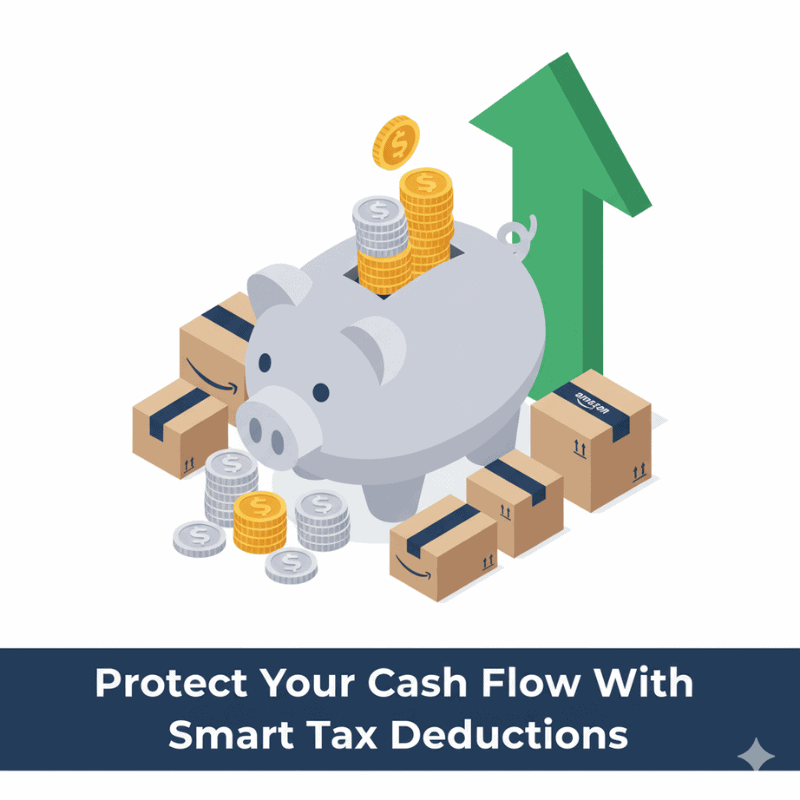

Smart Amazon sellers know tax deductions aren’t just about saving money at year-end — they’re the secret weapon for protecting cash flow and keeping profits in the business.

key points

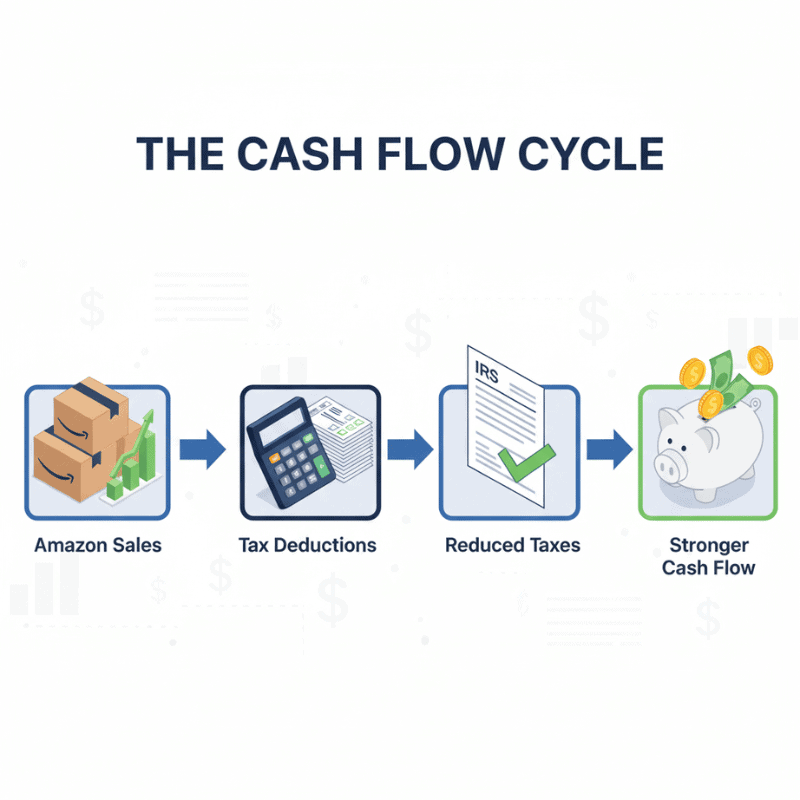

Running an Amazon business can feel like a dream come true—sales rolling in, products flying off virtual shelves, and profits on the horizon. But here’s the catch: no matter how much revenue you generate, if you miss out on key Amazon seller tax deductions, that dream can quickly turn into a cash flow nightmare.

Smart sellers know that tax planning isn’t just about filing at year-end—it’s a cash flow strategy. By taking advantage of deductions and avoiding costly tax mistakes, you can keep more money in your business and avoid the financial traps that hurt so many E-commerce entrepreneurs.

Table of Contents

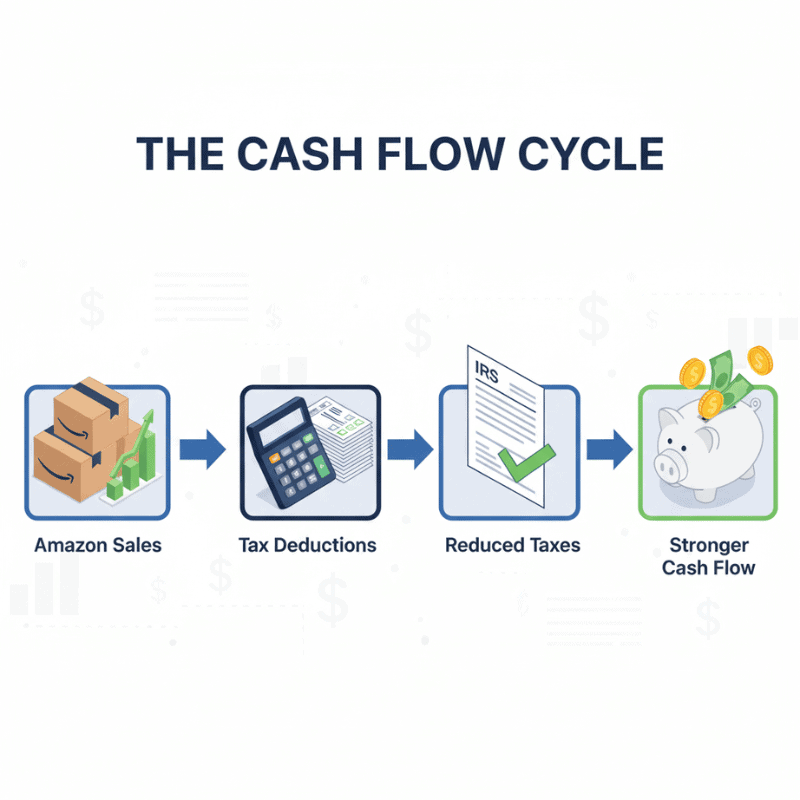

Why Amazon Selling Tax Deductions Are a Cash Flow Lifeline

Every dollar you save in taxes is a dollar you can reinvest in your business. Missed deductions mean higher tax bills, which eat into profits and tighten your operating cash flow.

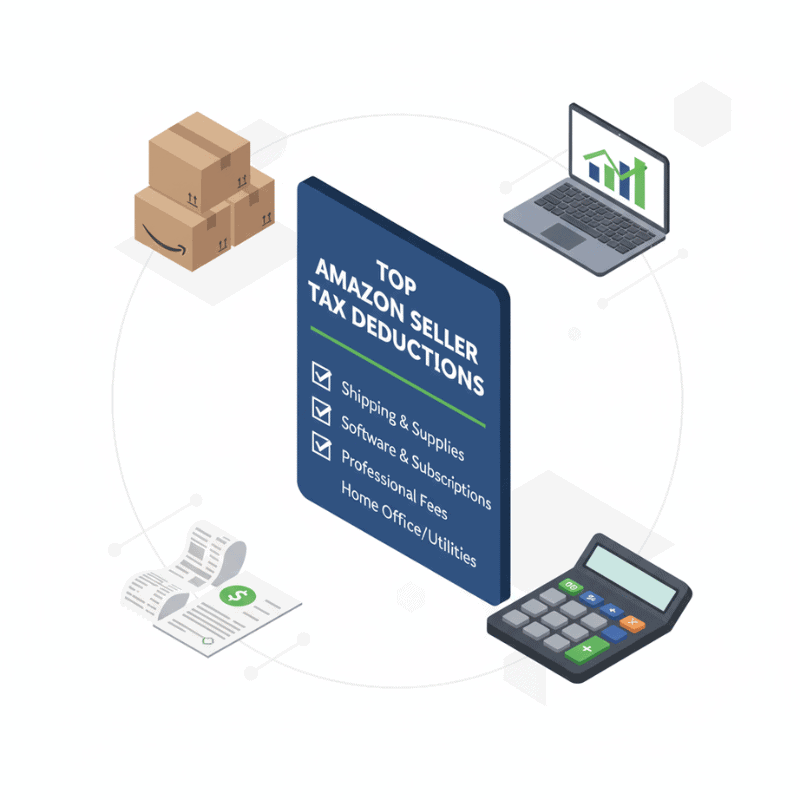

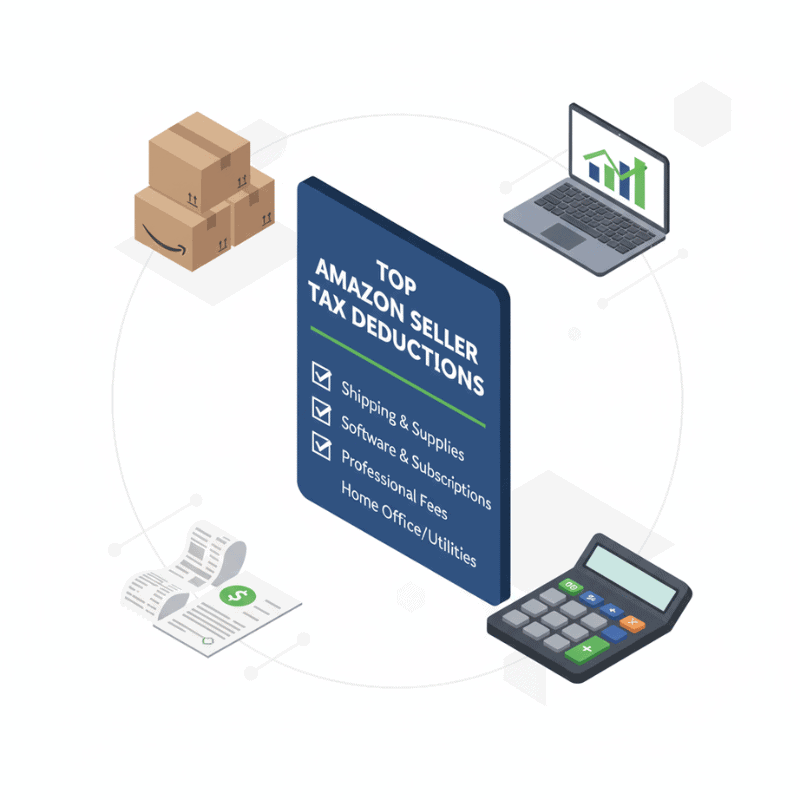

The Top Amazon Seller Tax Deductions That Free Up Cash

Missing out on common write-offs is one of the biggest cash flow mistakes sellers make. Knowing what you can deduct gives you more breathing room for growth.

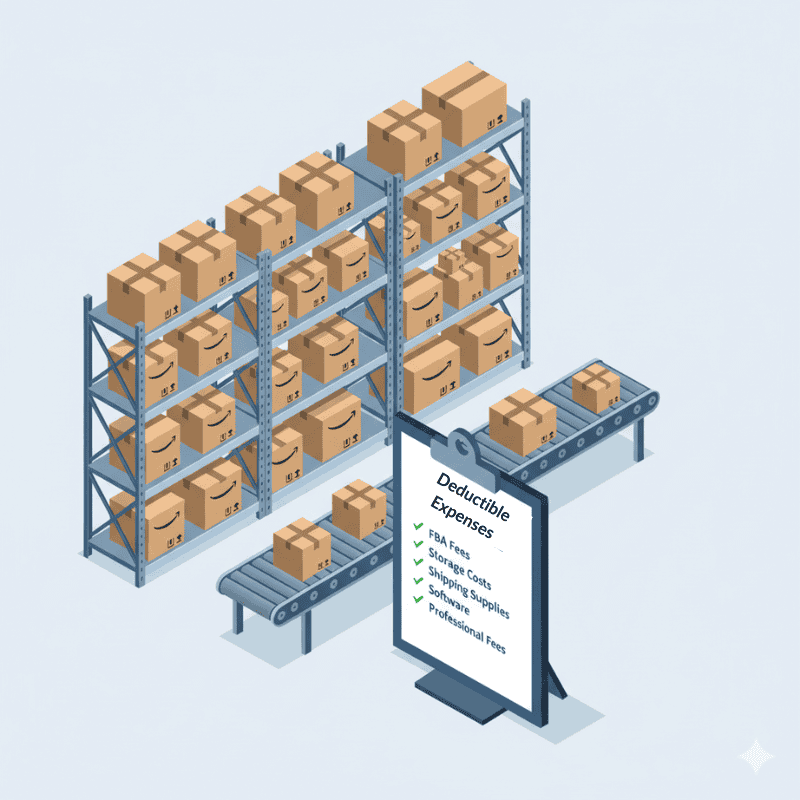

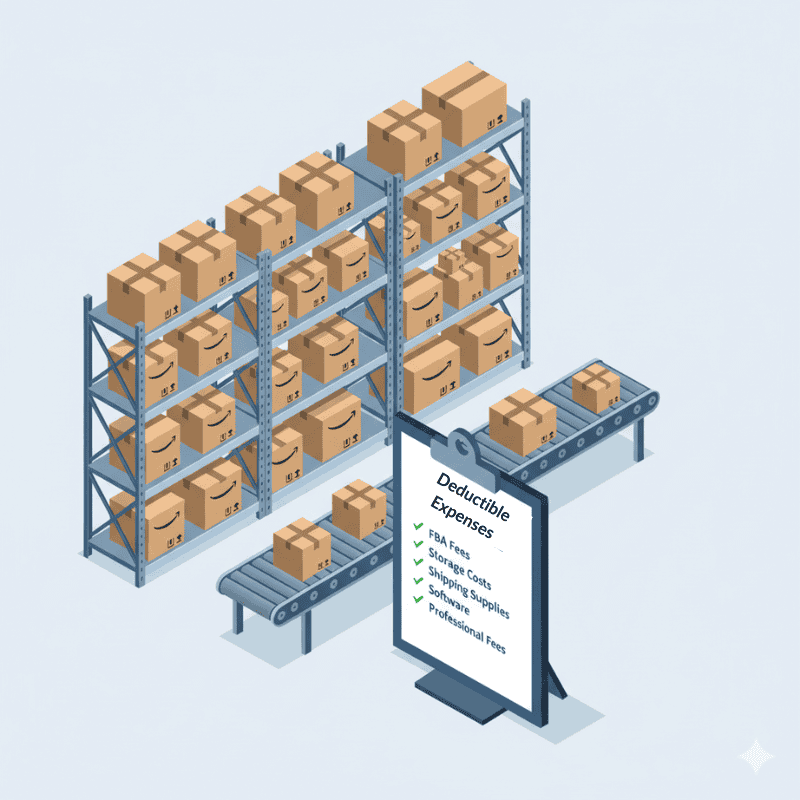

Shipping & Fulfillment Costs

From Amazon FBA fees to packaging, shipping, and returns, all fulfillment expenses are tax-deductible. These are often a seller’s largest operating costs—and overlooking them means losing thousands in potential tax savings.

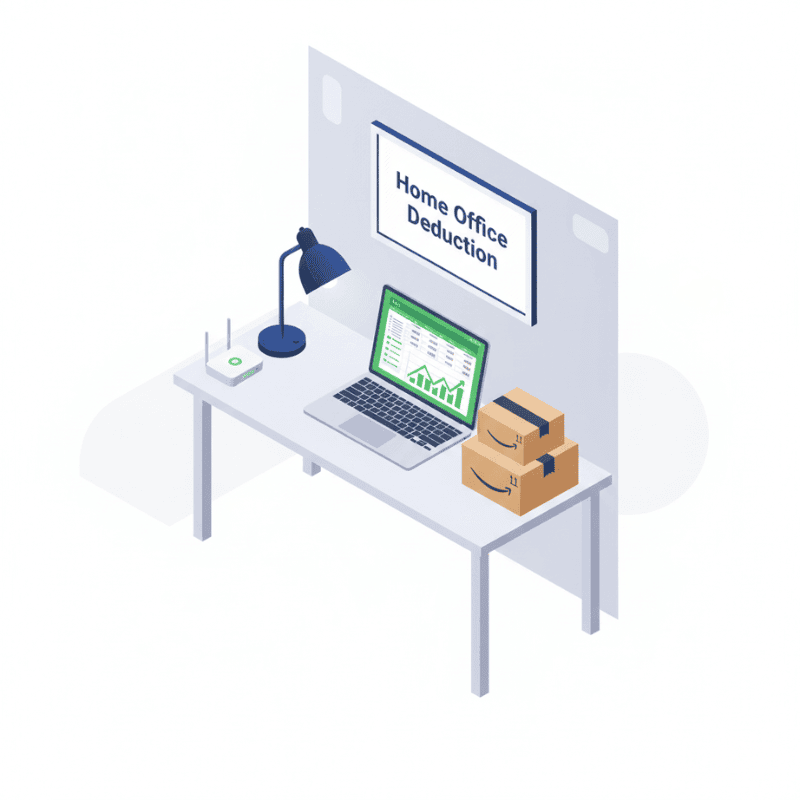

Home Office Deduction for Amazon Sellers

If you run your business from home, you may qualify for the home office deduction. That includes a percentage of your rent or mortgage, utilities, and internet costs.

Professional Services & Tools

Bookkeepers, tax advisors, inventory software, and PPC management tools all qualify as business expenses for Amazon sellers—and they can significantly reduce your taxable income.

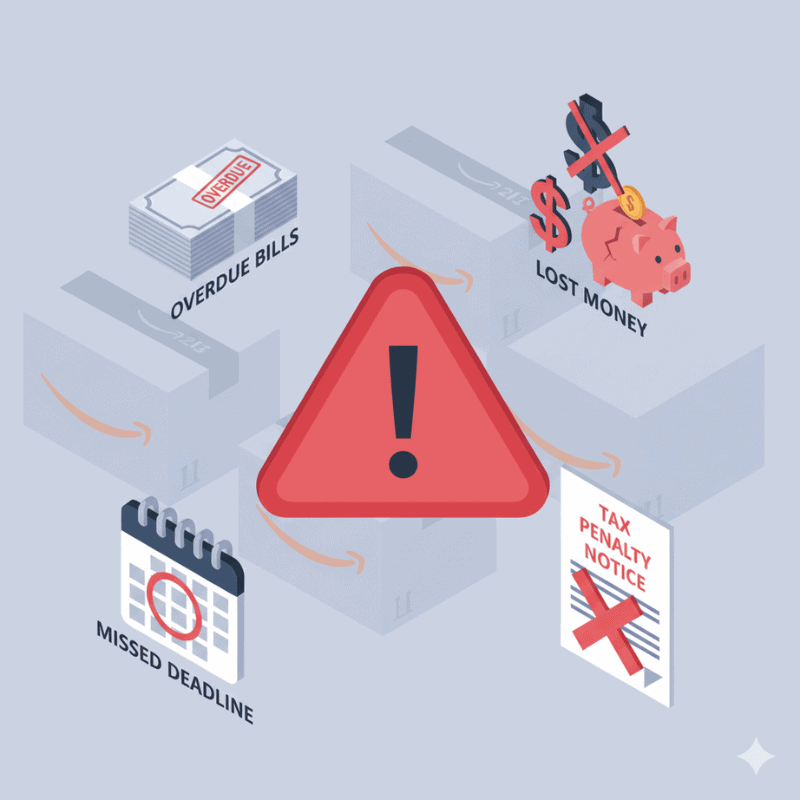

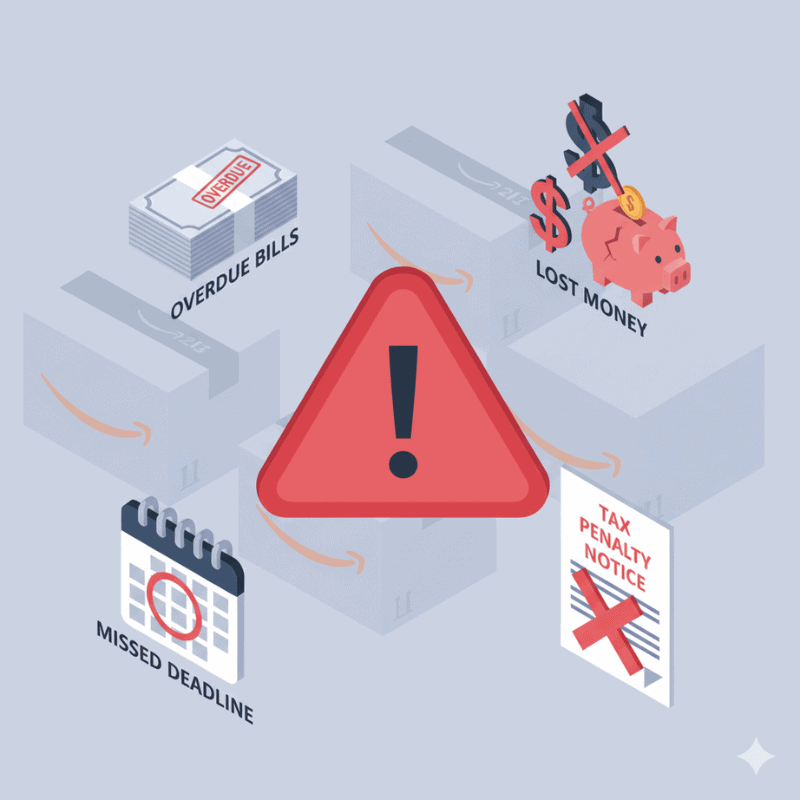

Tax Planning Mistakes That Hurt Amazon Seller Cash Flow

Even profitable Amazon businesses run into cash flow trouble if they mismanage taxes. The biggest culprit? Treating taxes like a once-a-year problem instead of an ongoing part of your financial strategy.

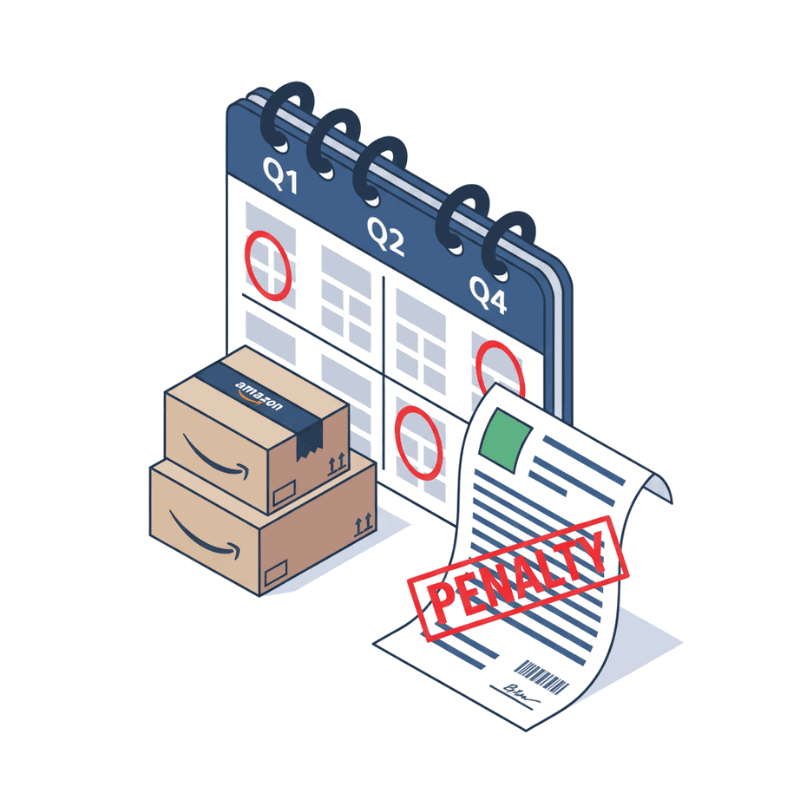

Ignoring Quarterly Estimated Taxes

Amazon sellers are required to pay quarterly taxes. Missing these payments leads to penalties and surprise tax bills that crush cash flow.

Mixing Business & Personal Expenses

Without separating accounts, you’ll miss deductions and raise red flags with the IRS. This mistake not only costs you tax savings but also makes cash tracking nearly impossible.

Waiting Until Tax Season

Scrambling at year-end leaves deductions on the table. Proactive tracking throughout the year ensures you maximize your write-offs and avoid last-minute stress.

Final Takeaway – Keep More Profit, Protect Your Cash Flow

Emily, from the original cautionary tale, lost her ecommerce business due to poor cash flow management. For Amazon sellers today, the same outcome often comes from ignoring tax deductions and planning mistakes.

The lesson is clear:

- Use every tax deduction available to you.

- Avoid mistakes that drain your profits.

Work with experts who specialize in Amazon seller tax help.

Take the Next Step: Find Out What Amazon Seller Tax Deductions You Qualify For

Reading about deductions is one thing — but knowing exactly what you qualify for is where the real savings begin. Every Amazon business is unique, and missing out on even one deduction can mean leaving thousands of dollars on the table.

That’s why we created a quick Amazon Seller Tax Deduction Survey. In just a few minutes, you’ll discover:

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

Smart Amazon sellers know tax deductions aren’t just about saving money at year-end — they’re the secret weapon for protecting cash flow and keeping profits in the business.

key points

Running an Amazon business can feel like a dream come true—sales rolling in, products flying off virtual shelves, and profits on the horizon. But here’s the catch: no matter how much revenue you generate, if you miss out on key Amazon seller tax deductions, that dream can quickly turn into a cash flow nightmare.

Smart sellers know that tax planning isn’t just about filing at year-end—it’s a cash flow strategy. By taking advantage of deductions and avoiding costly tax mistakes, you can keep more money in your business and avoid the financial traps that hurt so many E-commerce entrepreneurs.

Table of Contents

Why Amazon Selling Tax Deductions Are a Cash Flow Lifeline

Every dollar you save in taxes is a dollar you can reinvest in your business. Missed deductions mean higher tax bills, which eat into profits and tighten your operating cash flow.

The Top Amazon Seller Tax Deductions That Free Up Cash

Missing out on common write-offs is one of the biggest cash flow mistakes sellers make. Knowing what you can deduct gives you more breathing room for growth.

Shipping & Fulfillment Costs

From Amazon FBA fees to packaging, shipping, and returns, all fulfillment expenses are tax-deductible. These are often a seller’s largest operating costs—and overlooking them means losing thousands in potential tax savings.

Home Office Deduction for Amazon Sellers

If you run your business from home, you may qualify for the home office deduction. That includes a percentage of your rent or mortgage, utilities, and internet costs.

Professional Services & Tools

Bookkeepers, tax advisors, inventory software, and PPC management tools all qualify as business expenses for Amazon sellers—and they can significantly reduce your taxable income.

Tax Planning Mistakes That Hurt Amazon Seller Cash Flow

Even profitable Amazon businesses run into cash flow trouble if they mismanage taxes. The biggest culprit? Treating taxes like a once-a-year problem instead of an ongoing part of your financial strategy.

Ignoring Quarterly Estimated Taxes

Amazon sellers are required to pay quarterly taxes. Missing these payments leads to penalties and surprise tax bills that crush cash flow.

Mixing Business & Personal Expenses

Without separating accounts, you’ll miss deductions and raise red flags with the IRS. This mistake not only costs you tax savings but also makes cash tracking nearly impossible.

Waiting Until Tax Season

Scrambling at year-end leaves deductions on the table. Proactive tracking throughout the year ensures you maximize your write-offs and avoid last-minute stress.

Final Takeaway – Keep More Profit, Protect Your Cash Flow

Emily, from the original cautionary tale, lost her ecommerce business due to poor cash flow management. For Amazon sellers today, the same outcome often comes from ignoring tax deductions and planning mistakes.

The lesson is clear:

- Use every tax deduction available to you.

- Avoid mistakes that drain your profits.

Work with experts who specialize in Amazon seller tax help.

Take the Next Step: Find Out What Amazon Seller Tax Deductions You Qualify For

Reading about deductions is one thing — but knowing exactly what you qualify for is where the real savings begin. Every Amazon business is unique, and missing out on even one deduction can mean leaving thousands of dollars on the table.

That’s why we created a quick Amazon Seller Tax Deduction Survey. In just a few minutes, you’ll discover:

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.