Listen to this article in the form of an AI-Generated podcast episode:

Take a listen – it’s pretty amazing what AI can do!

18min 52sec

Amazon automation. The term has a certain pull, doesn’t it? It promises an entirely hands-off eCommerce business, where a third-party team manages everything for you—from finding profitable products and managing inventory to handling customer service and fulfilling orders on Amazon.

Here’s how it works: clients pay an upfront fee to an automation company, which then sets up and runs the Amazon store on their behalf. The automation company typically takes a percentage of the profits in exchange for managing all aspects of the business.

In theory, Amazon automation is the dream setup. The idea is that you sit back, relax, and watch the profits roll in. Sounds perfect, right? It’s easy to see why the idea appeals to people looking for a passive income stream without the typical workload of running an online store.

It’s marketed as the perfect solution for anyone looking to generate passive income in the eCommerce world. The allure is undeniable: with experts running the show, it feels like an automated path to wealth.

But behind this polished pitch, there are often complexities and risks hidden in the fine print, details that can turn a promising investment into a costly misstep. One of our clients, named Jack, learned this firsthand.

No stranger to business, Jack had successfully built and managed ventures before and was always open to new ways of expanding his income streams. So, when he heard about Amazon automation, he was intrigued by the idea of an eCommerce venture that required minimal effort. However, as he explored these contracts, he uncovered a series of Amazon automation scam red flags that changed everything.

Each red flag might look minor at first glance, but taken together, they painted a very different picture. Jack’s experience sheds light on what anyone considering Amazon automation should know.

Here’s a closer look at the 14 red flags he found and why Amazon automation may not be the easy, risk-free solution it appears to be.

Table of Contents

- 1. Non-Refundable Initial Fees—The $30K Trap

- 2. A $1,500 Fee for “Ungating”—What’s the Deal?

- 3. Gross Profit Splits—Taking 30% of Your Revenue

- 4. Gag Clauses—A $10K Fee for Talking

- 5. They’re Running Multiple Stores

- 6. Forced Monthly Payments on a Strict Timeline

- 7. Unverified Reports to Justify Profit Splits

- 8. Mystery Sourcing—Where Are the Products From?

- 9. No Guarantees on Income

- 10. “Growth” Periods with Zero Sales

- 11. A Sneaky 10% Cut on Selling Your Account

- 12. No Clear Exit Strategy

- 13. One-Sided Obligations

- 14. The Ultimate Escape Clause—Blaming Amazon for Closures

- Conclusion: Amazon Automation Scam—Know Before You Sign

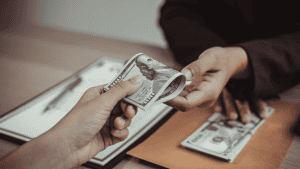

1. Non-Refundable Initial Fees—The $30K Trap

Jack’s first red flag came with a hefty upfront fee—$30,000, non-refundable, and due within 72 hours. It was a “pay now, think later” tactic designed to pressure clients into quick decisions before they’d done the research. The more he thought about it, the more it felt like a costly trap he couldn’t escape.

Why This Feels Like a Trap

- Rushed Decisions, Limited Time: Requiring payment within 72 hours forces clients to act before they’ve had a chance to consider the investment fully.

- Locked-in Losses: The non-refundable clause means once that money’s gone, it’s gone—no matter how things play out.

- Disregard for Due Diligence: There’s no time to consult advisors or sleep on it; clients feel pressured to jump in without solid ground.

- Blocks Critical Thinking: The urgency clouds judgment, making it easier for companies to close the deal without questions.

2. A $1,500 Fee for “Ungating”—What’s the Deal?

When Jack saw an extra $1,500 “ungating” fee, he was puzzled. Ungating grants access to certain Amazon categories, but most sellers manage it on their own with ease. Paying such a high fee for something readily accessible felt like an unnecessary charge with no real benefit.

Why This Ungating Fee is a Red Flag

- Inflated Cost for Simple Process: Experienced sellers ungate for free or minimal cost; the high fee hints at an exploitative setup.

- Unnecessary Expense: Clients unaware of ungating basics are tricked into paying for something they could manage solo.

- Squeezes Additional Fees: Fees like this add up, making “hands-free” automation a significant financial drain.

- Misleading Value: This fee doesn’t provide extra expertise—just an inflated bill for what should be simple.

3. Gross Profit Splits—Taking 30% of Your Revenue

Next up was the profit split clause—30% taken from gross revenue. It seemed fair until Jack realized it was based on revenue, not profit. This meant the company would take its share even if the business ran at a loss. It was a setup where they’d always make money while he bore all the risks.

Why This Gross Split Feels One-Sided

- Win-Win for Them, Not You: The company takes a cut off the top, regardless of expenses, guaranteeing their earnings while clients face potential losses.

- Sales Without Profit: High sales don’t mean high profits when expenses eat up earnings. This setup drains revenue before covering costs.

- Shifts All Risk to Clients: Clients face losses while the company’s revenue stays intact—creating a financially unbalanced relationship.

- Misaligned Incentives: Their focus is on sales volume, not sustainable profits, leaving clients to struggle with the bottom line.

4. Gag Clauses—A $10K Fee for Talking

Then there was the non-disparagement clause. This clause prevented Jack from sharing any negative experiences under penalty of a $10,000 fine. If he wanted to post an honest review, he’d risk paying for the privilege. This silencing tactic ensured complaints stayed buried, no matter what went wrong.

The Problems with Gag Clauses

- Blocks Honest Feedback: Gag clauses prevent clients from sharing real issues, keeping future customers in the dark.

- Financial Punishment for Complaints: One critical review could cost clients thousands, even if it’s true.

- Protects the Company, Not Clients: With enforced silence, the company doesn’t have to answer for poor performance.

- Limits Transparency: Gag clauses prevent potential clients from seeing the full picture, trapping them in the same experience.

5. They’re Running Multiple Stores

Another shocker came when Jack discovered that many automation companies manage multiple stores for different clients. This violates Amazon’s strict policies against linked accounts, putting all stores at risk of suspension. Jack read about sellers losing everything in one blow, making the risk clear.

Risks of Multiple Store Management

- Suspension Domino Effect: If Amazon suspends one account, all linked accounts could be impacted, wiping out multiple clients’ investments.

- Violation of Amazon’s Terms: Managing multiple stores under one entity increases the risk of permanent bans from Amazon.

- Client Accounts at Risk: When stores are linked, one bad apple could bring down the whole barrel, even for unrelated clients.

- Financial Fallout: If Amazon suspends accounts, clients bear the brunt of the loss with no compensation.

6. Forced Monthly Payments on a Strict Timeline

Jack was wary when he saw another clause requiring monthly payments within 72 hours of invoice. If he missed the deadline, the company would stop working on his account. A single late payment could halt his operations, even though he’d already paid thousands in upfront fees.

Why This Payment Timeline Feels Hostile

- Zero Flexibility for Disputes: Tight payment timelines leave no room for negotiating or disputing charges.

- Punishes Clients for Small Delays: One missed deadline can mean a loss of service, even if payments were consistent previously.

- Strains Financial Freedom: Clients feel cornered, having to make payments without time for financial flexibility.

- No Leeway for Service Issues: Even if the client isn’t satisfied, they must pay to avoid disruptions to their account.

7. Unverified Reports to Justify Profit Splits

The monthly reports justifying the company’s profit split lacked third-party verification. Without an audit, Jack realized he was left trusting the company’s word on how much his store was earning. This lack of transparency opened the door for potential number-padding to justify high profit splits.

Why Unverified Reports Are Concerning

- Easy to Manipulate: Without audits, the company could inflate figures to secure a bigger cut.

- Leaves Clients in the Dark: Clients rely on internal numbers with no external check, fostering potential misrepresentation.

- Lacks Financial Trust: Unverified reports mean clients can’t be confident in the profit they’re being told they’re making.

- Unfair Advantage to the Company: Clients face extra costs without verified transparency, skewing financial accountability.

8. Mystery Sourcing—Where Are the Products From?

Jack asked for details about product sourcing, but the company reps were vague, sidestepping questions about product origins and quality. Without knowing where the items came from, Jack feared that his store would face penalties for selling unauthorized goods. Amazon’s penalties for this can be severe, making it a serious risk.

Why Mystery Sourcing is a Red Flag

- Potential for Counterfeit Goods: Clients might unknowingly sell counterfeit goods if items aren’t sourced properly.

- Violation of Amazon’s Authenticity Policy: Poor sourcing could lead to serious penalties, even account suspension.

- Client Bears the Burden: When sourcing is questionable, it’s the client who faces penalties and reputation damage.

- Compromises Quality Control: Without transparency, clients lose control over quality assurance, increasing their liability.

9. No Guarantees on Income

Jack was used to calculated risks in business, but these contracts took “no guarantees” to a new level. There was no assurance of profit, even after paying $30,000 upfront. For the amount being invested, Jack thought there’d be at least some level of performance accountability. There wasn’t.

Why Income Disclaimers are Problematic

- Clients Carry All Financial Risk: With no guarantees, clients must bear all potential losses, even after steep investments.

- No Accountability for the Company: Without income guarantees, companies are free from the pressure to deliver.

- One-Sided Risk: Clients invest heavily with no safety net, while the company secures earnings regardless.

- Dilutes Company Responsibility: These disclaimers ensure the company faces no consequences for underperformance.

10. “Growth” Periods with Zero Sales

Many contracts had a “growth phase” that conveniently spanned the entire contract term. It sounded fair until Jack realized it was a built-in excuse for slow sales. The company could underdeliver for years, using this “growth” period as cover while his investment sat idle.

Why “Growth Phases” Feel Like a Stall

- Excuse for Poor Performance: Companies use “growth phase” language to buy time without delivering results.

- Misleads Client Expectations: The promise of sales and growth is delayed indefinitely, leaving clients with little return.

- Costs Keep Mounting: While sales lag, fees continue, straining the client’s resources without income to cover them.

- Shields Company from Responsibility: The growth phase gives companies cover, making underperformance acceptable.

11. A Sneaky 10% Cut on Selling Your Account

If Jack decides to sell his account, the company reserves the right to a 10% cut of his earnings from the sale. Even if the business were underperforming, they’d still pocket a piece if he cut his losses. It was a last-minute twist that stung after everything else he’d invested.

The Issue with Exit Fees

- Adds Extra Financial Burden: Clients pay heavily upfront, then face additional fees just to leave.

- Limits Financial Flexibility: It discourages clients from selling, trapping them in the contract.

- Benefits Company Even in Exit: The company takes a cut, whether or not they delivered on initial promises.

- Costs Clients in the Long Run: By taking a portion of the sale, they profit even from dissatisfied clients.

12. No Clear Exit Strategy

Lock-in periods were common in these contracts, but without an exit clause, clients were trapped for the full term. This left Jack worried—no way to leave early if things went south, meaning he’d be stuck even if the service underperformed.

Problems with Lack of Exit Options

- Financial Trap: Clients are locked into full-term commitments with no way out, regardless of performance.

- Risk of Mounting Losses: If the business fails to deliver, clients continue paying without returns.

- Prioritizes Company’s Interest: With no exit, the contract protects the company’s revenue over the client’s flexibility.

- Client Bears All Costs: Clients must absorb losses, trapped by a rigid contract that benefits the service provider.

13. One-Sided Obligations

The contract was filled with obligations for Jack, yet the company’s own responsibilities were vague, with terms like “reasonable efforts.” There was no definition for what “reasonable” meant, leaving the company with all the leeway and Jack with all the accountability.

Why This Bias is Concerning

- Unequal Burden: Clients face clear terms, while the company operates under vague commitments.

- Little Accountability for Underperformance: Broad language lets the company escape consequences for lackluster service.

- Increases Client Risk: Clients are left exposed, bearing most of the responsibility for a service with undefined standards.

- Limits Recourse for Clients: If the service falls short, clients have little room to dispute or demand better.

14. The Ultimate Escape Clause—Blaming Amazon for Closures

In the contract’s fine print, Jack noticed that if Amazon shut down his store due to policy violations, the company wouldn’t be held accountable. Whether it was due to their sourcing or practices, they’d leave him holding the bag. It was the ultimate escape clause.

The Impact of This Escape Clause

- All Responsibility on Clients: Clients face financial fallout from suspensions, even if the company’s actions led to it.

- Company Avoids Liability: This clause shifts all risk to the client, ensuring the company faces no consequences.

- No Accountability for Mistakes: The company sidesteps repercussions for practices that put accounts at risk.

- Protects Company’s Interests Over Clients: This escape clause prioritizes the company’s protection, leaving clients financially exposed.

Conclusion: Amazon Automation Scam—Know Before You Sign

The promises of Amazon automation can feel exciting, but as Jack’s story shows, there’s a lot hiding beneath the surface. Each red flag underscores a larger issue: a system crafted to protect the company’s profits at the client’s expense. From hidden fees and restrictive clauses to disclaimers that strip away accountability, these contracts are designed to secure the company’s success while exposing clients to most of the risk.

So, before diving into Amazon automation, make sure to read every line. What looks like a passive-income dream could quickly turn into a costly, high-stakes venture that benefits the company far more than the client.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

6 Comments

Leave A Comment

Listen to this article in the form of an AI-Generated podcast episode:

Take a listen – it’s pretty amazing what AI can do!

18min 52sec

Amazon automation. The term has a certain pull, doesn’t it? It promises an entirely hands-off eCommerce business, where a third-party team manages everything for you—from finding profitable products and managing inventory to handling customer service and fulfilling orders on Amazon.

Here’s how it works: clients pay an upfront fee to an automation company, which then sets up and runs the Amazon store on their behalf. The automation company typically takes a percentage of the profits in exchange for managing all aspects of the business.

In theory, Amazon automation is the dream setup. The idea is that you sit back, relax, and watch the profits roll in. Sounds perfect, right? It’s easy to see why the idea appeals to people looking for a passive income stream without the typical workload of running an online store.

It’s marketed as the perfect solution for anyone looking to generate passive income in the eCommerce world. The allure is undeniable: with experts running the show, it feels like an automated path to wealth.

But behind this polished pitch, there are often complexities and risks hidden in the fine print, details that can turn a promising investment into a costly misstep. One of our clients, named Jack, learned this firsthand.

No stranger to business, Jack had successfully built and managed ventures before and was always open to new ways of expanding his income streams. So, when he heard about Amazon automation, he was intrigued by the idea of an eCommerce venture that required minimal effort. However, as he explored these contracts, he uncovered a series of Amazon automation scam red flags that changed everything.

Each red flag might look minor at first glance, but taken together, they painted a very different picture. Jack’s experience sheds light on what anyone considering Amazon automation should know.

Here’s a closer look at the 14 red flags he found and why Amazon automation may not be the easy, risk-free solution it appears to be.

Table of Contents

- 1. Non-Refundable Initial Fees—The $30K Trap

- 2. A $1,500 Fee for “Ungating”—What’s the Deal?

- 3. Gross Profit Splits—Taking 30% of Your Revenue

- 4. Gag Clauses—A $10K Fee for Talking

- 5. They’re Running Multiple Stores

- 6. Forced Monthly Payments on a Strict Timeline

- 7. Unverified Reports to Justify Profit Splits

- 8. Mystery Sourcing—Where Are the Products From?

- 9. No Guarantees on Income

- 10. “Growth” Periods with Zero Sales

- 11. A Sneaky 10% Cut on Selling Your Account

- 12. No Clear Exit Strategy

- 13. One-Sided Obligations

- 14. The Ultimate Escape Clause—Blaming Amazon for Closures

- Conclusion: Amazon Automation Scam—Know Before You Sign

1. Non-Refundable Initial Fees—The $30K Trap

Jack’s first red flag came with a hefty upfront fee—$30,000, non-refundable, and due within 72 hours. It was a “pay now, think later” tactic designed to pressure clients into quick decisions before they’d done the research. The more he thought about it, the more it felt like a costly trap he couldn’t escape.

Why This Feels Like a Trap

- Rushed Decisions, Limited Time: Requiring payment within 72 hours forces clients to act before they’ve had a chance to consider the investment fully.

- Locked-in Losses: The non-refundable clause means once that money’s gone, it’s gone—no matter how things play out.

- Disregard for Due Diligence: There’s no time to consult advisors or sleep on it; clients feel pressured to jump in without solid ground.

- Blocks Critical Thinking: The urgency clouds judgment, making it easier for companies to close the deal without questions.

2. A $1,500 Fee for “Ungating”—What’s the Deal?

When Jack saw an extra $1,500 “ungating” fee, he was puzzled. Ungating grants access to certain Amazon categories, but most sellers manage it on their own with ease. Paying such a high fee for something readily accessible felt like an unnecessary charge with no real benefit.

Why This Ungating Fee is a Red Flag

- Inflated Cost for Simple Process: Experienced sellers ungate for free or minimal cost; the high fee hints at an exploitative setup.

- Unnecessary Expense: Clients unaware of ungating basics are tricked into paying for something they could manage solo.

- Squeezes Additional Fees: Fees like this add up, making “hands-free” automation a significant financial drain.

- Misleading Value: This fee doesn’t provide extra expertise—just an inflated bill for what should be simple.

3. Gross Profit Splits—Taking 30% of Your Revenue

Next up was the profit split clause—30% taken from gross revenue. It seemed fair until Jack realized it was based on revenue, not profit. This meant the company would take its share even if the business ran at a loss. It was a setup where they’d always make money while he bore all the risks.

Why This Gross Split Feels One-Sided

- Win-Win for Them, Not You: The company takes a cut off the top, regardless of expenses, guaranteeing their earnings while clients face potential losses.

- Sales Without Profit: High sales don’t mean high profits when expenses eat up earnings. This setup drains revenue before covering costs.

- Shifts All Risk to Clients: Clients face losses while the company’s revenue stays intact—creating a financially unbalanced relationship.

- Misaligned Incentives: Their focus is on sales volume, not sustainable profits, leaving clients to struggle with the bottom line.

4. Gag Clauses—A $10K Fee for Talking

Then there was the non-disparagement clause. This clause prevented Jack from sharing any negative experiences under penalty of a $10,000 fine. If he wanted to post an honest review, he’d risk paying for the privilege. This silencing tactic ensured complaints stayed buried, no matter what went wrong.

The Problems with Gag Clauses

- Blocks Honest Feedback: Gag clauses prevent clients from sharing real issues, keeping future customers in the dark.

- Financial Punishment for Complaints: One critical review could cost clients thousands, even if it’s true.

- Protects the Company, Not Clients: With enforced silence, the company doesn’t have to answer for poor performance.

- Limits Transparency: Gag clauses prevent potential clients from seeing the full picture, trapping them in the same experience.

5. They’re Running Multiple Stores

Another shocker came when Jack discovered that many automation companies manage multiple stores for different clients. This violates Amazon’s strict policies against linked accounts, putting all stores at risk of suspension. Jack read about sellers losing everything in one blow, making the risk clear.

Risks of Multiple Store Management

- Suspension Domino Effect: If Amazon suspends one account, all linked accounts could be impacted, wiping out multiple clients’ investments.

- Violation of Amazon’s Terms: Managing multiple stores under one entity increases the risk of permanent bans from Amazon.

- Client Accounts at Risk: When stores are linked, one bad apple could bring down the whole barrel, even for unrelated clients.

- Financial Fallout: If Amazon suspends accounts, clients bear the brunt of the loss with no compensation.

6. Forced Monthly Payments on a Strict Timeline

Jack was wary when he saw another clause requiring monthly payments within 72 hours of invoice. If he missed the deadline, the company would stop working on his account. A single late payment could halt his operations, even though he’d already paid thousands in upfront fees.

Why This Payment Timeline Feels Hostile

- Zero Flexibility for Disputes: Tight payment timelines leave no room for negotiating or disputing charges.

- Punishes Clients for Small Delays: One missed deadline can mean a loss of service, even if payments were consistent previously.

- Strains Financial Freedom: Clients feel cornered, having to make payments without time for financial flexibility.

- No Leeway for Service Issues: Even if the client isn’t satisfied, they must pay to avoid disruptions to their account.

7. Unverified Reports to Justify Profit Splits

The monthly reports justifying the company’s profit split lacked third-party verification. Without an audit, Jack realized he was left trusting the company’s word on how much his store was earning. This lack of transparency opened the door for potential number-padding to justify high profit splits.

Why Unverified Reports Are Concerning

- Easy to Manipulate: Without audits, the company could inflate figures to secure a bigger cut.

- Leaves Clients in the Dark: Clients rely on internal numbers with no external check, fostering potential misrepresentation.

- Lacks Financial Trust: Unverified reports mean clients can’t be confident in the profit they’re being told they’re making.

- Unfair Advantage to the Company: Clients face extra costs without verified transparency, skewing financial accountability.

8. Mystery Sourcing—Where Are the Products From?

Jack asked for details about product sourcing, but the company reps were vague, sidestepping questions about product origins and quality. Without knowing where the items came from, Jack feared that his store would face penalties for selling unauthorized goods. Amazon’s penalties for this can be severe, making it a serious risk.

Why Mystery Sourcing is a Red Flag

- Potential for Counterfeit Goods: Clients might unknowingly sell counterfeit goods if items aren’t sourced properly.

- Violation of Amazon’s Authenticity Policy: Poor sourcing could lead to serious penalties, even account suspension.

- Client Bears the Burden: When sourcing is questionable, it’s the client who faces penalties and reputation damage.

- Compromises Quality Control: Without transparency, clients lose control over quality assurance, increasing their liability.

9. No Guarantees on Income

Jack was used to calculated risks in business, but these contracts took “no guarantees” to a new level. There was no assurance of profit, even after paying $30,000 upfront. For the amount being invested, Jack thought there’d be at least some level of performance accountability. There wasn’t.

Why Income Disclaimers are Problematic

- Clients Carry All Financial Risk: With no guarantees, clients must bear all potential losses, even after steep investments.

- No Accountability for the Company: Without income guarantees, companies are free from the pressure to deliver.

- One-Sided Risk: Clients invest heavily with no safety net, while the company secures earnings regardless.

- Dilutes Company Responsibility: These disclaimers ensure the company faces no consequences for underperformance.

10. “Growth” Periods with Zero Sales

Many contracts had a “growth phase” that conveniently spanned the entire contract term. It sounded fair until Jack realized it was a built-in excuse for slow sales. The company could underdeliver for years, using this “growth” period as cover while his investment sat idle.

Why “Growth Phases” Feel Like a Stall

- Excuse for Poor Performance: Companies use “growth phase” language to buy time without delivering results.

- Misleads Client Expectations: The promise of sales and growth is delayed indefinitely, leaving clients with little return.

- Costs Keep Mounting: While sales lag, fees continue, straining the client’s resources without income to cover them.

- Shields Company from Responsibility: The growth phase gives companies cover, making underperformance acceptable.

11. A Sneaky 10% Cut on Selling Your Account

If Jack decides to sell his account, the company reserves the right to a 10% cut of his earnings from the sale. Even if the business were underperforming, they’d still pocket a piece if he cut his losses. It was a last-minute twist that stung after everything else he’d invested.

The Issue with Exit Fees

- Adds Extra Financial Burden: Clients pay heavily upfront, then face additional fees just to leave.

- Limits Financial Flexibility: It discourages clients from selling, trapping them in the contract.

- Benefits Company Even in Exit: The company takes a cut, whether or not they delivered on initial promises.

- Costs Clients in the Long Run: By taking a portion of the sale, they profit even from dissatisfied clients.

12. No Clear Exit Strategy

Lock-in periods were common in these contracts, but without an exit clause, clients were trapped for the full term. This left Jack worried—no way to leave early if things went south, meaning he’d be stuck even if the service underperformed.

Problems with Lack of Exit Options

- Financial Trap: Clients are locked into full-term commitments with no way out, regardless of performance.

- Risk of Mounting Losses: If the business fails to deliver, clients continue paying without returns.

- Prioritizes Company’s Interest: With no exit, the contract protects the company’s revenue over the client’s flexibility.

- Client Bears All Costs: Clients must absorb losses, trapped by a rigid contract that benefits the service provider.

13. One-Sided Obligations

The contract was filled with obligations for Jack, yet the company’s own responsibilities were vague, with terms like “reasonable efforts.” There was no definition for what “reasonable” meant, leaving the company with all the leeway and Jack with all the accountability.

Why This Bias is Concerning

- Unequal Burden: Clients face clear terms, while the company operates under vague commitments.

- Little Accountability for Underperformance: Broad language lets the company escape consequences for lackluster service.

- Increases Client Risk: Clients are left exposed, bearing most of the responsibility for a service with undefined standards.

- Limits Recourse for Clients: If the service falls short, clients have little room to dispute or demand better.

14. The Ultimate Escape Clause—Blaming Amazon for Closures

In the contract’s fine print, Jack noticed that if Amazon shut down his store due to policy violations, the company wouldn’t be held accountable. Whether it was due to their sourcing or practices, they’d leave him holding the bag. It was the ultimate escape clause.

The Impact of This Escape Clause

- All Responsibility on Clients: Clients face financial fallout from suspensions, even if the company’s actions led to it.

- Company Avoids Liability: This clause shifts all risk to the client, ensuring the company faces no consequences.

- No Accountability for Mistakes: The company sidesteps repercussions for practices that put accounts at risk.

- Protects Company’s Interests Over Clients: This escape clause prioritizes the company’s protection, leaving clients financially exposed.

Conclusion: Amazon Automation Scam—Know Before You Sign

The promises of Amazon automation can feel exciting, but as Jack’s story shows, there’s a lot hiding beneath the surface. Each red flag underscores a larger issue: a system crafted to protect the company’s profits at the client’s expense. From hidden fees and restrictive clauses to disclaimers that strip away accountability, these contracts are designed to secure the company’s success while exposing clients to most of the risk.

So, before diving into Amazon automation, make sure to read every line. What looks like a passive-income dream could quickly turn into a costly, high-stakes venture that benefits the company far more than the client.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

6 Comments

-

ive been looking at this whole amazon thing cause my buddy was all like ‘you gotta get in on this’ but now im reading about all these fees and im not so sure. like, why would they charge $30k upfront and then take a cut of what i make too? sounds like they make money no matter if i do or not. got any advice for someone just starting to look into this?

-

This article was an eye-opener, thank you for shedding light on those hidden aspects of Amazon automation scams. It’s essential to be vigilant and ask the right questions before diving into such commitments.

-

Chris Potter, you’re shedding light on big issues here. It’s vital for us to be aware of these traps before we get caught. Those unverified reports are definitely a red flag. Shows they might be hiding the actual performance. Anyone had a different experience? I’m curious if there’s another side to this.

ive been looking at this whole amazon thing cause my buddy was all like ‘you gotta get in on this’ but now im reading about all these fees and im not so sure. like, why would they charge $30k upfront and then take a cut of what i make too? sounds like they make money no matter if i do or not. got any advice for someone just starting to look into this?

You can make money with Amazon (we have a lot of clients proving this!) If you don’t have a lot of money to start, Arbitrage is a good starting point. You can also start your own brand, which you can start with less than $30k.

This article was an eye-opener, thank you for shedding light on those hidden aspects of Amazon automation scams. It’s essential to be vigilant and ask the right questions before diving into such commitments.

No problem Karen!

Chris Potter, you’re shedding light on big issues here. It’s vital for us to be aware of these traps before we get caught. Those unverified reports are definitely a red flag. Shows they might be hiding the actual performance. Anyone had a different experience? I’m curious if there’s another side to this.

Yeah, it’s a huge red flag. We’ve seen numerous people get scammed by this.