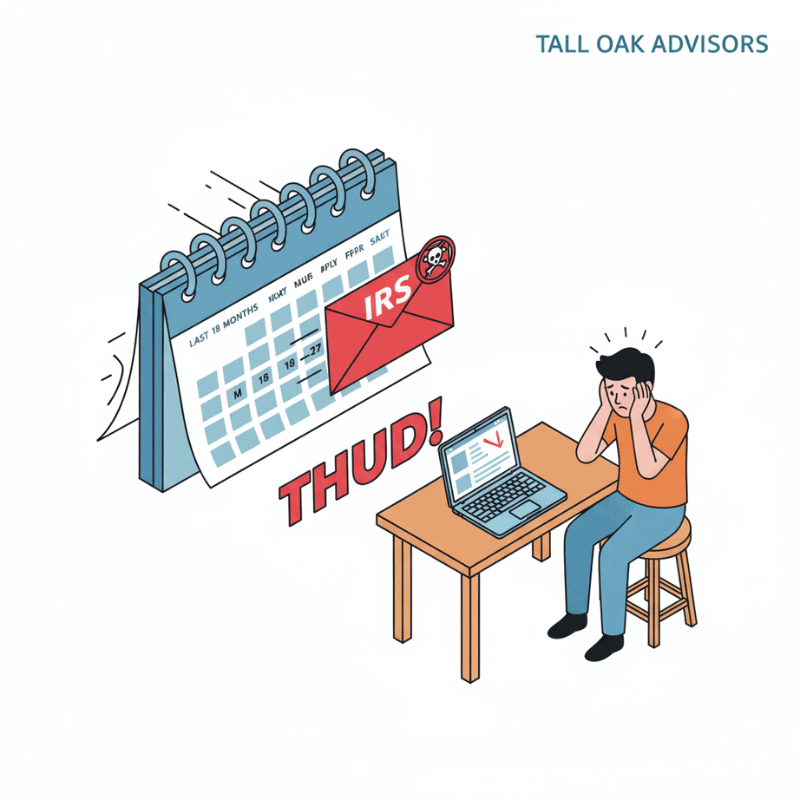

The IRS Doesn’t Catch It Right Away

Here’s the cruel twist: the IRS didn’t send the letter right away.

Eighteen months passed before the notice landed in his mailbox. He thought he was in the clear.

That’s why Amazon 1099-K reporting errors are so dangerous. The IRS is slow — but when they act, the penalties feel crushing.

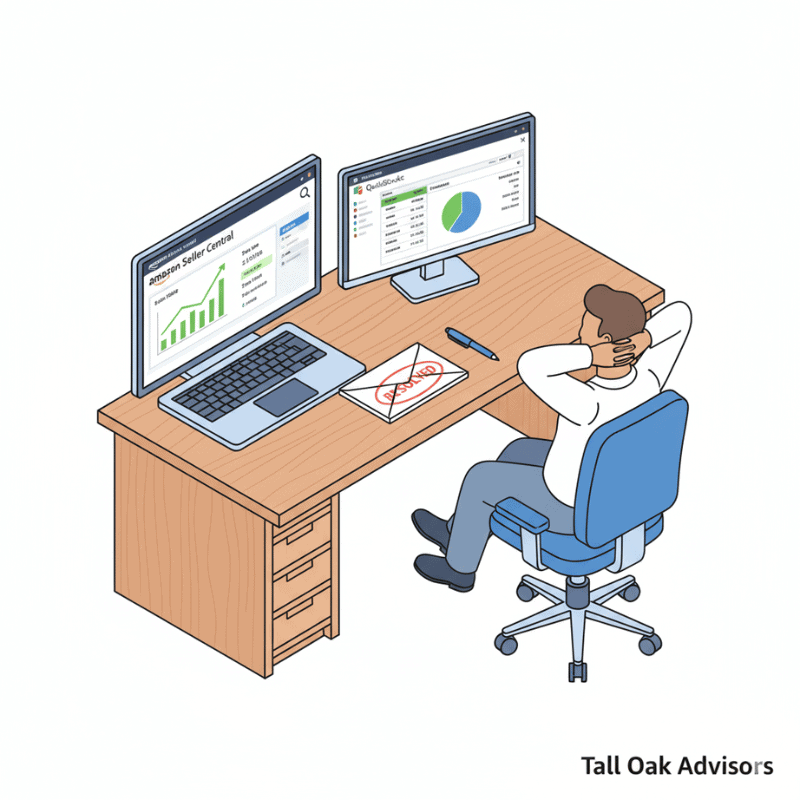

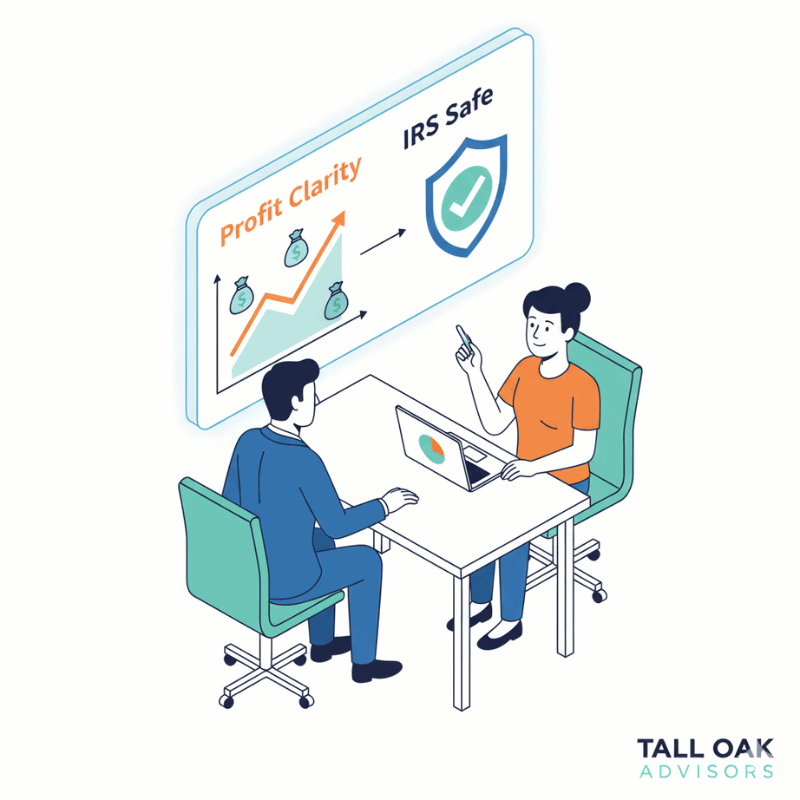

The Fix for Amazon 1099-K Confusion

The good news? It’s fixable. Here’s what I told him to do:

- Pull all financial reports from Amazon — every hidden fee, every charge.

- Re-do his books for 2023 so fees are matched and accounted for.

- Re-file his 2023 tax return with the corrected figures.

Done properly, this wipes out the $13K tax liability the IRS claimed he owed.

Why Most Sellers Misunderstand the Amazon 1099-K

This isn’t rare. Out of hundreds of sellers I’ve worked with, most have Amazon 1099-K confusion at some point.

- They think deposits = sales.

- They don’t track fees at SKU-level detail.

- They don’t realize how the IRS matches 1099-K gross amounts to tax returns.

The result? Sellers believe they’re making more money than they are — and panic when the IRS comes knocking.

Protect Yourself from Amazon 1099-K Penalties

The lesson? Don’t let an IRS letter blindside you.

- Account for all fees (not just cost of goods).

- Reconcile 1099-K reports with deposits.

- Use professional bookkeeping to avoid mistakes.

Our team has helped hundreds of sellers clean up their books, re-file correctly, and avoid penalties from Amazon 1099-K confusion.

Schedule a free consultation today and start Q4 with clarity and confidence.

Stop Amazon 1099-K Confusion Before the IRS Stops You

If you’ve ever opened an IRS letter and felt your stomach drop, you’re not alone. Amazon 1099-K confusion blindsides sellers every year — and most don’t even realize they’ve made a mistake until the penalties arrive.

The good news? It’s 100% fixable. The difference between gross sales and net deposits is a bookkeeping problem, not a business failure. But unless you know how to reconcile the two, the IRS will assume the worst — and you’ll pay the price.

That’s why we created our Amazon Seller Strategy Session. In just one call, we’ll:

✅ Review your Amazon 1099-K and deposits.

✅ Spot hidden fees that are eroding your margins.

✅ Give you a clear action plan to fix mistakes before the IRS comes knocking.

Don’t wait 18 months for a scary letter to show up. Book your free strategy session today and start running your Amazon business with confidence — not confusion.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

Misreporting gross vs. net sales leaves sellers owing thousands — accountants urge urgent fixes before penalties stack.

key points

Yesterday I got a call from a client who was drowning in Amazon 1099-K confusion.

He hadn’t even thrown out his junk mail when he saw a letter stamped Internal Revenue Service. The kind of envelope that makes your stomach knot before you even open it.

Inside: Balance Due: $13,247.

He froze. Coffee still sitting untouched, mail scattered across the counter. His wife asked what was wrong. All he could say was:

“Thirteen thousand… they say I owe thirteen thousand. But I don’t even have thirteen thousand.”

This is the nightmare scenario many Amazon sellers face when they don’t understand how the Amazon 1099-K form really works.

Table of Contents

How Amazon 1099-K Taxes Create Hidden Traps

Here’s what happened to my client:

In 2023, it was his first year selling on Amazon. He generated $165,734 in gross sales — the exact figure Amazon reported to the IRS on Form 1099-K.

But on his tax return, he only reported $110k — because that’s what was deposited into his bank account. He didn’t realize those deposits were already shaved down by storage fees, fulfillment charges, and hidden costs.

To the IRS, it looked like he underreported $55k in income.

That’s the core of Amazon 1099-K confusion: gross vs. net.

The IRS Doesn’t Catch It Right Away

Here’s the cruel twist: the IRS didn’t send the letter right away.

Eighteen months passed before the notice landed in his mailbox. He thought he was in the clear.

That’s why Amazon 1099-K reporting errors are so dangerous. The IRS is slow — but when they act, the penalties feel crushing.

The Fix for Amazon 1099-K Confusion

The good news? It’s fixable. Here’s what I told him to do:

- Pull all financial reports from Amazon — every hidden fee, every charge.

- Re-do his books for 2023 so fees are matched and accounted for.

- Re-file his 2023 tax return with the corrected figures.

Done properly, this wipes out the $13K tax liability the IRS claimed he owed.

Why Most Sellers Misunderstand the Amazon 1099-K

This isn’t rare. Out of hundreds of sellers I’ve worked with, most have Amazon 1099-K confusion at some point.

- They think deposits = sales.

- They don’t track fees at SKU-level detail.

- They don’t realize how the IRS matches 1099-K gross amounts to tax returns.

The result? Sellers believe they’re making more money than they are — and panic when the IRS comes knocking.

Protect Yourself from Amazon 1099-K Penalties

The lesson? Don’t let an IRS letter blindside you.

- Account for all fees (not just cost of goods).

- Reconcile 1099-K reports with deposits.

- Use professional bookkeeping to avoid mistakes.

Our team has helped hundreds of sellers clean up their books, re-file correctly, and avoid penalties from Amazon 1099-K confusion.

Schedule a free consultation today and start Q4 with clarity and confidence.

Stop Amazon 1099-K Confusion Before the IRS Stops You

If you’ve ever opened an IRS letter and felt your stomach drop, you’re not alone. Amazon 1099-K confusion blindsides sellers every year — and most don’t even realize they’ve made a mistake until the penalties arrive.

The good news? It’s 100% fixable. The difference between gross sales and net deposits is a bookkeeping problem, not a business failure. But unless you know how to reconcile the two, the IRS will assume the worst — and you’ll pay the price.

That’s why we created our Amazon Seller Strategy Session. In just one call, we’ll:

✅ Review your Amazon 1099-K and deposits.

✅ Spot hidden fees that are eroding your margins.

✅ Give you a clear action plan to fix mistakes before the IRS comes knocking.

Don’t wait 18 months for a scary letter to show up. Book your free strategy session today and start running your Amazon business with confidence — not confusion.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.