Taxes, liability, and take-home pay — discover which structure Amazon sellers are choosing in 2025 and why it matters more than you think.

key points

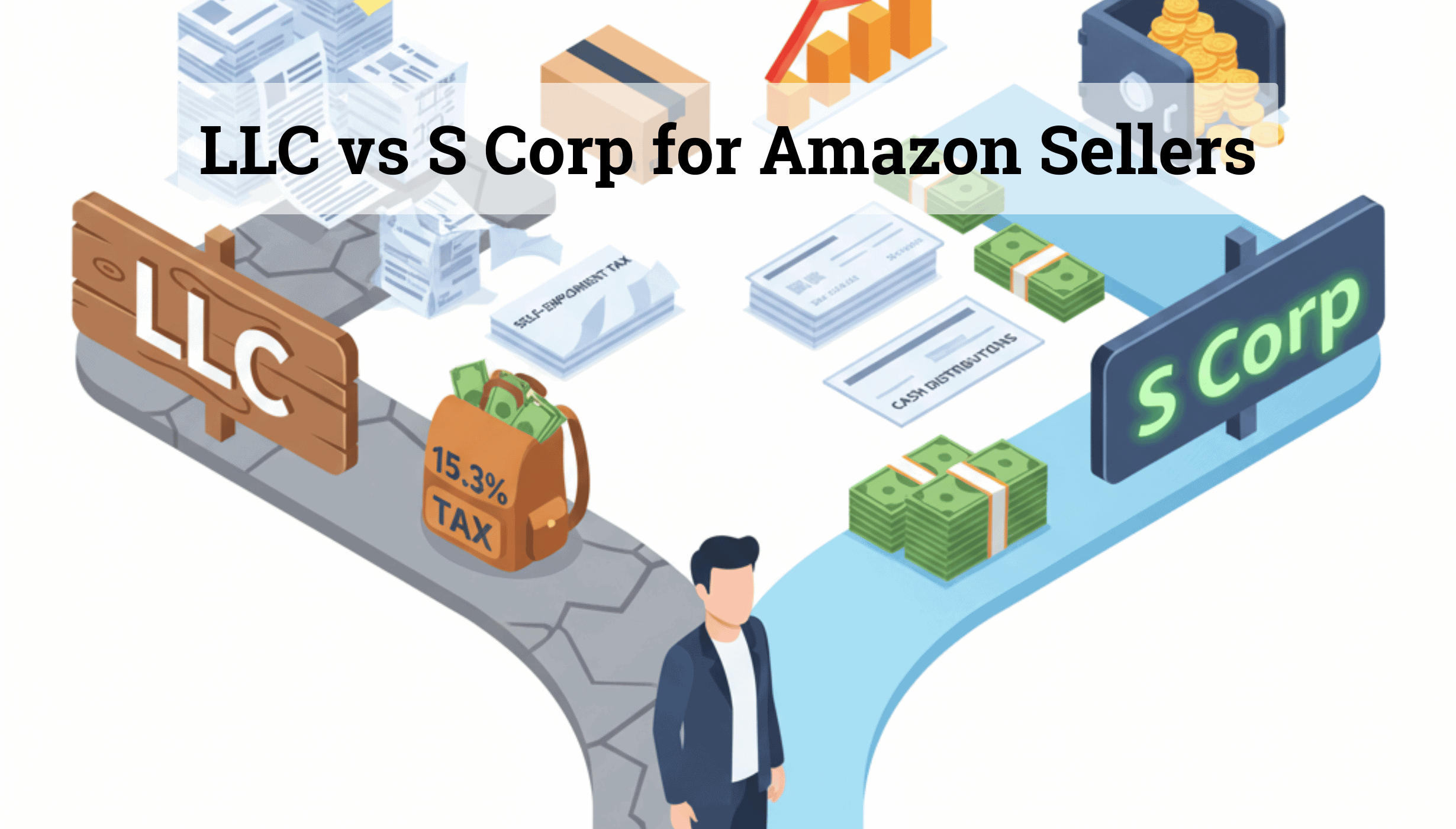

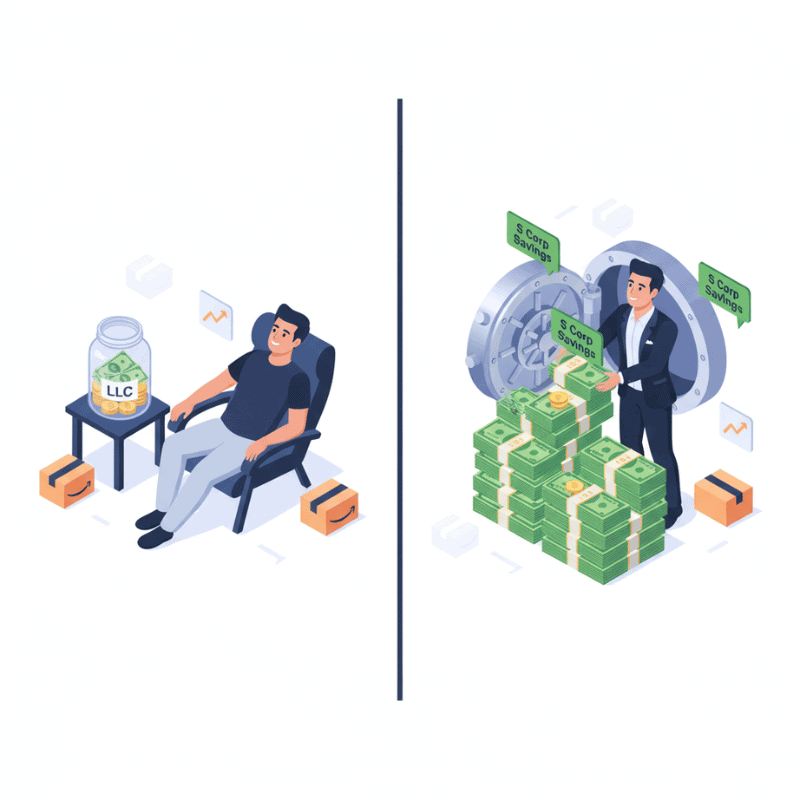

Let’s be honest: talking about LLC vs S Corp as a business structure for Amazon sellers is about as exciting as reading the fine print on your Wi-Fi contract. Necessary? Yes. Thrilling? Only if you count the adrenaline rush of realizing you could have saved thousands in taxes last year.

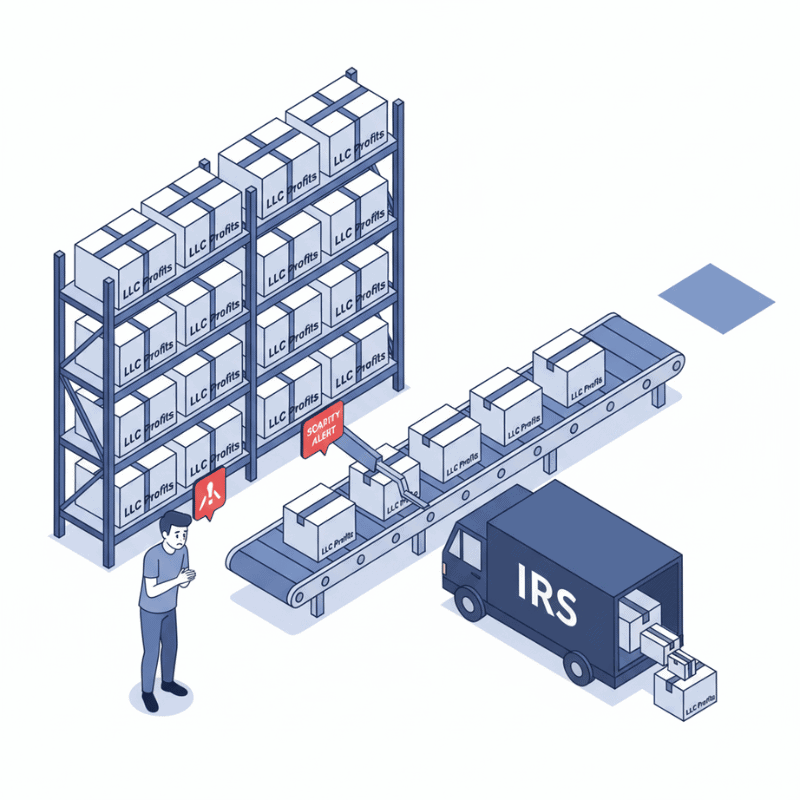

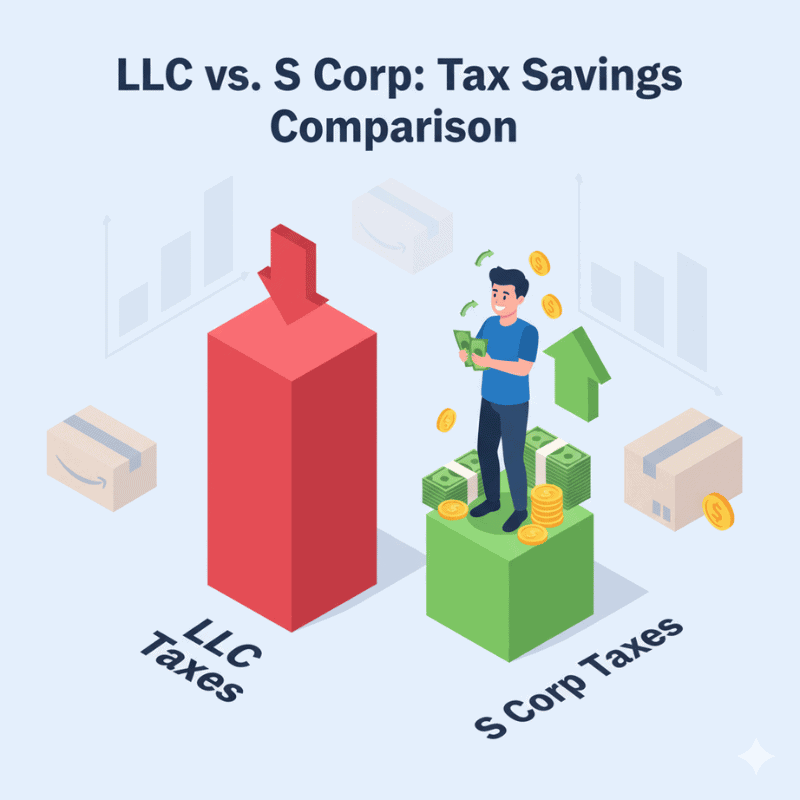

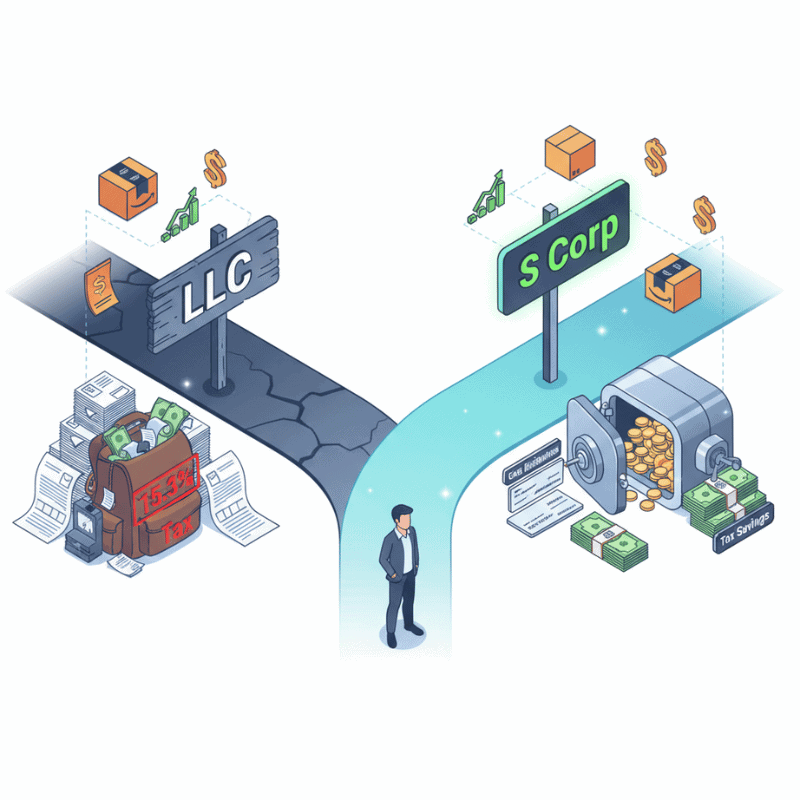

But here’s the deal: the decision between an LLC and an S Corp isn’t just legal jargon. For Amazon sellers and e-commerce entrepreneurs, it can mean the difference between pocketing more of your hard-earned profits… or handing them to the IRS like an involuntary tip.

And since most guides on this topic read like a tax law textbook, we’re going to do things differently. We’ll use plain English, a little wit, and some real-world Amazon seller context. By the end, you’ll know whether your business should stay comfortably in LLC land or level up to S Corp status — without nodding off halfway through.

Table of Contents

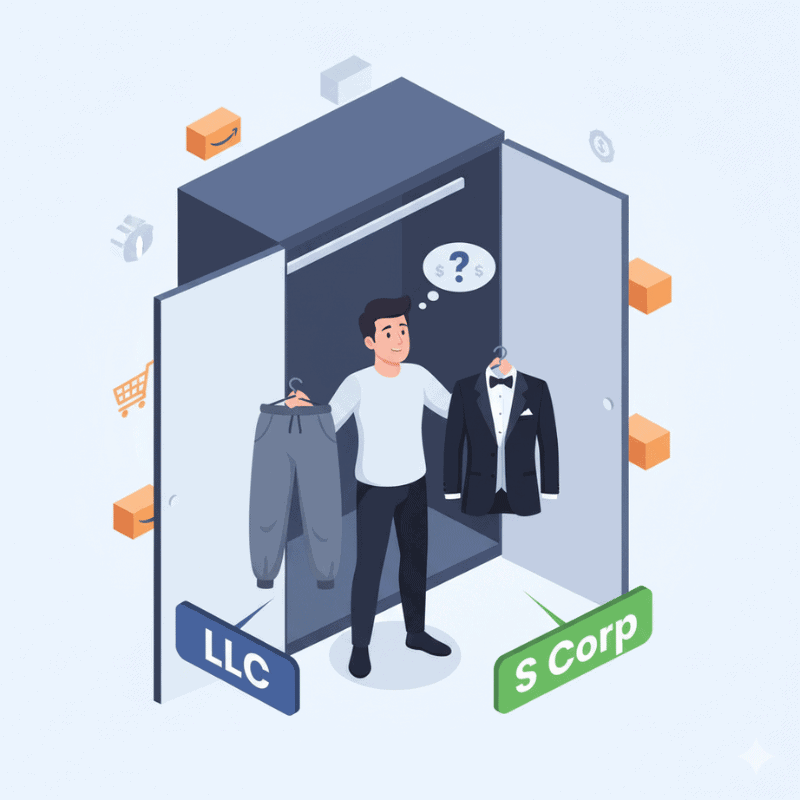

LLC 101: The Sweatpants of Business Structures

Quick Takeaways:

- Flexible and easy to set up.

- Protects personal assets from business risks.

- Pass-through taxation (profits flow to your personal return).

- Downside: all profits hit with self-employment tax.

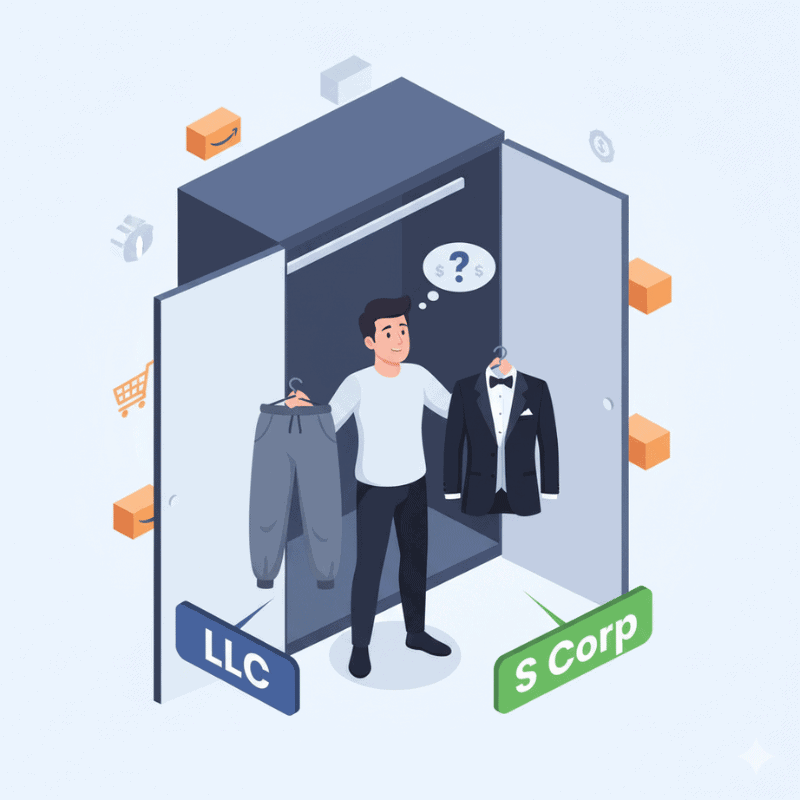

An LLC (Limited Liability Company) is the most popular starting point for Amazon sellers, and for good reason. Think of it as the sweatpants of business structures: flexible, comfortable, and no one expects you to iron them.

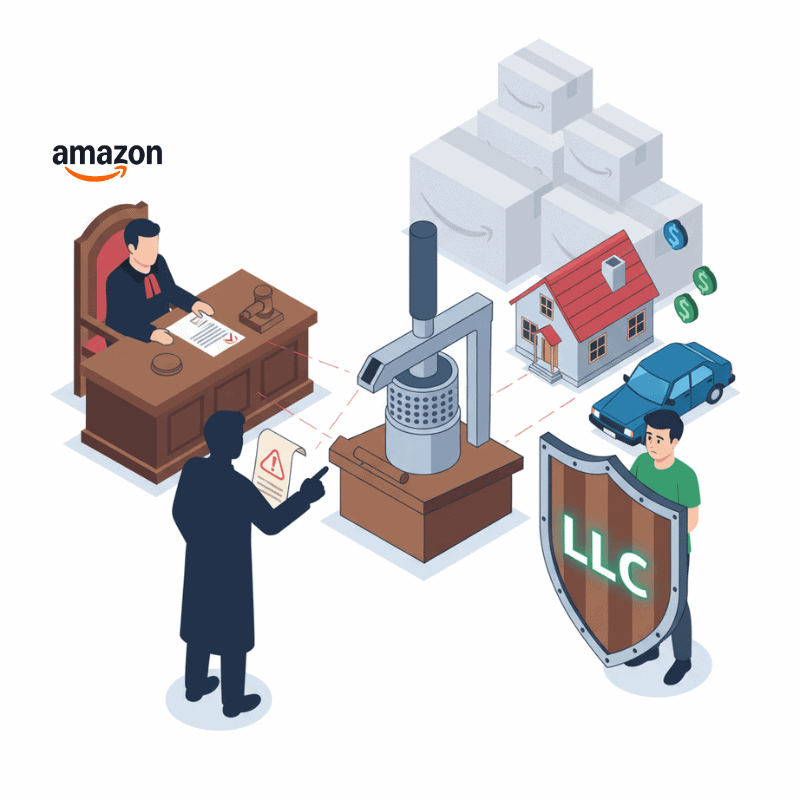

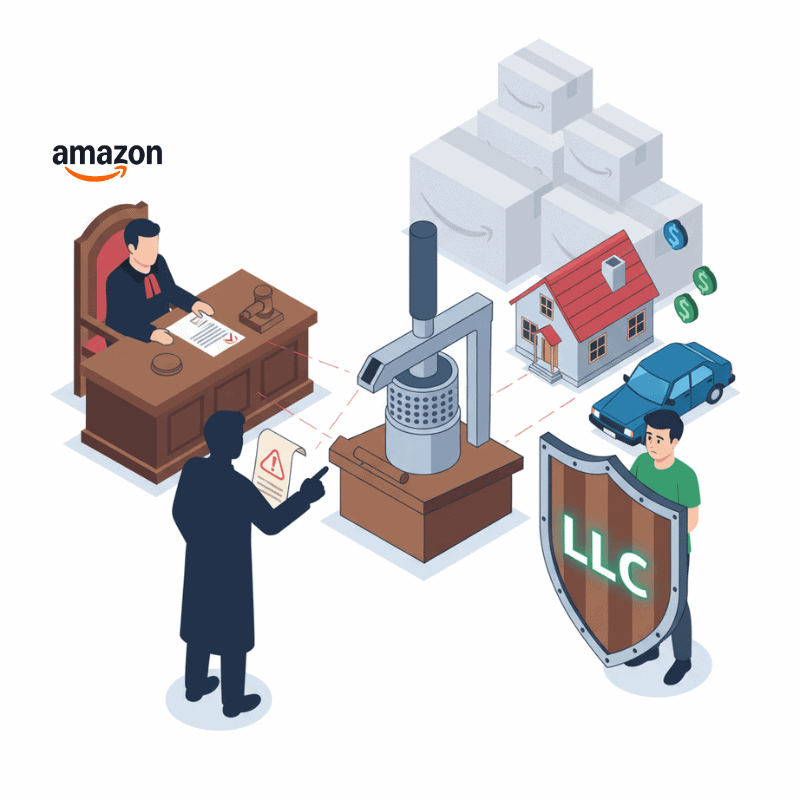

The main perk? Liability protection. If your Amazon garlic press suddenly turns into a medieval weapon and a customer sues, your personal assets (house, car, savings) are generally shielded. Unlike a sole proprietorship, where you and your business are one and the same, the LLC draws a legal line in the sand.

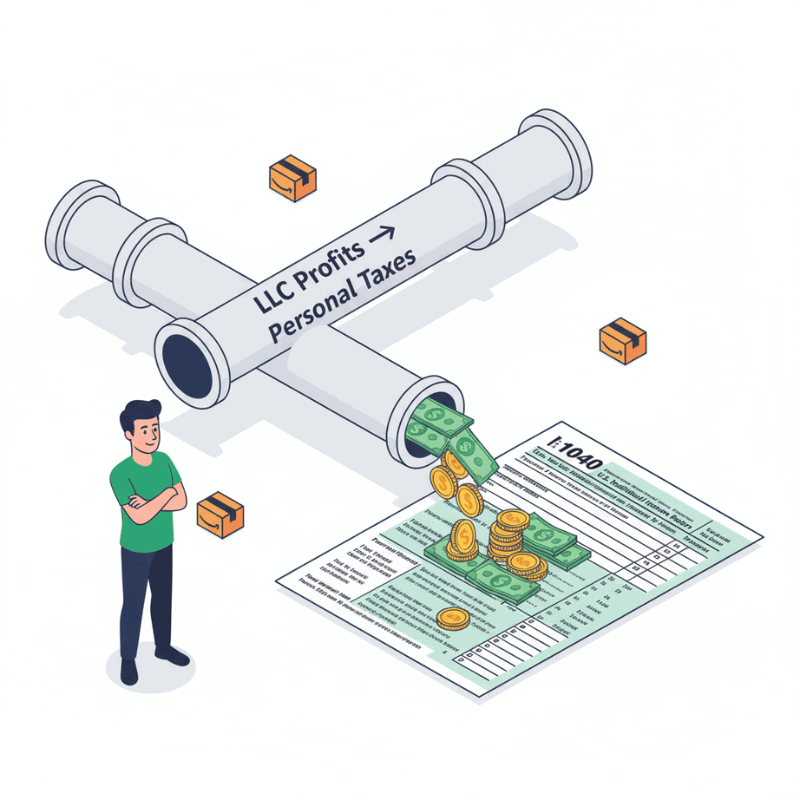

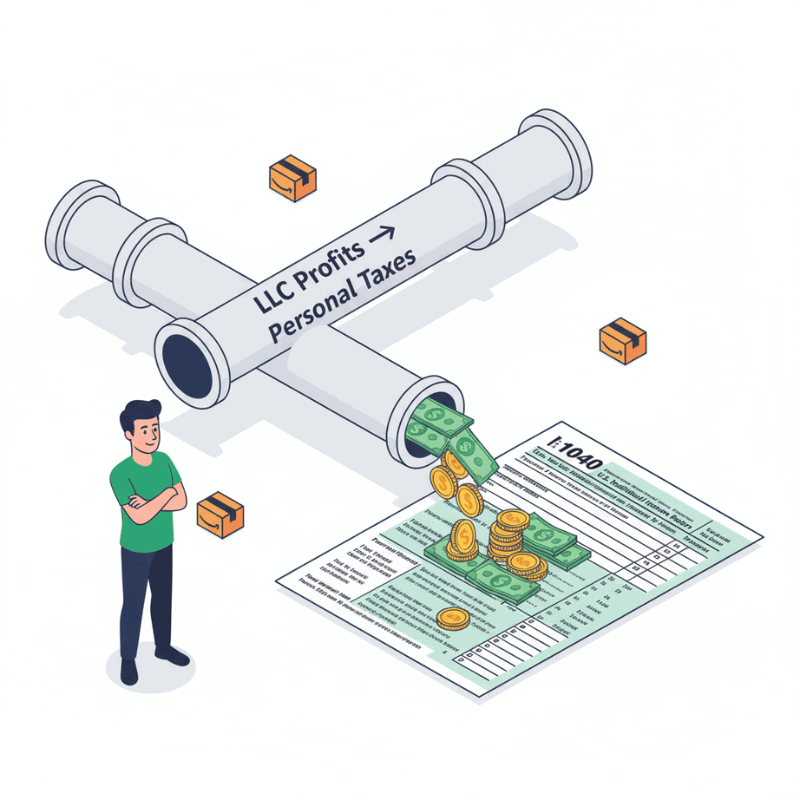

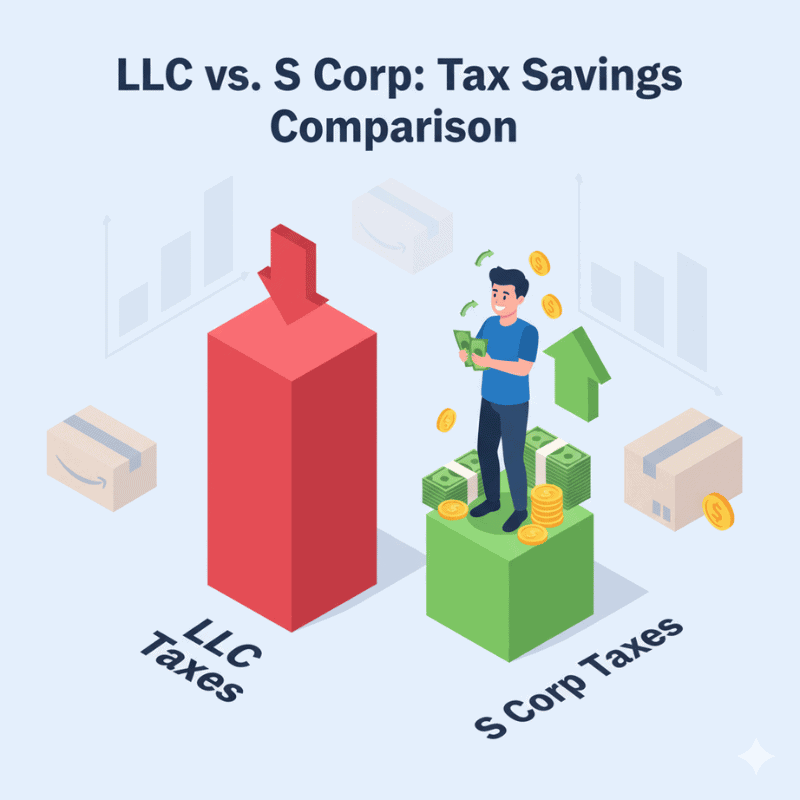

From a tax perspective, the IRS sees LLCs as pass-through entities. Profits flow directly to your personal return, avoiding the dreaded “double taxation” of a C Corp. Simple enough.

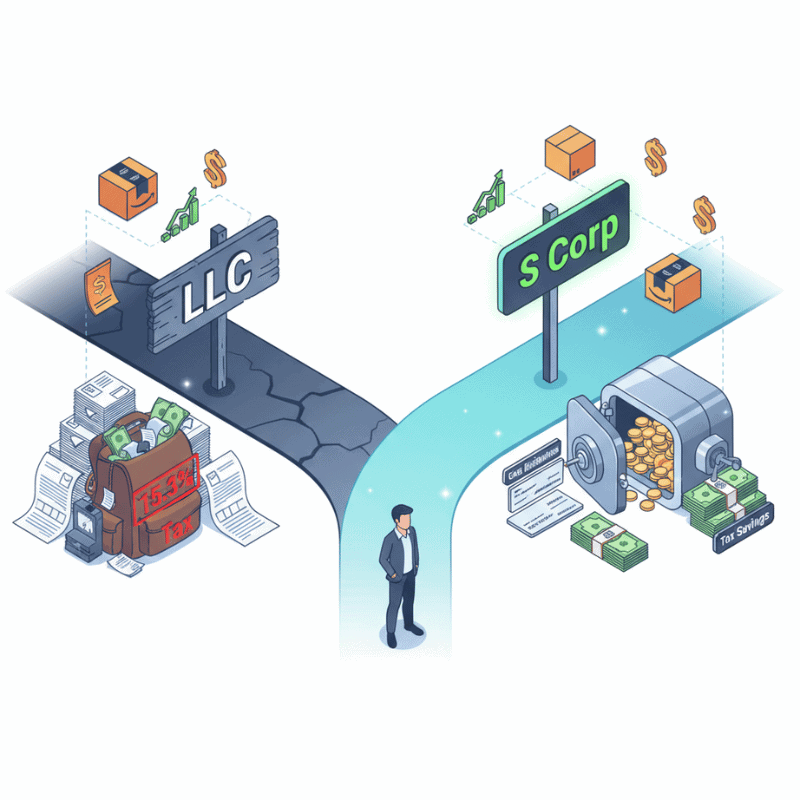

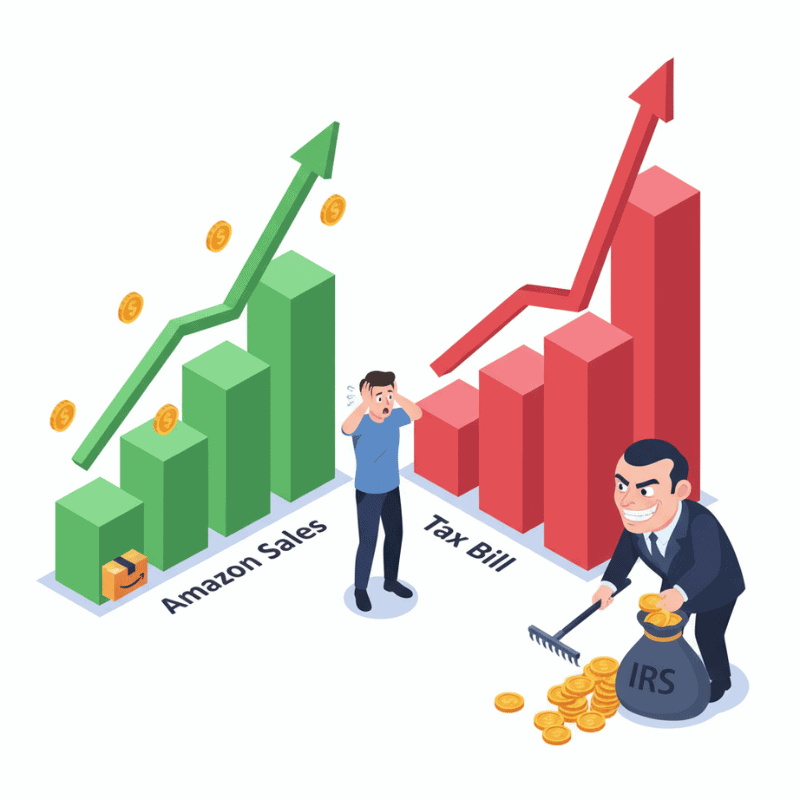

But here’s the catch: as an LLC owner, you pay self-employment tax on all profits — 15.3% for Social Security and Medicare. Ouch. That means once your Amazon sales grow, your tax bill grows right along with it.

So while LLCs are simple and flexible, they don’t save you much on taxes once you start scaling your Amazon FBA business.

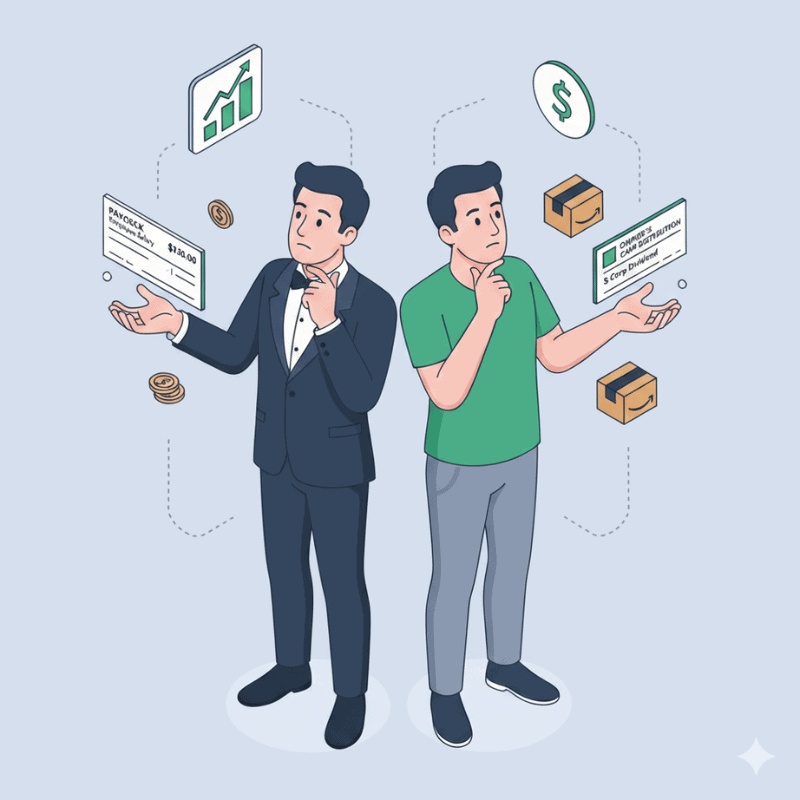

S Corp 101: The Business Tuxedo

Quick Takeaways:

- S Corp is a tax election, not a business type.

- Lets you pay yourself a salary + distributions.

- Only salary gets hit with payroll tax; distributions avoid self-employment tax.

- More compliance required (payroll, filings, accounting).

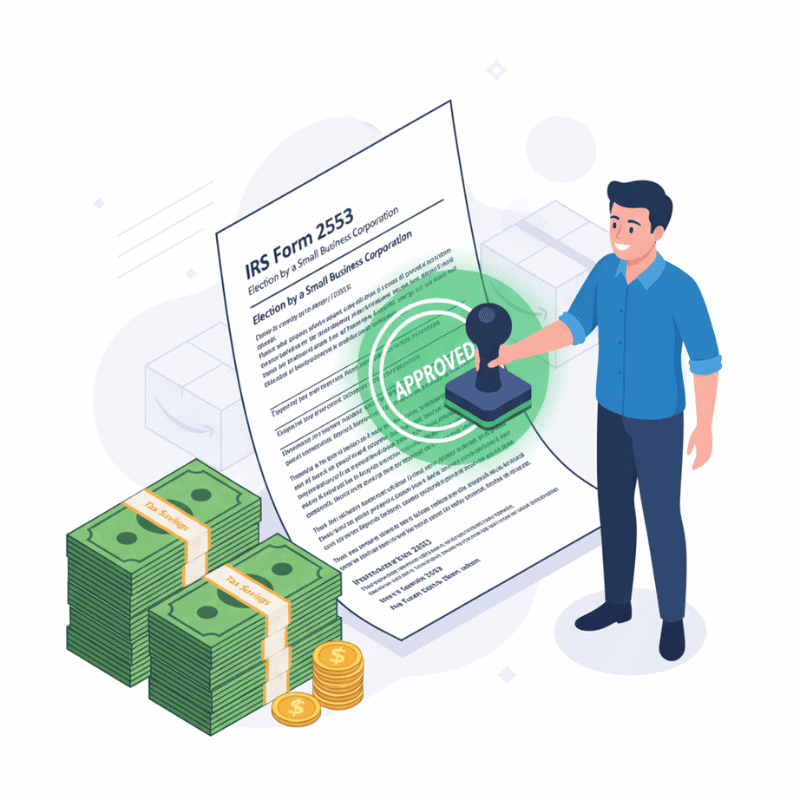

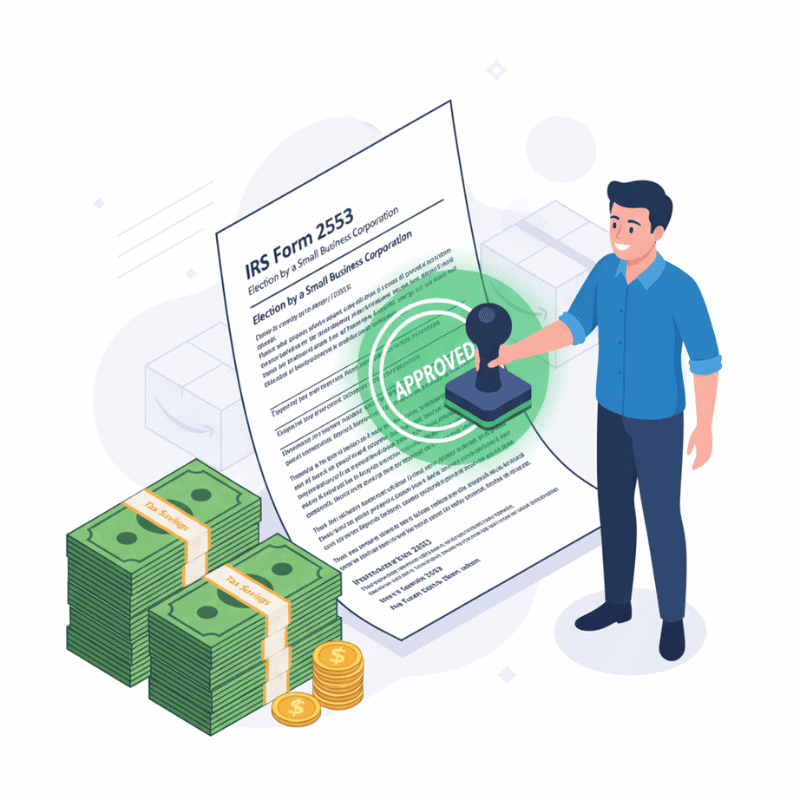

An S Corp (Subchapter S Corporation) isn’t a business type you can just “form” outright. You create an LLC (or a C Corp), then file IRS Form 2553 to elect S Corp status.

If an LLC is sweatpants, an S Corp is a tuxedo: sharper, more impressive, and capable of saving you money — but higher maintenance.

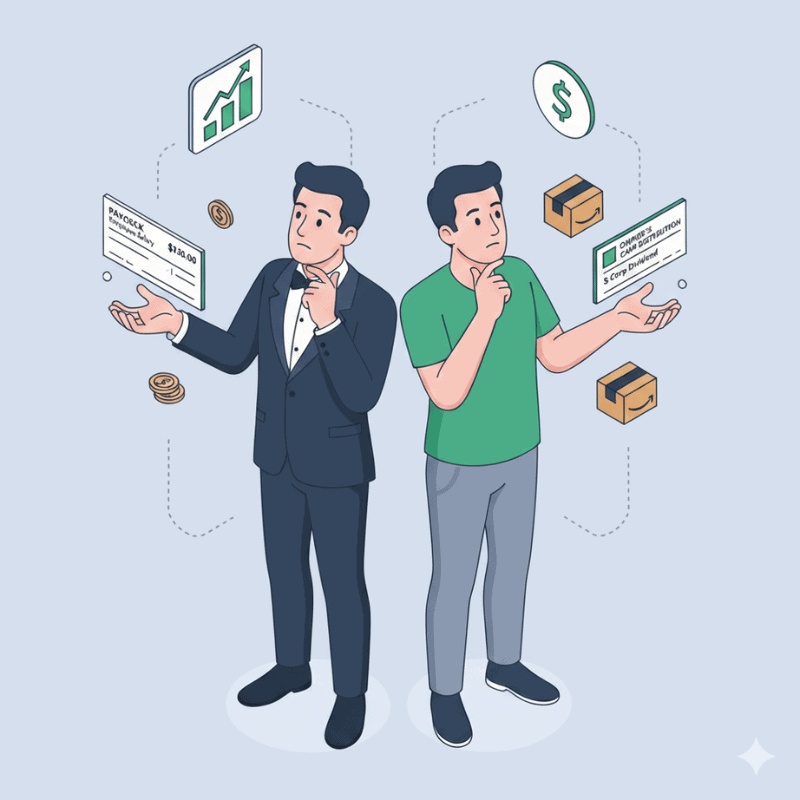

Here’s why: as an S Corp owner, you wear two hats. You’re both employee and shareholder. You pay yourself a “reasonable salary” (IRS-speak for “don’t pay yourself $1 just to dodge taxes”), and only that salary gets hit with payroll taxes. The rest of your profits? You take them as distributions, which are not subject to self-employment tax.

That’s where the real savings kick in. For many Amazon sellers, choosing LLC vs S Corp comes down to one thing: saving thousands in taxes every year once profits grow.

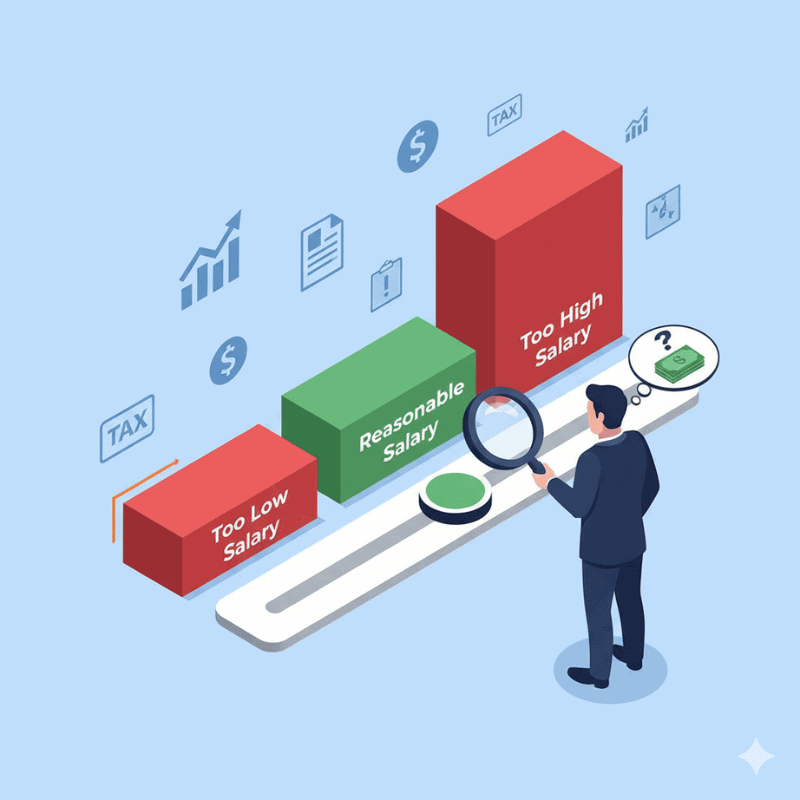

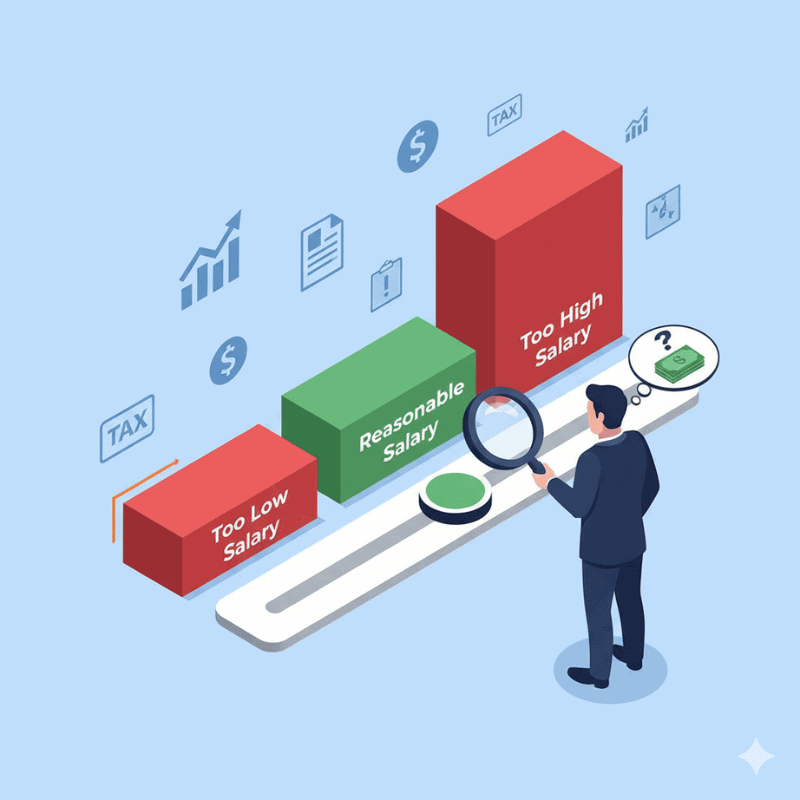

The IRS’s Favorite Vague Term: “Reasonable Salary”

The phrase “reasonable compensation” is famously fuzzy. The IRS won’t give you a hard number. Instead, they expect your salary to be comparable to what someone in your role would earn in a similar business.

For Amazon sellers, that means looking at:

- Your profit levels.

- Time spent running your store.

- The tasks you are performing.

- Industry averages.

Pay yourself too little, and the IRS may reclassify your distributions as wages (hello, back taxes + penalties). Pay yourself too much, and you miss out on the S Corp’s biggest tax advantage.

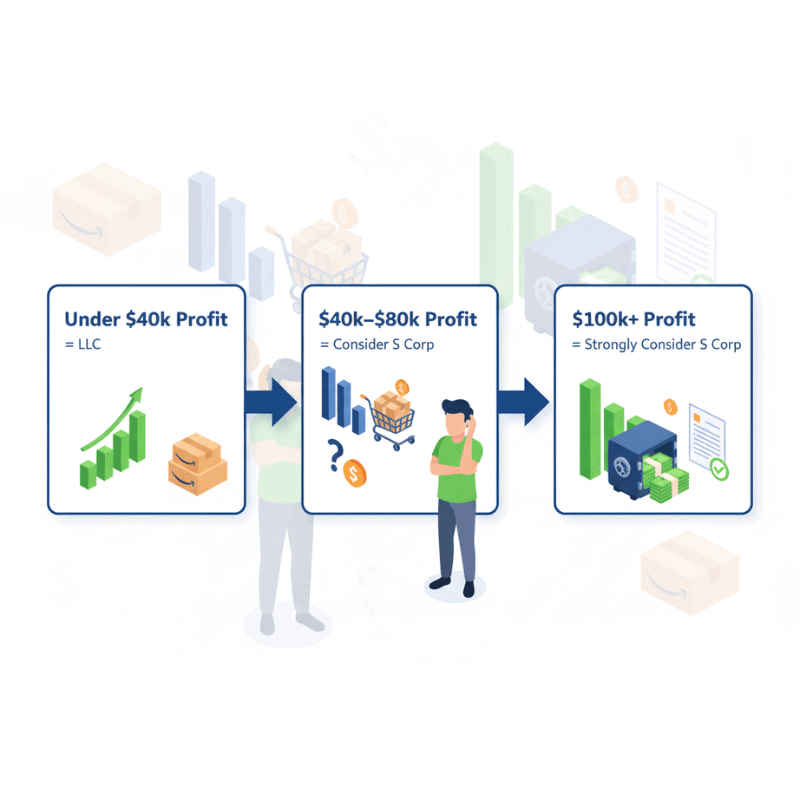

The Amazon Seller’s Dilemma: When to Switch

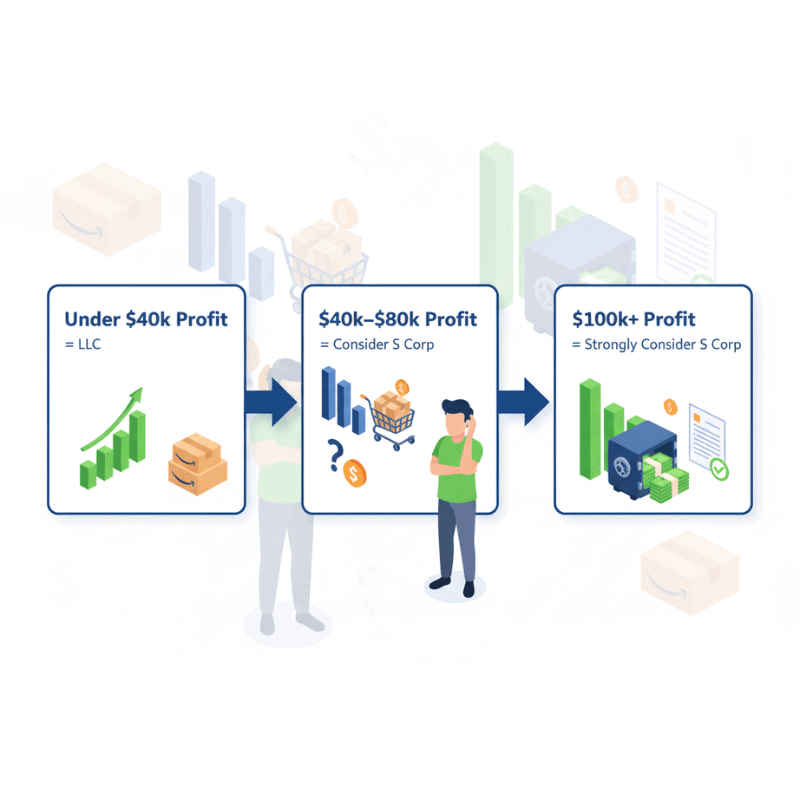

Many Amazon sellers ask: At what point should I switch from LLC to S Corp? The answer depends on profitability and complexity.

Typically, once your Amazon business clears around $40,000–$50,000 in annual profit, the tax savings of an S Corp begin to outweigh the additional costs of payroll, accounting, and compliance.

Switching too early means unnecessary overhead; switching too late means leaving money on the table for the IRS.

Final Verdict: Sweatpants or Tuxedo?

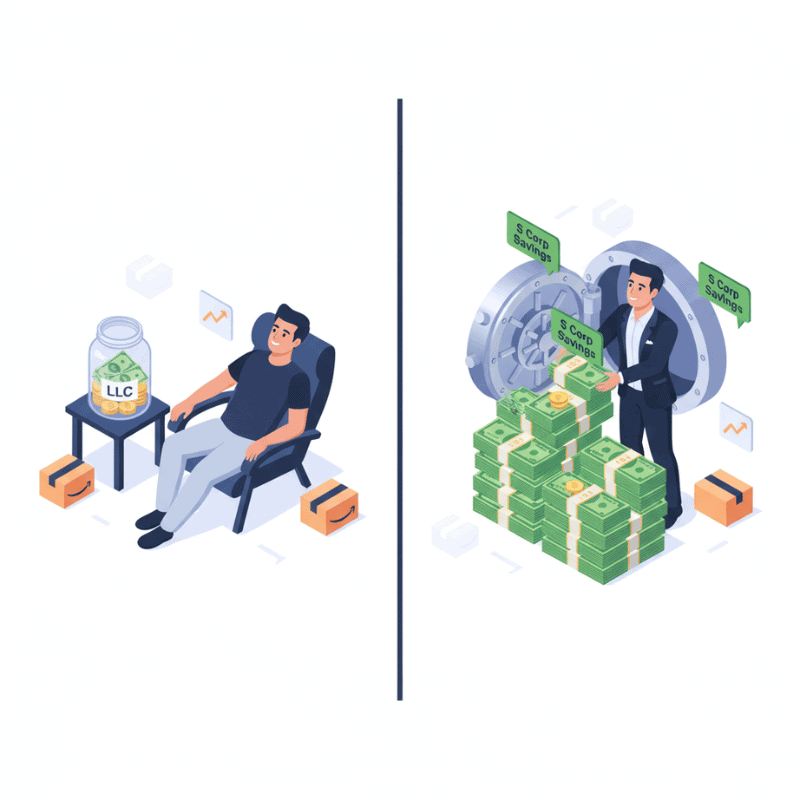

When it comes to LLC vs S Corp for Amazon sellers, the right choice depends on your stage of growth and appetite for complexity. LLCs are simple, low-maintenance, and protective. S Corps demand more structure but reward you with significant tax savings once you’re profitable.

For most Amazon FBA entrepreneurs, the journey starts with an LLC. Once profits grow and taxes bite harder, the S Corp election is a natural next step — your business tuxedo for the big leagues.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

Taxes, liability, and take-home pay — discover which structure Amazon sellers are choosing in 2025 and why it matters more than you think.

key points

Let’s be honest: talking about LLC vs S Corp as a business structure for Amazon sellers is about as exciting as reading the fine print on your Wi-Fi contract. Necessary? Yes. Thrilling? Only if you count the adrenaline rush of realizing you could have saved thousands in taxes last year.

But here’s the deal: the decision between an LLC and an S Corp isn’t just legal jargon. For Amazon sellers and e-commerce entrepreneurs, it can mean the difference between pocketing more of your hard-earned profits… or handing them to the IRS like an involuntary tip.

And since most guides on this topic read like a tax law textbook, we’re going to do things differently. We’ll use plain English, a little wit, and some real-world Amazon seller context. By the end, you’ll know whether your business should stay comfortably in LLC land or level up to S Corp status — without nodding off halfway through.

Table of Contents

LLC 101: The Sweatpants of Business Structures

Quick Takeaways:

- Flexible and easy to set up.

- Protects personal assets from business risks.

- Pass-through taxation (profits flow to your personal return).

- Downside: all profits hit with self-employment tax.

An LLC (Limited Liability Company) is the most popular starting point for Amazon sellers, and for good reason. Think of it as the sweatpants of business structures: flexible, comfortable, and no one expects you to iron them.

The main perk? Liability protection. If your Amazon garlic press suddenly turns into a medieval weapon and a customer sues, your personal assets (house, car, savings) are generally shielded. Unlike a sole proprietorship, where you and your business are one and the same, the LLC draws a legal line in the sand.

From a tax perspective, the IRS sees LLCs as pass-through entities. Profits flow directly to your personal return, avoiding the dreaded “double taxation” of a C Corp. Simple enough.

But here’s the catch: as an LLC owner, you pay self-employment tax on all profits — 15.3% for Social Security and Medicare. Ouch. That means once your Amazon sales grow, your tax bill grows right along with it.

So while LLCs are simple and flexible, they don’t save you much on taxes once you start scaling your Amazon FBA business.

S Corp 101: The Business Tuxedo

Quick Takeaways:

- S Corp is a tax election, not a business type.

- Lets you pay yourself a salary + distributions.

- Only salary gets hit with payroll tax; distributions avoid self-employment tax.

- More compliance required (payroll, filings, accounting).

An S Corp (Subchapter S Corporation) isn’t a business type you can just “form” outright. You create an LLC (or a C Corp), then file IRS Form 2553 to elect S Corp status.

If an LLC is sweatpants, an S Corp is a tuxedo: sharper, more impressive, and capable of saving you money — but higher maintenance.

Here’s why: as an S Corp owner, you wear two hats. You’re both employee and shareholder. You pay yourself a “reasonable salary” (IRS-speak for “don’t pay yourself $1 just to dodge taxes”), and only that salary gets hit with payroll taxes. The rest of your profits? You take them as distributions, which are not subject to self-employment tax.

That’s where the real savings kick in. For many Amazon sellers, choosing LLC vs S Corp comes down to one thing: saving thousands in taxes every year once profits grow.

The IRS’s Favorite Vague Term: “Reasonable Salary”

The phrase “reasonable compensation” is famously fuzzy. The IRS won’t give you a hard number. Instead, they expect your salary to be comparable to what someone in your role would earn in a similar business.

For Amazon sellers, that means looking at:

- Your profit levels.

- Time spent running your store.

- The tasks you are performing.

- Industry averages.

Pay yourself too little, and the IRS may reclassify your distributions as wages (hello, back taxes + penalties). Pay yourself too much, and you miss out on the S Corp’s biggest tax advantage.

The Amazon Seller’s Dilemma: When to Switch

Many Amazon sellers ask: At what point should I switch from LLC to S Corp? The answer depends on profitability and complexity.

Typically, once your Amazon business clears around $40,000–$50,000 in annual profit, the tax savings of an S Corp begin to outweigh the additional costs of payroll, accounting, and compliance.

Switching too early means unnecessary overhead; switching too late means leaving money on the table for the IRS.

Final Verdict: Sweatpants or Tuxedo?

When it comes to LLC vs S Corp for Amazon sellers, the right choice depends on your stage of growth and appetite for complexity. LLCs are simple, low-maintenance, and protective. S Corps demand more structure but reward you with significant tax savings once you’re profitable.

For most Amazon FBA entrepreneurs, the journey starts with an LLC. Once profits grow and taxes bite harder, the S Corp election is a natural next step — your business tuxedo for the big leagues.

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.