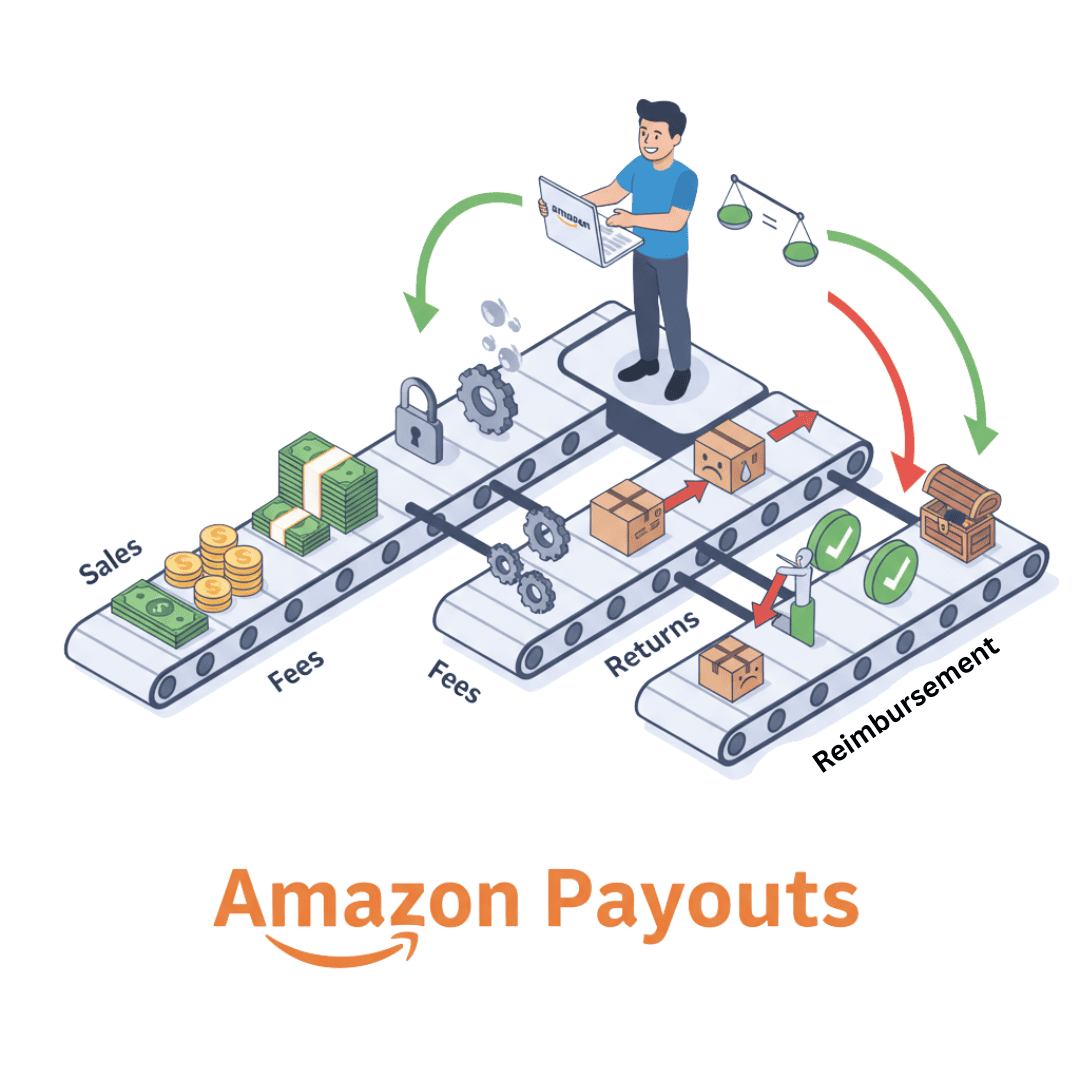

Behind every Amazon payout lurks hidden fees, returns, and ad costs. Without proper accounting, sellers risk scaling losses instead of profits.

key points

If you’re running retail or online arbitrage, buying and selling products might feel straightforward at first — grab a deal, list it, make a sale. But when it comes to Amazon arbitrage accounting, most sellers quickly realize it’s a whole different story. Amazon payouts are messy, margins are razor thin, and tax season can turn into a nightmare if you’re not prepared.

Table of Contents

Why Amazon Arbitrage Accounting Matters More Than You Think

Many arbitrage sellers think Amazon deposits = profit. But those deposits hide fees, ads, returns, and storage charges. On paper, it can look like you’re making money when in reality you’re barely breaking even — or losing money.

💡 It’s like running a marathon without checking the distance — you feel like you’re moving fast, but you don’t know if you’re even close to the finish line.

Why Clean Amazon Arbitrage Accounting Sets You Apart

Let’s be honest: arbitrage is the lowest-margin business model on Amazon. It works to get started, but if you ever want to move beyond it — into wholesale, private label, or exclusive brand partnerships — clean books are your ticket out. Do accounting like a side hustler, and you’ll get treated like a side hustler when you try to open wholesale accounts.

But this isn’t just about arbitrage sellers. Whether you’re flipping clearance items, running wholesale, or building your own brand, the principle is the same: clarity and professionalism separate you from the crowd.

-

Brands want partners who look professional. When you can show you know your numbers, you build trust instantly.

-

Banks and lenders only take you seriously if you can hand them clean financials.

-

Taxes hit harder when you’re sloppy. Tracking deductions correctly keeps more money in your pocket.

🛡️ Clean Amazon arbitrage accounting is like showing up to a knife fight with body armor. Everyone else looks vulnerable; you’re protected and in control.

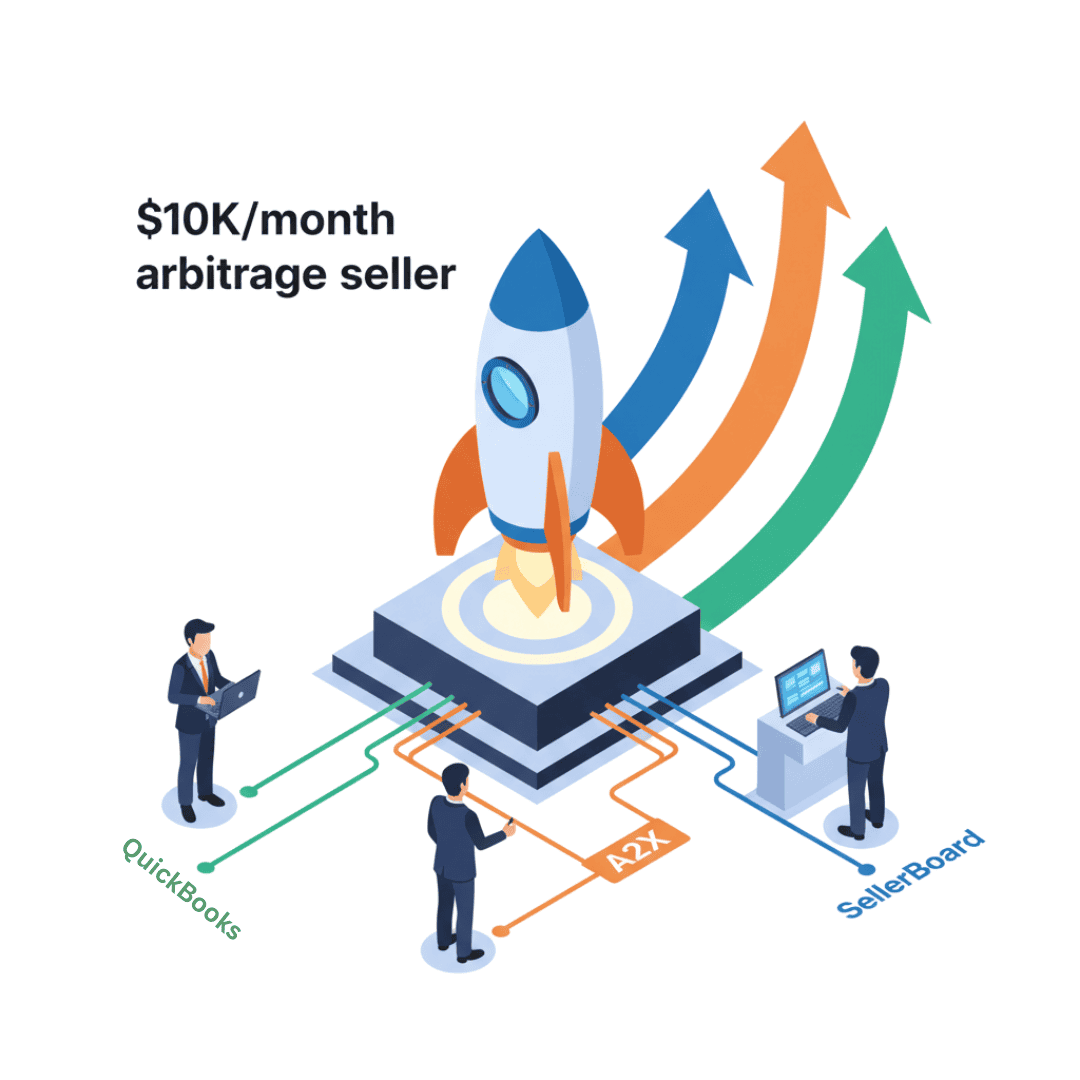

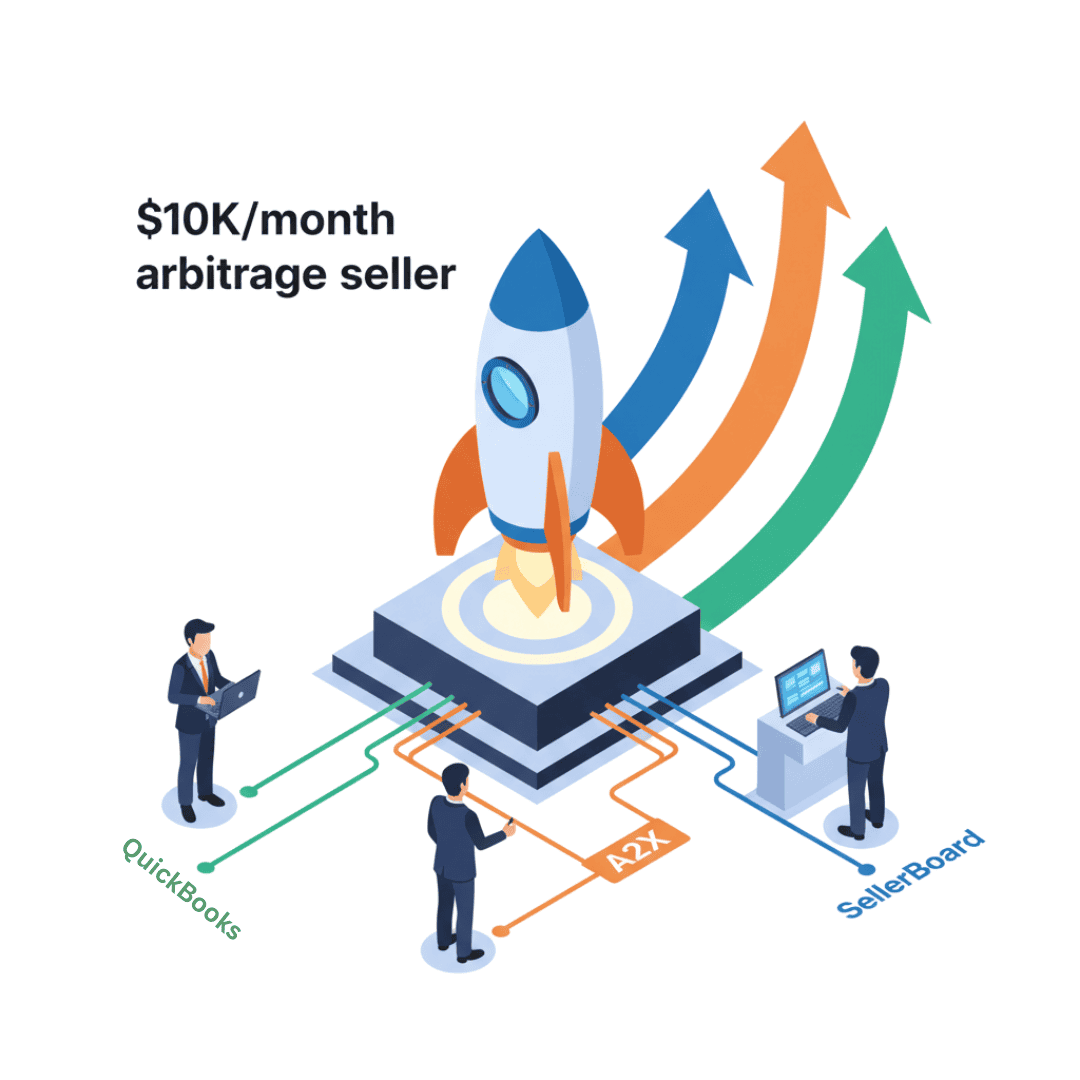

The First Step to Looking Like a Real Business

Even if you’re only doing $10K/month, having books set up right shows discipline. It proves you’re ready to scale. And the cost of setup? It’s deductible.

🚀 Small rockets still need strong launchpads. Clean Amazon arbitrage accounting is that launchpad — without it, you can’t lift off.

The Core Amazon Arbitrage Accounting Stack

So how do you actually do accounting for an arbitrage business? You don’t need to become an accountant — you just need the right stack of tools. Here are the essentials:

Bookkeeping Software for Amazon Arbitrage Accounting

Tracks income and expenses, produces profit & loss statements, and keeps you compliant at tax time. These tools also sync with your credit cards and bank accounts, making reconciliation faster and less error-prone. Many versions also handle invoicing, bill pay, and even basic inventory tracking.

👉 We almost always use QuickBooks when setting up clients because it integrates smoothly and makes ongoing delivery simpler. Xero can be a solid alternative, especially if you prefer a more modern interface, but QuickBooks is typically stronger when it comes to U.S.-based tax features and integrations.

Think of it as your financial control center.

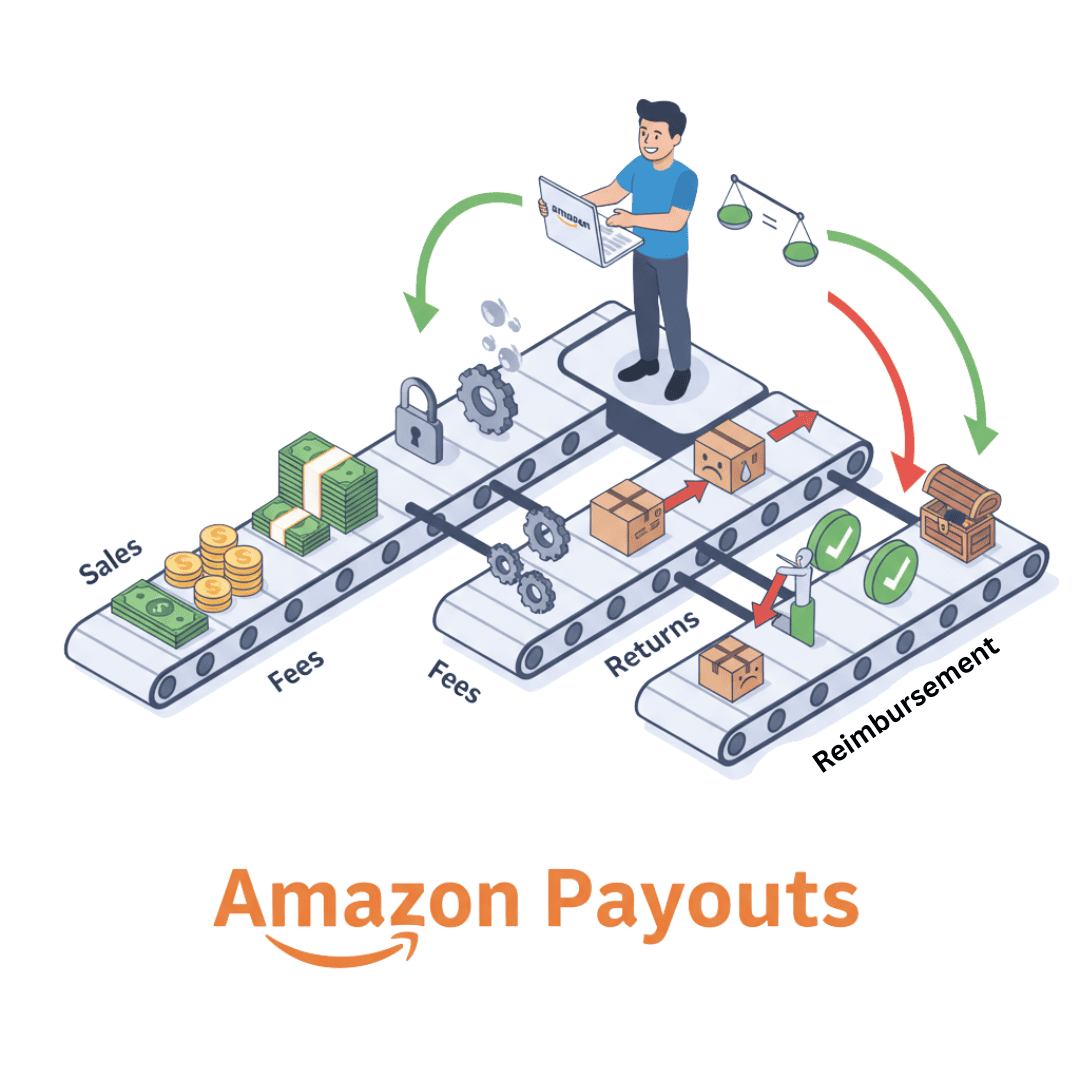

Amazon Sync Tool (A2X, Link My Books)

Breaks down Amazon’s confusing payouts into sales, fees, returns, and reimbursements. This way your books match reality instead of messy lump sums.

Without a sync tool, you’re stuck reconciling with spreadsheets. That guesswork leads to mistakes.

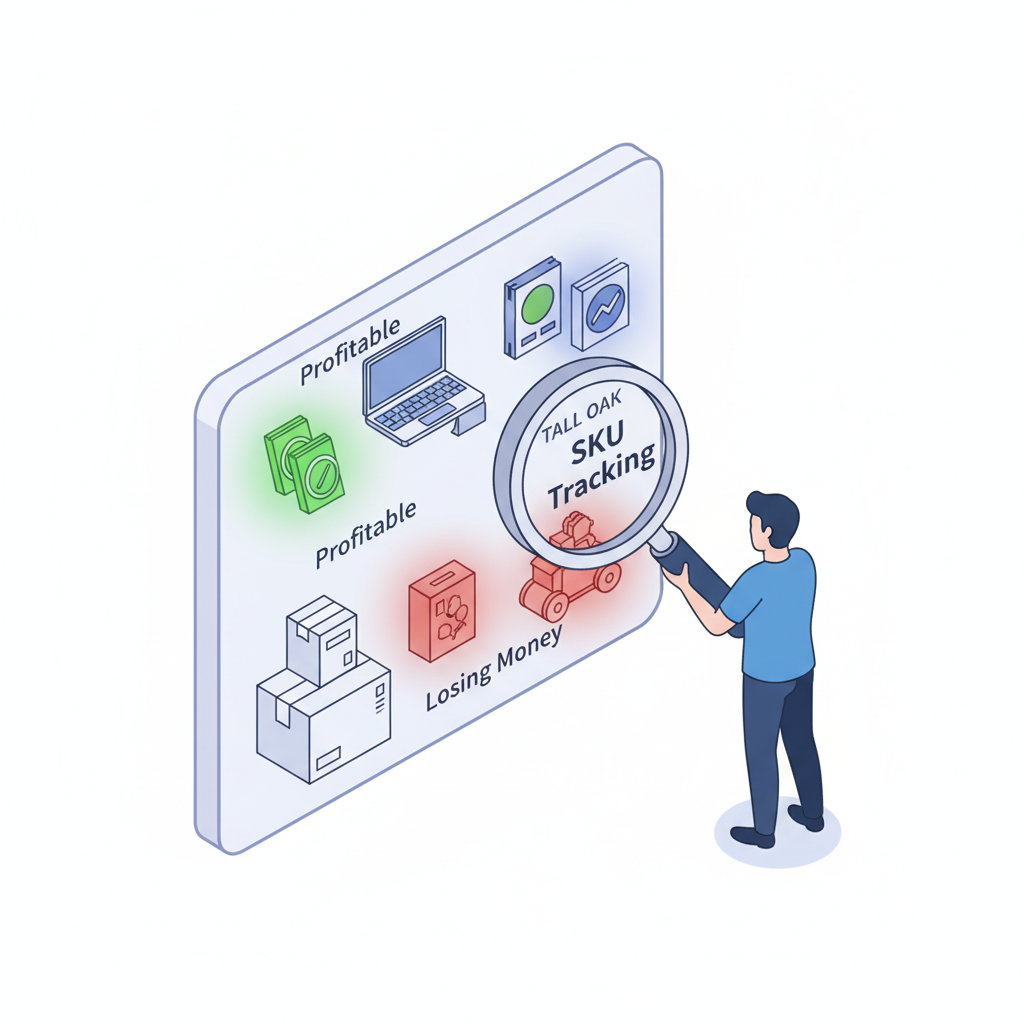

SKU-Level Profit Tracking (SellerBoard, InventoryLab)

Shows profit per product after fees, ads, and returns. This isn’t just a nice-to-have — it’s critical.

Example: one seller thought a toy line was netting 20% margins. Once SKU tracking revealed a 15% return rate, they realized they were barely breaking even. If they had doubled down on that product, they would have sunk even more cash into a money pit.

SKU tracking gives you x-ray vision into your catalog. Without it, you’re making buying decisions blind.

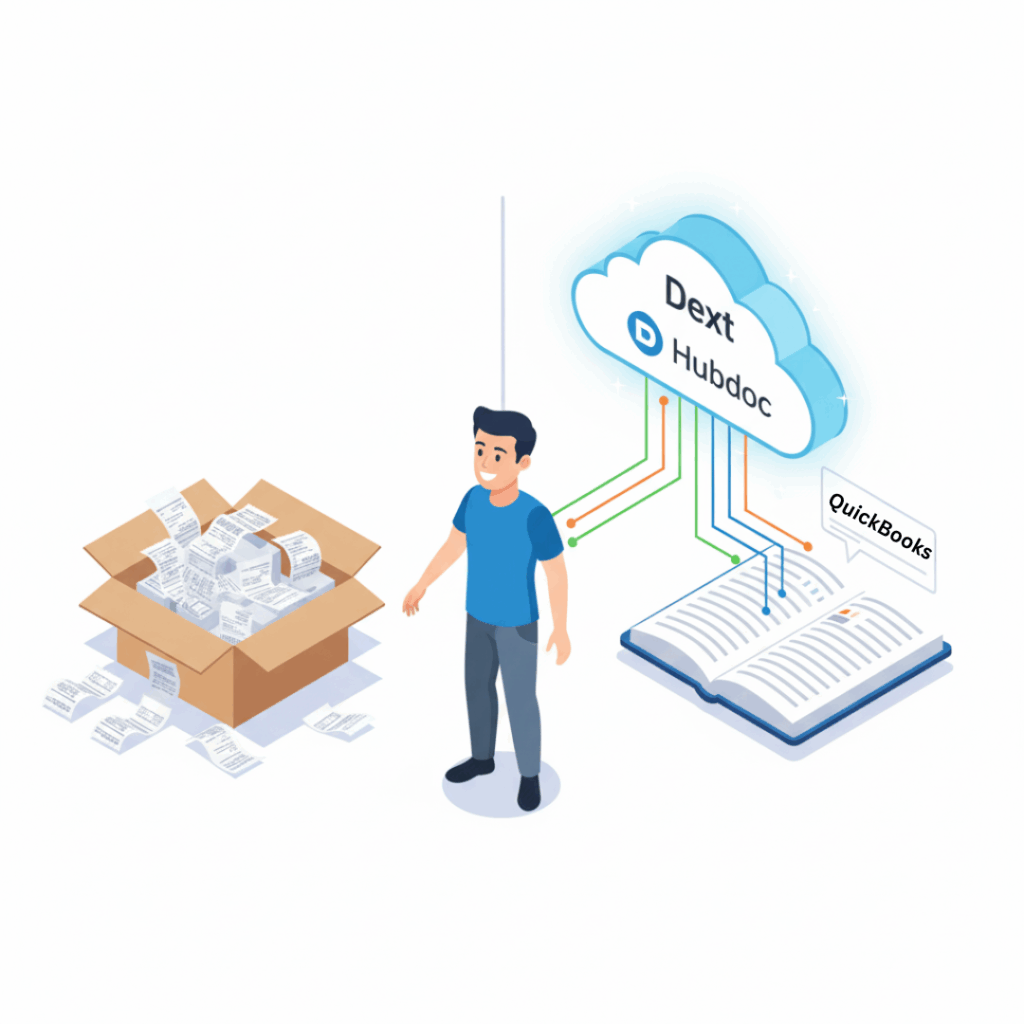

Receipt & Expense Capture (Dext, Hubdoc, Google Drive)

Stores receipts digitally and connects them to your bookkeeping. If the IRS ever asks, you’ll have proof for every deduction.

Without this, you’re digging through shoeboxes of paper or scrolling endless email receipts. That’s how deductions get lost — and money gets left on the table.

Final Word: Why Amazon Arbitrage Accounting Is Your Real Advantage

If you want to stay stuck in arbitrage forever, you can keep winging it with spreadsheets. But if you want to grow — into wholesale accounts, private label, or even just a more profitable arbitrage business — clean Amazon arbitrage accounting is your first real advantage.

🔥 Don’t wait until tax season to find out you’ve been running blind. Set it up right today and you’ll finally know whether your flips are actually profitable.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

Behind every Amazon payout lurks hidden fees, returns, and ad costs. Without proper accounting, sellers risk scaling losses instead of profits.

key points

If you’re running retail or online arbitrage, buying and selling products might feel straightforward at first — grab a deal, list it, make a sale. But when it comes to Amazon arbitrage accounting, most sellers quickly realize it’s a whole different story. Amazon payouts are messy, margins are razor thin, and tax season can turn into a nightmare if you’re not prepared.

Table of Contents

Why Amazon Arbitrage Accounting Matters More Than You Think

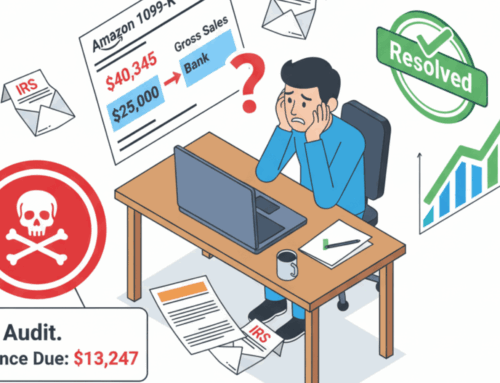

Many arbitrage sellers think Amazon deposits = profit. But those deposits hide fees, ads, returns, and storage charges. On paper, it can look like you’re making money when in reality you’re barely breaking even — or losing money.

💡 It’s like running a marathon without checking the distance — you feel like you’re moving fast, but you don’t know if you’re even close to the finish line.

Why Clean Amazon Arbitrage Accounting Sets You Apart

Let’s be honest: arbitrage is the lowest-margin business model on Amazon. It works to get started, but if you ever want to move beyond it — into wholesale, private label, or exclusive brand partnerships — clean books are your ticket out. Do accounting like a side hustler, and you’ll get treated like a side hustler when you try to open wholesale accounts.

But this isn’t just about arbitrage sellers. Whether you’re flipping clearance items, running wholesale, or building your own brand, the principle is the same: clarity and professionalism separate you from the crowd.

-

Brands want partners who look professional. When you can show you know your numbers, you build trust instantly.

-

Banks and lenders only take you seriously if you can hand them clean financials.

-

Taxes hit harder when you’re sloppy. Tracking deductions correctly keeps more money in your pocket.

🛡️ Clean Amazon arbitrage accounting is like showing up to a knife fight with body armor. Everyone else looks vulnerable; you’re protected and in control.

The First Step to Looking Like a Real Business

Even if you’re only doing $10K/month, having books set up right shows discipline. It proves you’re ready to scale. And the cost of setup? It’s deductible.

🚀 Small rockets still need strong launchpads. Clean Amazon arbitrage accounting is that launchpad — without it, you can’t lift off.

The Core Amazon Arbitrage Accounting Stack

So how do you actually do accounting for an arbitrage business? You don’t need to become an accountant — you just need the right stack of tools. Here are the essentials:

Bookkeeping Software for Amazon Arbitrage Accounting

Tracks income and expenses, produces profit & loss statements, and keeps you compliant at tax time. These tools also sync with your credit cards and bank accounts, making reconciliation faster and less error-prone. Many versions also handle invoicing, bill pay, and even basic inventory tracking.

👉 We almost always use QuickBooks when setting up clients because it integrates smoothly and makes ongoing delivery simpler. Xero can be a solid alternative, especially if you prefer a more modern interface, but QuickBooks is typically stronger when it comes to U.S.-based tax features and integrations.

Think of it as your financial control center.

Amazon Sync Tool (A2X, Link My Books)

Breaks down Amazon’s confusing payouts into sales, fees, returns, and reimbursements. This way your books match reality instead of messy lump sums.

Without a sync tool, you’re stuck reconciling with spreadsheets. That guesswork leads to mistakes.

SKU-Level Profit Tracking (SellerBoard, InventoryLab)

Shows profit per product after fees, ads, and returns. This isn’t just a nice-to-have — it’s critical.

Example: one seller thought a toy line was netting 20% margins. Once SKU tracking revealed a 15% return rate, they realized they were barely breaking even. If they had doubled down on that product, they would have sunk even more cash into a money pit.

SKU tracking gives you x-ray vision into your catalog. Without it, you’re making buying decisions blind.

Receipt & Expense Capture (Dext, Hubdoc, Google Drive)

Stores receipts digitally and connects them to your bookkeeping. If the IRS ever asks, you’ll have proof for every deduction.

Without this, you’re digging through shoeboxes of paper or scrolling endless email receipts. That’s how deductions get lost — and money gets left on the table.

Final Word: Why Amazon Arbitrage Accounting Is Your Real Advantage

If you want to stay stuck in arbitrage forever, you can keep winging it with spreadsheets. But if you want to grow — into wholesale accounts, private label, or even just a more profitable arbitrage business — clean Amazon arbitrage accounting is your first real advantage.

🔥 Don’t wait until tax season to find out you’ve been running blind. Set it up right today and you’ll finally know whether your flips are actually profitable.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.