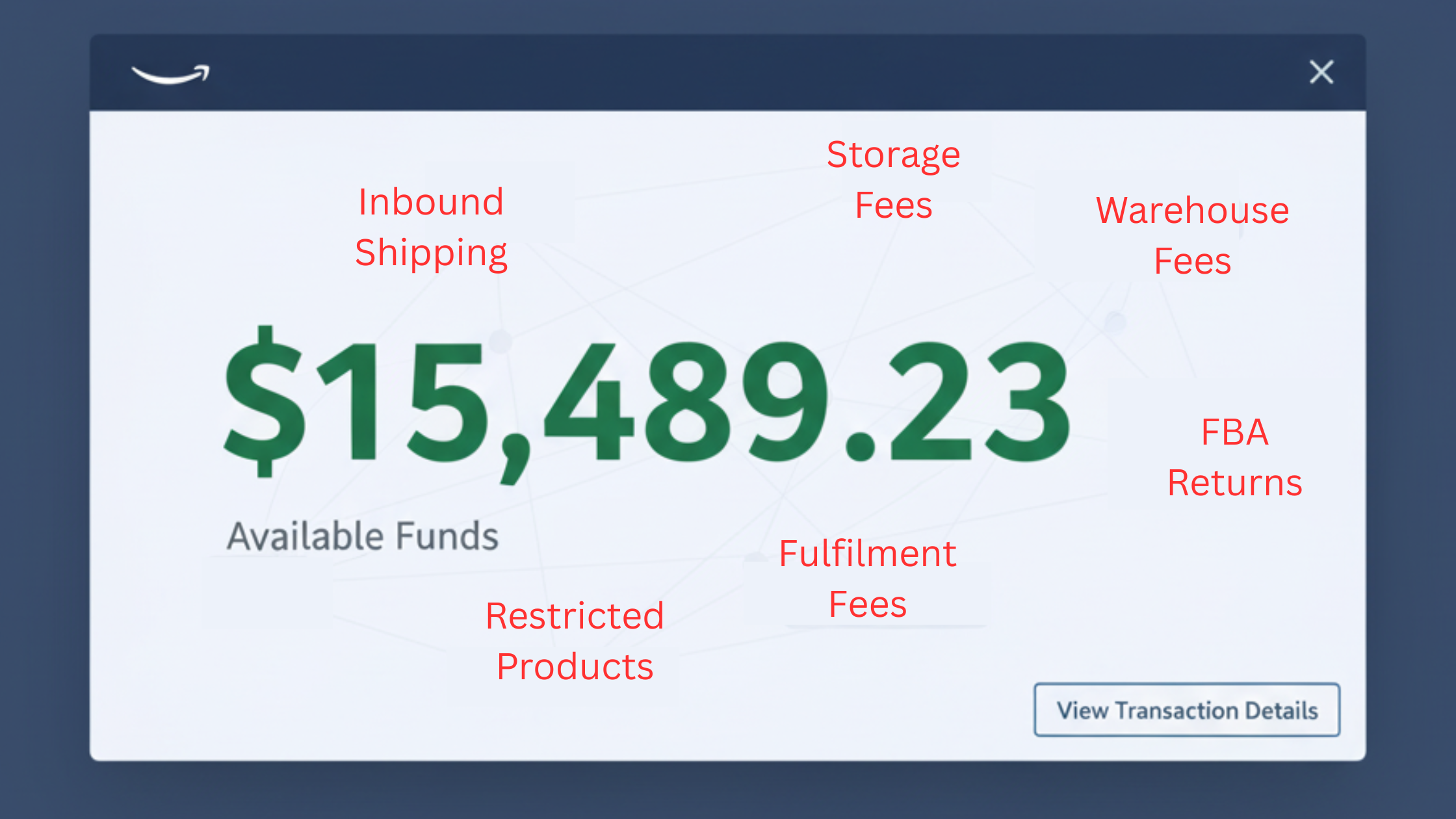

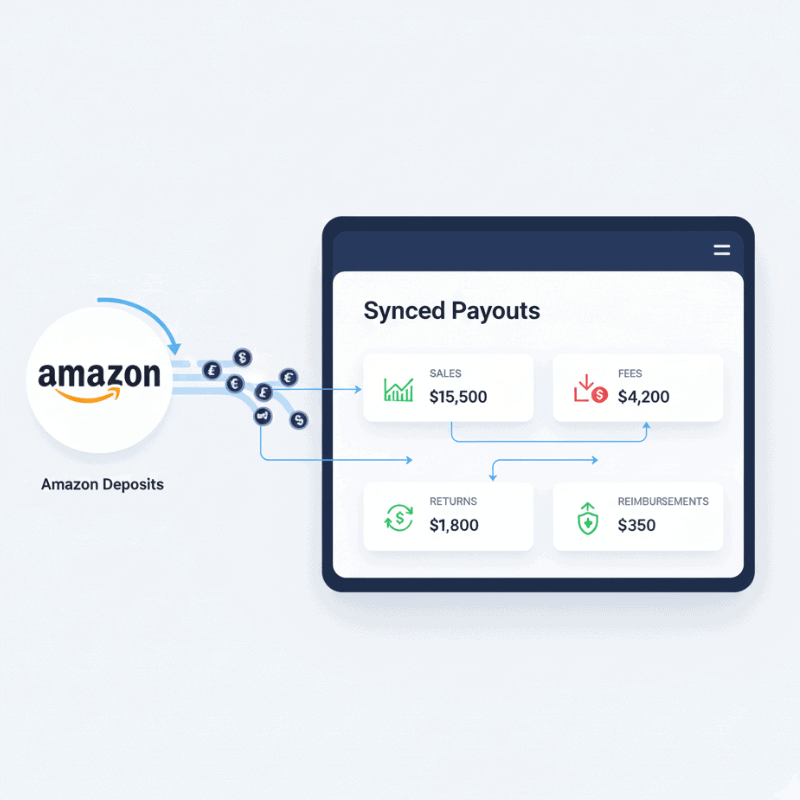

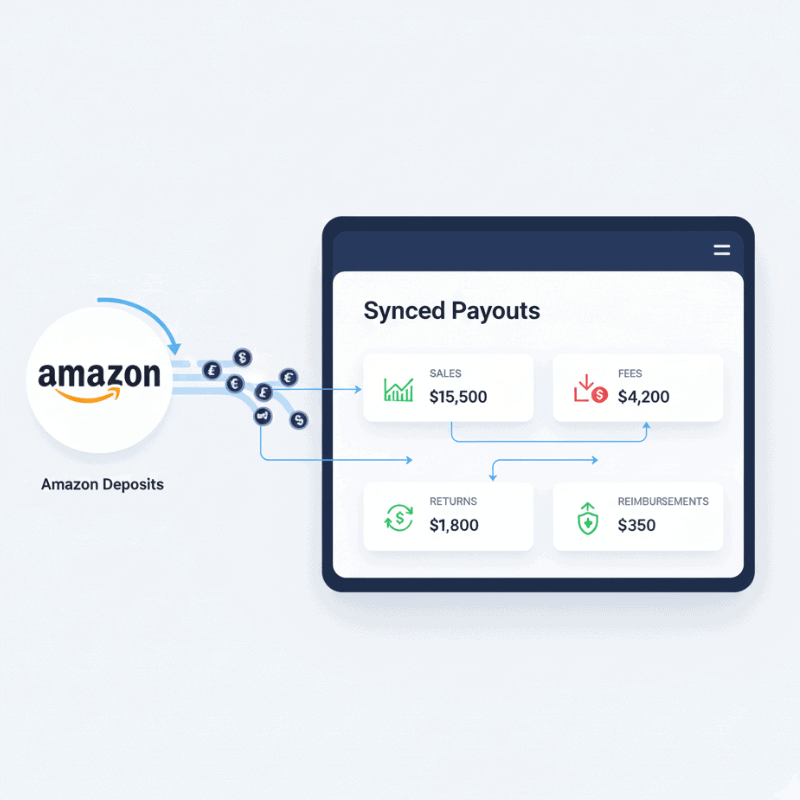

When most Amazon sellers first get started, bookkeeping feels deceptively simple. Amazon pays you every two weeks, the deposit shows up in your account, and it’s easy to assume that number is your profit.

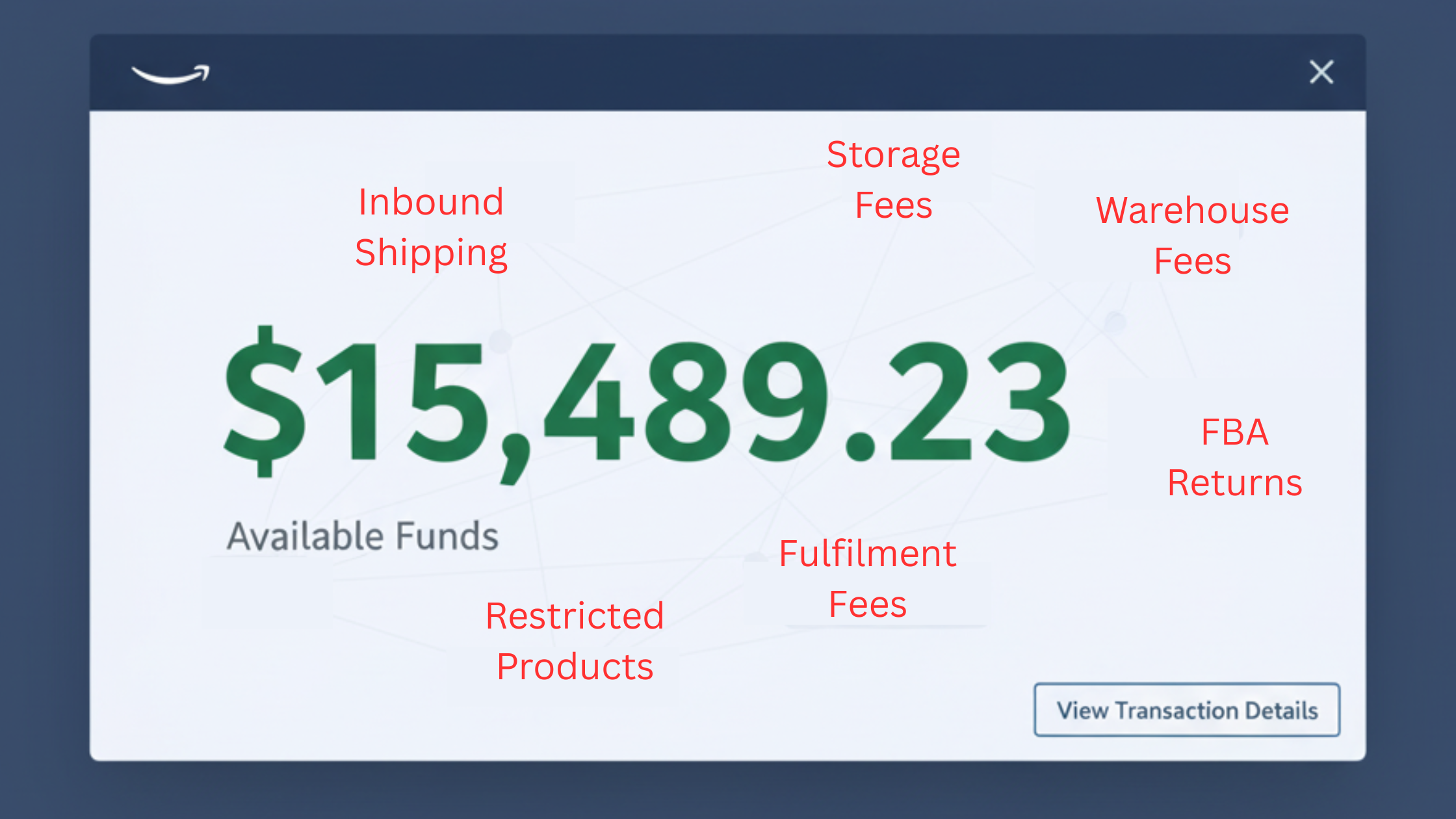

But here’s the truth: those payouts don’t tell the whole story. They already have fees, shipping costs, ad spend, and returns deducted — which means you’re only seeing leftovers, not true profit. Without accurate books, you’re flying blind.

That’s why understanding Amazon bookkeeping costs is so critical. Clean financials show you the real picture behind those deposits, protect you from tax mistakes, and keep you from scaling based on false margins. Without them, bad decisions are almost guaranteed to follow.

Table of Contents

The common misconception: payout = profit

When most Amazon sellers start, bookkeeping feels simple. Amazon pays you every two weeks, you see the deposit hit your account, and you assume that number is your profit.

But here’s the truth: Amazon’s payout is not profit. It’s a lump figure that already has fees, shipping costs, ad spend, returns, and other deductions baked in. Without proper bookkeeping, you’re flying blind.

And when you’re flying blind, bad decisions follow.

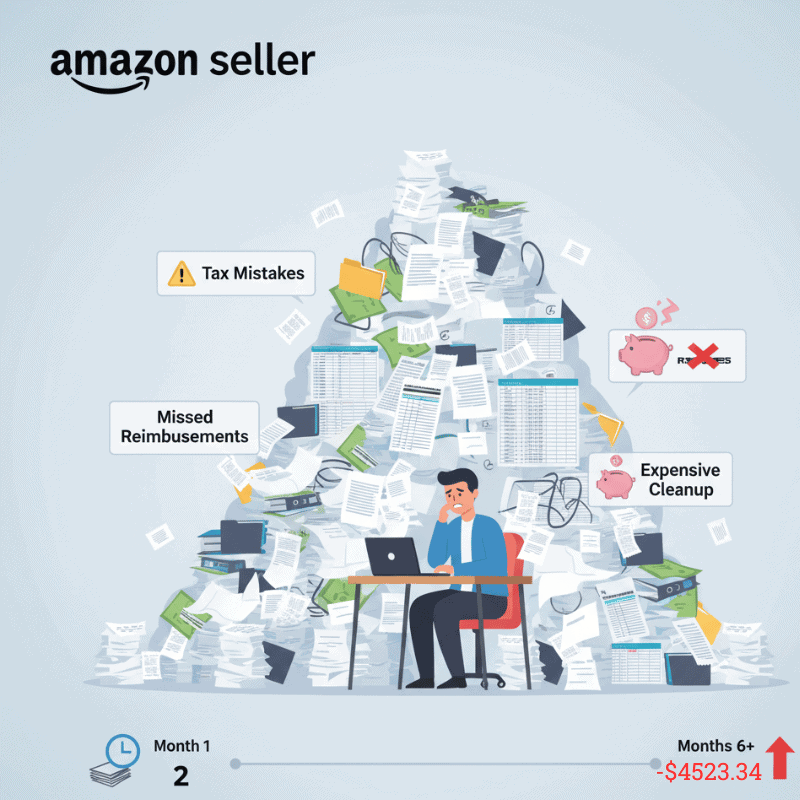

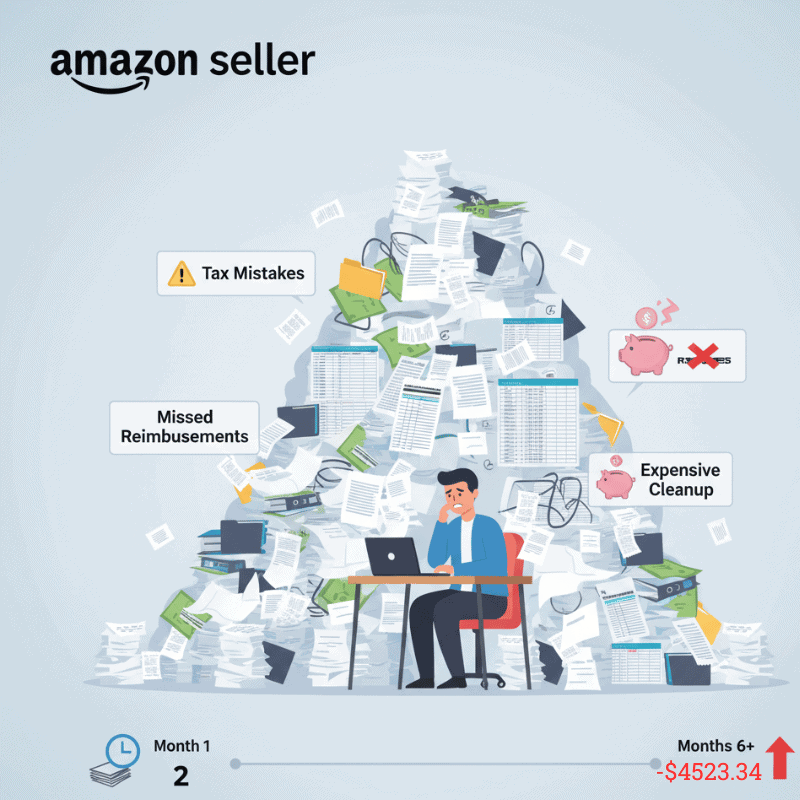

The Hidden Cost of “Good Enough” Bookkeeping

Many sellers keep a spreadsheet or let their CPA record the Amazon deposit as “income.” On the surface, it feels fine — until tax season comes around, or you try to figure out which SKUs are actually worth scaling.

That’s when the cracks appear.

Marc, for example, started with spreadsheets, then moved to QuickBooks. But he never had his system set up correctly. One month his books showed no profit. Another month showed a negative number. Every time he changed one line, the whole report shifted. His exact words: “I don’t even know if I’m overpaying or underpaying taxes.”

Another example is when Ariel scaled past $1M in sales. On paper, she looked like a success story. But her books were always three months late. She didn’t know how much cash she could safely pull, or which products were actually profitable.

Both sellers had the same problem: they were running their business with guesswork instead of financial clarity.

The Hidden Risks Of Doing It Wrong

Running with incomplete books is like driving at night with your headlights off. You think you’re getting to your destination, but it’s only a matter of time before you crash.

The risks show up in three painful ways:

- Tax mistakes: One wrong assumption can lead to overpaying or underpaying by thousands.

- Cash flow strain: You order inventory thinking you’re profitable, only to find out your margins were eaten by fees and returns.

- Expensive cleanup: The longer your books are messy, the more it costs to fix them later. Sellers often spend $5K–$10K just to get caught up.

This is why waiting to “get serious” about bookkeeping is the most expensive choice of all.

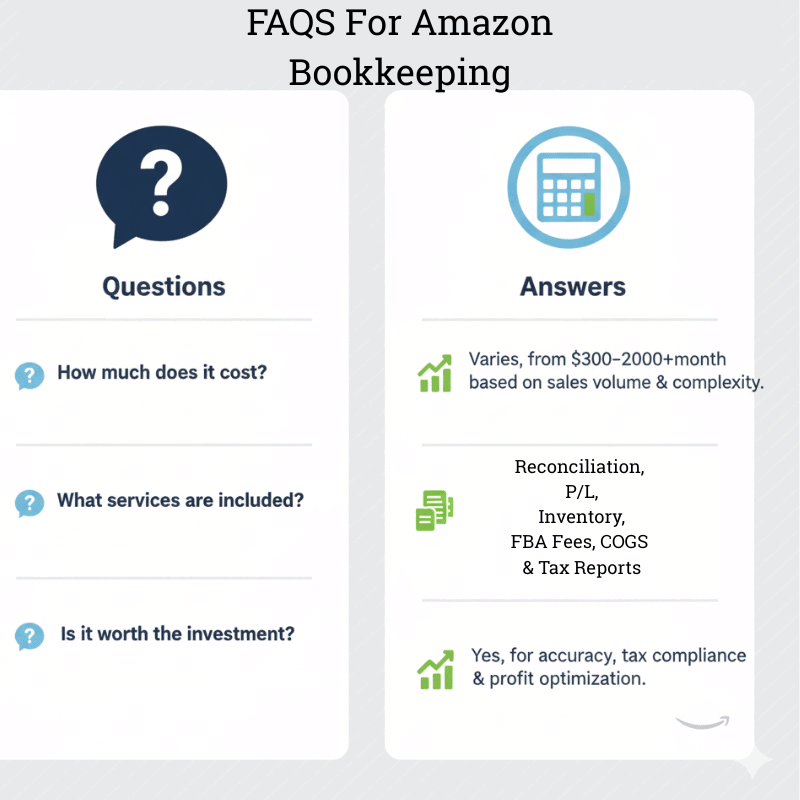

The Real Cost of Amazon Bookkeeping

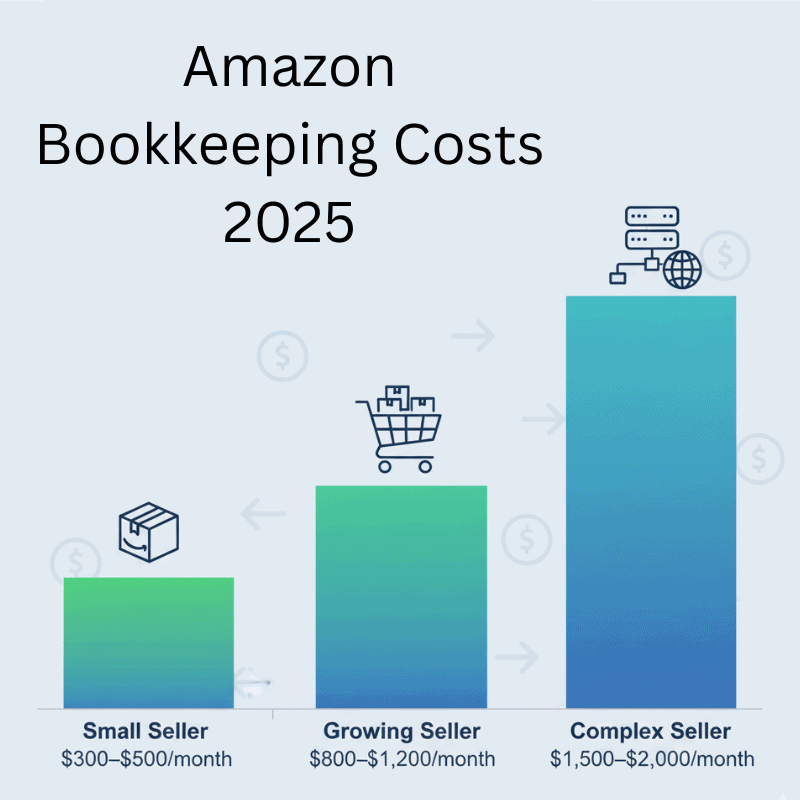

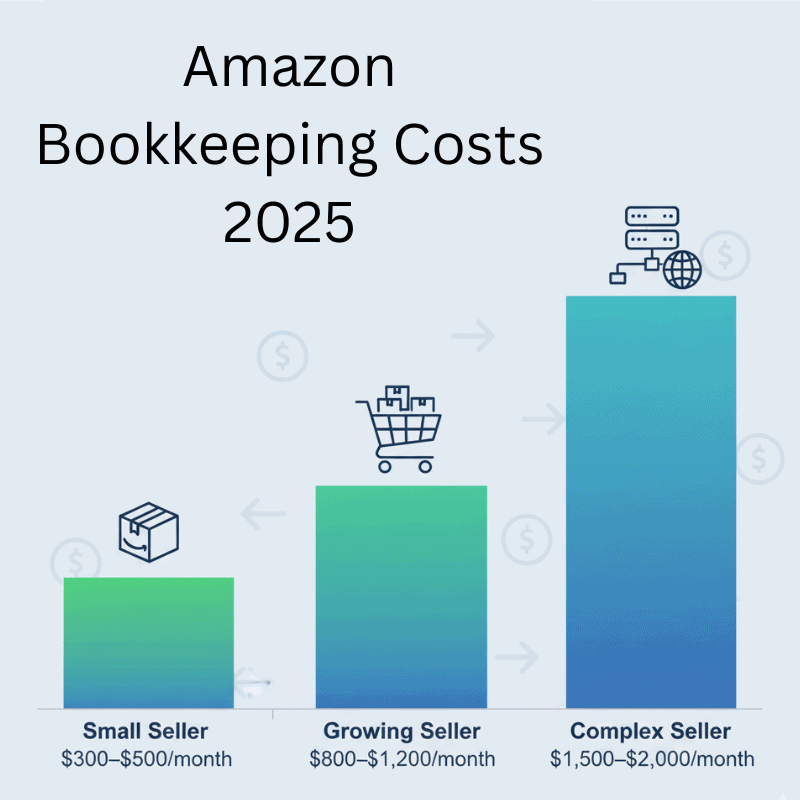

So how much does it really cost to have Amazon bookkeeping handled by a pro? For most sellers, the range is $300 to $2,000 per month.

But here’s the important part: the price doesn’t necessarily only scale with revenue. It scales with complexity.

A seller doing $20K/month could have higher bookkeeping fees than someone doing $200K/month — if their setup is more complicated.

Key Drivers of Amazon Bookkeeping Costs

- How Accounts and Cards Impact Amazon Bookkeeping Costs

Every bank account and credit card adds reconciliation work. One bank + two cards is simple. Ten cards + three banks is a reconciliation nightmare. - Your Bookkeeping Software Stack

Tools like Sellerboard or InventoryLab are great for operations — tracking buy costs, inventory values, or SKU profitability. But they don’t match QuickBooks, and they aren’t meant to. We don’t try to force them to reconcile. Instead, we treat QuickBooks Online as the financial source of truth. - How Marketplaces and Currencies Effect Amazon Bookkeeping Complexity

Amazon US is straightforward. Add Canada, UK, or EU and now you’re dealing with multiple deposits, currencies, and reporting flows. While we don’t handle VAT/GST filings, those deposits still need to be cleanly captured in QBO. - Business Models Change Amazon Bookkeeping Costs

- Private Label: big purchase orders, ad-heavy launches. Least complex of the Amazon models.

- Wholesale: Vendor invoices and larger transactions. Often more skus and more transactions on the “buy side” to track.

- Online Arbitrage/Retail Arbitrage: dozens or hundreds of small credit card charges. Add in gift cards, and the sheet volume of small buy transactions and it’s the most complex of the models.

- Private Label: big purchase orders, ad-heavy launches. Least complex of the Amazon models.

- Transaction Volume Adds Amazon Bookkeeping Fees

Ten large POs are easier to manage than 500 small charges. More line items = more time = higher fees.

What Amazon Bookkeeping Is — and Isn’t

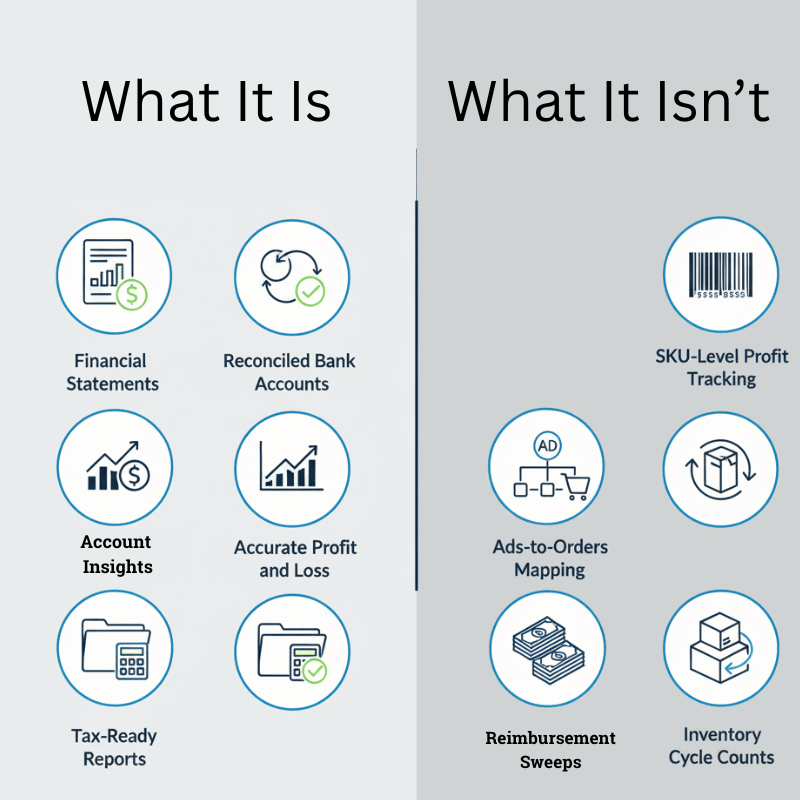

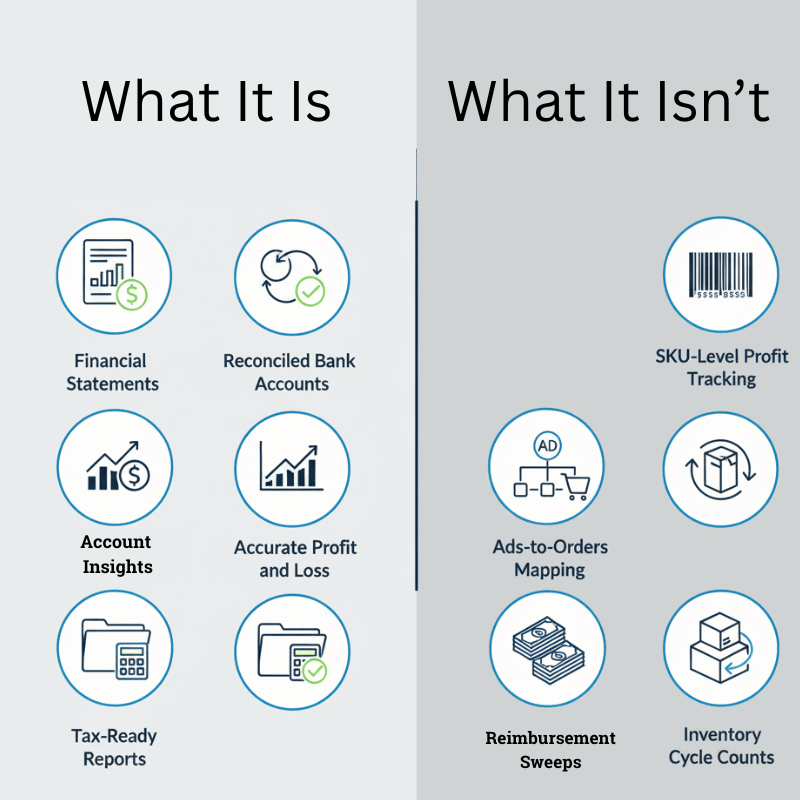

It’s important to be clear: Amazon bookkeeping is not the same as operational reporting.

- We don’t reconcile Sellerboard/InventoryLab to QuickBooks.

- We don’t manage SKU-level COGS or inventory turn counts.

- We don’t map ads to orders.

- We don’t run reimbursement sweeps.

Those are valuable operational processes, but they aren’t bookkeeping. Bookkeepings role is to make sure your financial statements in QBO are accurate, reconciled, and tax-ready.

That’s what your CPA, the IRS, and your lenders will care about — and that’s what gives you a true picture of your profitability. And if you don’t yet have a CPA and need some help getting your taxes filed, we can help with that.

Amazon Bookkeeping Costs vs. the Cost of Mistakes

At first, $500–$1,200/month might feel like a lot. But let’s compare it to the alternative:

- A tax mistake that costs $20K+.

- $10K in missed reimbursements you never tracked and you have no transparency.

- $50K tied up in inventory you thought was profitable but wasn’t.

Clean books are an investment, not an expense. Anything otherwise is guessing and that’s not a long term business strategy. Would you agree with that?

Why Delaying Your Bookkeeping Costs You More

The longer you put off proper bookkeeping, the more expensive it gets:

- Every month adds more messy transactions to clean.

- Every tax season without clarity multiplies your risk.

- Every decision you make without real numbers can backfire.

It’s not just about saving money on bookkeeping fees. It’s about avoiding the much larger losses that come from bad data. I have friends who have gone bankrupt because they had bad books. It’s not pretty.

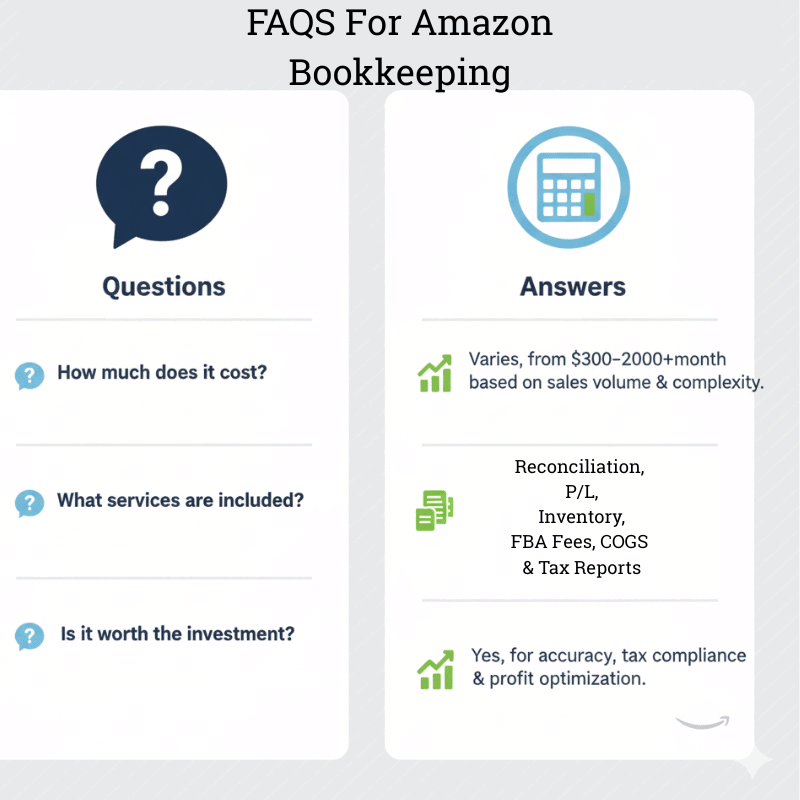

Amazon Bookkeeping FAQs We Usually Get

Do I need bookkeeping if I only sell on Amazon US?

Yes. Even a single marketplace has fees, returns, ads, and other deductions that don’t show up in your payout.

Can you make Sellerboard match QuickBooks?

No — and they’re not supposed to. Sellerboard is for SKU insights. QuickBooks is for accounting.

Do you do SKU-level profit tracking?

No. That’s what Sellerboard or InventoryLab are for. We record total COGS in QBO so your financials are tax-ready.

Do you help with VAT/GST?

We can record deposits from foreign marketplaces, but we don’t file local taxes.

How do I get my taxes filed after I get my books done?

Some sellers choose to file their own taxes. While others prefer to hire a professional that can walk them through each step. If you’re not confident in exactly what to do, it’s inexpensive to hire us. We charge a fair fee, and will help you make sure it’s done right.

Click Here To get information on our tax filing service for Amazon sellers.

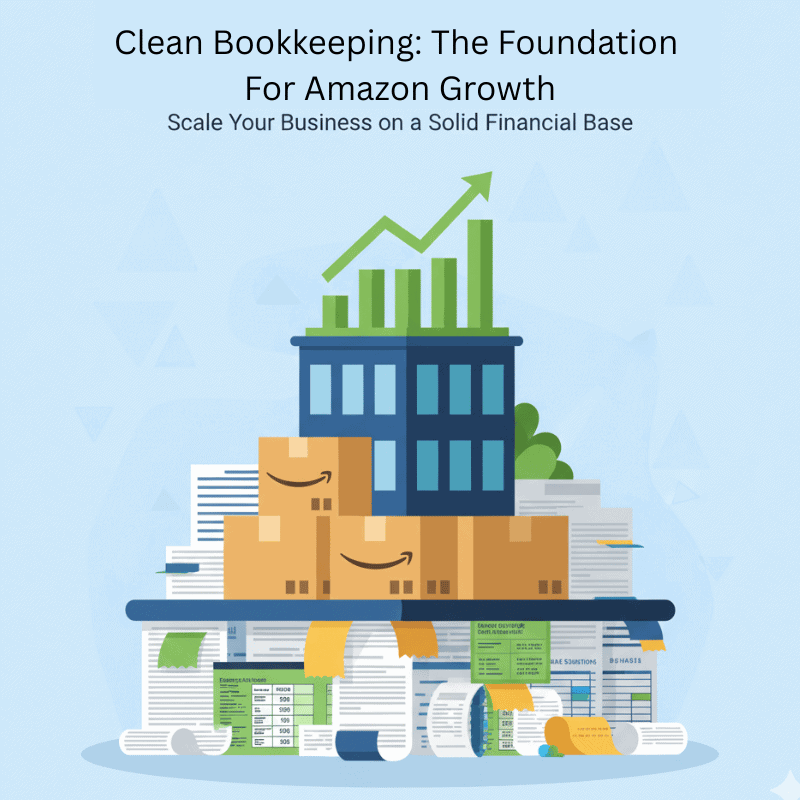

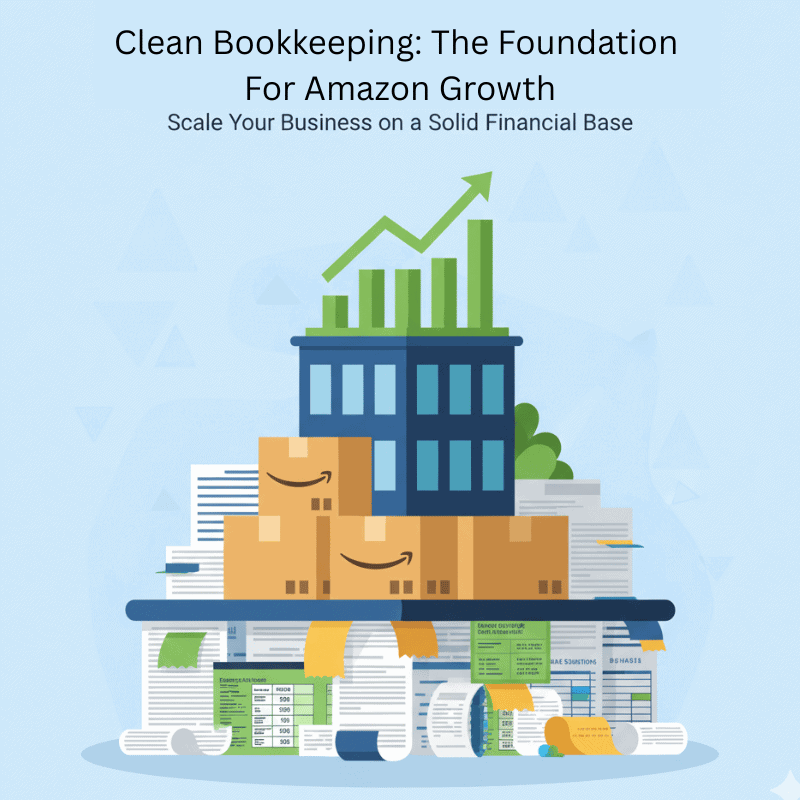

Amazon Bookkeeping as Your Financial Foundation

Amazon Bookkeeping isn’t about “keeping receipts.” It’s about building the financial foundation of your business. Without it, you’ll never know your true profit.

For most sellers, the real range is $300–$2,000/month depending on complexity. The cost is small compared to the risk of flying blind.

If you want clarity instead of guesses, it starts with one step: getting your books set up right.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

When most Amazon sellers first get started, bookkeeping feels deceptively simple. Amazon pays you every two weeks, the deposit shows up in your account, and it’s easy to assume that number is your profit.

But here’s the truth: those payouts don’t tell the whole story. They already have fees, shipping costs, ad spend, and returns deducted — which means you’re only seeing leftovers, not true profit. Without accurate books, you’re flying blind.

That’s why understanding Amazon bookkeeping costs is so critical. Clean financials show you the real picture behind those deposits, protect you from tax mistakes, and keep you from scaling based on false margins. Without them, bad decisions are almost guaranteed to follow.

Table of Contents

The common misconception: payout = profit

When most Amazon sellers start, bookkeeping feels simple. Amazon pays you every two weeks, you see the deposit hit your account, and you assume that number is your profit.

But here’s the truth: Amazon’s payout is not profit. It’s a lump figure that already has fees, shipping costs, ad spend, returns, and other deductions baked in. Without proper bookkeeping, you’re flying blind.

And when you’re flying blind, bad decisions follow.

The Hidden Cost of “Good Enough” Bookkeeping

Many sellers keep a spreadsheet or let their CPA record the Amazon deposit as “income.” On the surface, it feels fine — until tax season comes around, or you try to figure out which SKUs are actually worth scaling.

That’s when the cracks appear.

Marc, for example, started with spreadsheets, then moved to QuickBooks. But he never had his system set up correctly. One month his books showed no profit. Another month showed a negative number. Every time he changed one line, the whole report shifted. His exact words: “I don’t even know if I’m overpaying or underpaying taxes.”

Another example is when Ariel scaled past $1M in sales. On paper, she looked like a success story. But her books were always three months late. She didn’t know how much cash she could safely pull, or which products were actually profitable.

Both sellers had the same problem: they were running their business with guesswork instead of financial clarity.

The Hidden Risks Of Doing It Wrong

Running with incomplete books is like driving at night with your headlights off. You think you’re getting to your destination, but it’s only a matter of time before you crash.

The risks show up in three painful ways:

- Tax mistakes: One wrong assumption can lead to overpaying or underpaying by thousands.

- Cash flow strain: You order inventory thinking you’re profitable, only to find out your margins were eaten by fees and returns.

- Expensive cleanup: The longer your books are messy, the more it costs to fix them later. Sellers often spend $5K–$10K just to get caught up.

This is why waiting to “get serious” about bookkeeping is the most expensive choice of all.

The Real Cost of Amazon Bookkeeping

So how much does it really cost to have Amazon bookkeeping handled by a pro? For most sellers, the range is $300 to $2,000 per month.

But here’s the important part: the price doesn’t necessarily only scale with revenue. It scales with complexity.

A seller doing $20K/month could have higher bookkeeping fees than someone doing $200K/month — if their setup is more complicated.

Key Drivers of Amazon Bookkeeping Costs

- How Accounts and Cards Impact Amazon Bookkeeping Costs

Every bank account and credit card adds reconciliation work. One bank + two cards is simple. Ten cards + three banks is a reconciliation nightmare. - Your Bookkeeping Software Stack

Tools like Sellerboard or InventoryLab are great for operations — tracking buy costs, inventory values, or SKU profitability. But they don’t match QuickBooks, and they aren’t meant to. We don’t try to force them to reconcile. Instead, we treat QuickBooks Online as the financial source of truth. - How Marketplaces and Currencies Effect Amazon Bookkeeping Complexity

Amazon US is straightforward. Add Canada, UK, or EU and now you’re dealing with multiple deposits, currencies, and reporting flows. While we don’t handle VAT/GST filings, those deposits still need to be cleanly captured in QBO. - Business Models Change Amazon Bookkeeping Costs

- Private Label: big purchase orders, ad-heavy launches. Least complex of the Amazon models.

- Wholesale: Vendor invoices and larger transactions. Often more skus and more transactions on the “buy side” to track.

- Online Arbitrage/Retail Arbitrage: dozens or hundreds of small credit card charges. Add in gift cards, and the sheet volume of small buy transactions and it’s the most complex of the models.

- Private Label: big purchase orders, ad-heavy launches. Least complex of the Amazon models.

- Transaction Volume Adds Amazon Bookkeeping Fees

Ten large POs are easier to manage than 500 small charges. More line items = more time = higher fees.

What Amazon Bookkeeping Is — and Isn’t

It’s important to be clear: Amazon bookkeeping is not the same as operational reporting.

- We don’t reconcile Sellerboard/InventoryLab to QuickBooks.

- We don’t manage SKU-level COGS or inventory turn counts.

- We don’t map ads to orders.

- We don’t run reimbursement sweeps.

Those are valuable operational processes, but they aren’t bookkeeping. Bookkeepings role is to make sure your financial statements in QBO are accurate, reconciled, and tax-ready.

That’s what your CPA, the IRS, and your lenders will care about — and that’s what gives you a true picture of your profitability. And if you don’t yet have a CPA and need some help getting your taxes filed, we can help with that.

Amazon Bookkeeping Costs vs. the Cost of Mistakes

At first, $500–$1,200/month might feel like a lot. But let’s compare it to the alternative:

- A tax mistake that costs $20K+.

- $10K in missed reimbursements you never tracked and you have no transparency.

- $50K tied up in inventory you thought was profitable but wasn’t.

Clean books are an investment, not an expense. Anything otherwise is guessing and that’s not a long term business strategy. Would you agree with that?

Why Delaying Your Bookkeeping Costs You More

The longer you put off proper bookkeeping, the more expensive it gets:

- Every month adds more messy transactions to clean.

- Every tax season without clarity multiplies your risk.

- Every decision you make without real numbers can backfire.

It’s not just about saving money on bookkeeping fees. It’s about avoiding the much larger losses that come from bad data. I have friends who have gone bankrupt because they had bad books. It’s not pretty.

Amazon Bookkeeping FAQs We Usually Get

Do I need bookkeeping if I only sell on Amazon US?

Yes. Even a single marketplace has fees, returns, ads, and other deductions that don’t show up in your payout.

Can you make Sellerboard match QuickBooks?

No — and they’re not supposed to. Sellerboard is for SKU insights. QuickBooks is for accounting.

Do you do SKU-level profit tracking?

No. That’s what Sellerboard or InventoryLab are for. We record total COGS in QBO so your financials are tax-ready.

Do you help with VAT/GST?

We can record deposits from foreign marketplaces, but we don’t file local taxes.

How do I get my taxes filed after I get my books done?

Some sellers choose to file their own taxes. While others prefer to hire a professional that can walk them through each step. If you’re not confident in exactly what to do, it’s inexpensive to hire us. We charge a fair fee, and will help you make sure it’s done right.

Click Here To get information on our tax filing service for Amazon sellers.

Amazon Bookkeeping as Your Financial Foundation

Amazon Bookkeeping isn’t about “keeping receipts.” It’s about building the financial foundation of your business. Without it, you’ll never know your true profit.

For most sellers, the real range is $300–$2,000/month depending on complexity. The cost is small compared to the risk of flying blind.

If you want clarity instead of guesses, it starts with one step: getting your books set up right.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.