Filing a BOI Report: What Every Small Business Owner Needs to Know

key points

Table of Contents

- What Is the BOI Report, and Why Does It Matter?

- Who Needs to File a BOI Report?

- When Do You Need to File the BOI Report?

- Why Do Businesses Need to File the BOI Report?

- What Happens if I Don’t File a BOI Report?

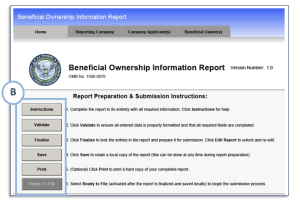

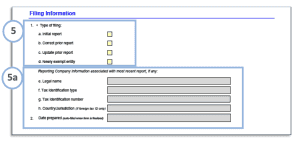

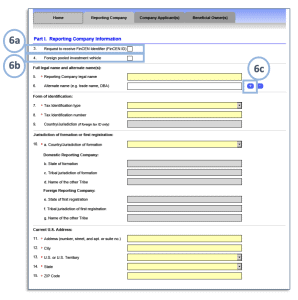

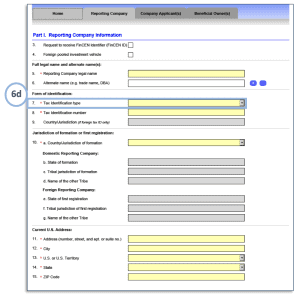

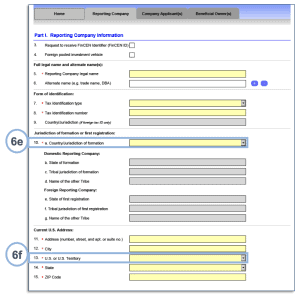

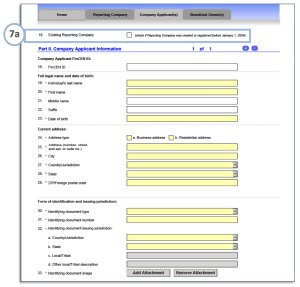

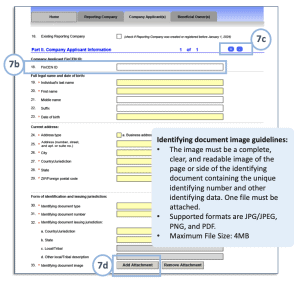

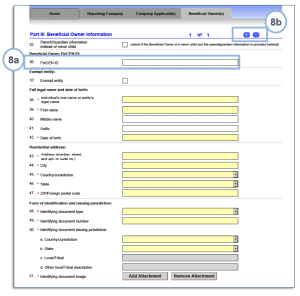

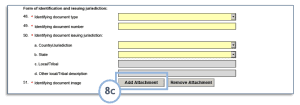

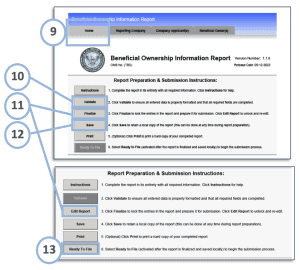

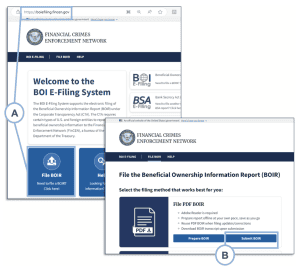

- Step-by-Step Guide on How to Fill Out a BOI Report

- Simplifying Your BOI Report Submission

- Frequently Asked Questions (FAQ)

Imagine running a thriving Amazon storefront. Inventory is stocked, orders are rolling in, and you’re heading into the year’s busiest season.

Everything is going smoothly until Amazon sends a request—a required form from the U.S. government: the Beneficial Ownership Information (BOI) Report. At first glance, it seems like just another form.

But this isn’t just paperwork; it’s a legal requirement under the Corporate Transparency Act (CTA) designed to uncover who truly owns and controls businesses across the U.S. For eCommerce owners, failing to file the BOI Report correctly could mean penalties, delays in financial processes, or even damage to your business’s credibility with key partners.

Amazon might give only three days to submit the report upon request, with the threat of suspending your account if you miss the deadline. This would not only shut off your income instantly but also trigger fines of $500 per day (up to $10,000) and could even lead to two years in jail.

As of late 2024, Amazon hasn’t started doing this check, but it will likely happen starting in 2025. But the federal fines are real and are here now.

For many eCommerce sellers, accurately completing the BOI Report is critical to avoiding setbacks like these. Imagine if Amazon flagged your account over BOI compliance issues—but with even higher stakes.

This story serves as a cautionary reminder of the serious financial and operational risks that can arise when compliance is neglected. This guide walks through each step to help you stay compliant, credible, and ready for growth without unnecessary interruptions.

What Is the BOI Report, and Why Does It Matter?

The BOI Report is more than just another government form. It’s the U.S. government’s way of uncovering who truly controls a business. The term “beneficial owner” refers to those individuals who, either by ownership or authority, hold significant influence within a company. This information helps the government track suspicious activity, prevent financial crimes like money laundering, and ensure businesses operate transparently.

For many businesses, the BOI Report isn’t just a checkbox. It’s a statement of credibility. The report communicates that the company has nothing to hide and operates with integrity. Transparency like this can build trust—not just with the government but also with clients, partners, and investors.

Who Needs to File a BOI Report?

Most small to mid-sized corporations, LLCs, and similar entities must file a BOI Report. Under the CTA, these businesses must disclose their beneficial owners to ensure full transparency.

If your company is set up as a corporation, LLC, or similar entity, chances are high that a BOI Report is required.

Exemptions in BOI Filling

Not every business is required to file a BOI report. Certain legal entities are exempt due to their existing regulatory obligations or specific operational structure. Currently, 23 types of legal entities are exempt from providing beneficial ownership information under the Corporate Transparency Act. Here’s a quick overview:

- Large Operating Companies: Companies with more than 20 employees and at least $5 million in revenue qualify for an exemption.

- Financial Institutions: Banks, credit unions, and certain accounting firms do not need to file since they’re already regulated under stringent financial reporting rules.

- Publicly Traded Companies and Tax-Exempt Organizations: These entities are already subject to rigorous public disclosure requirements, so they are excluded from the BOI filing requirement.

- Utility Companies: Certain public utility companies are also exempt.

Some foreign entities, such as foreign reporting companies that ceased operations and were formally dissolved before January 1, 2024, do not need to file a BOI report. Additionally, foreign pooled investment vehicles (FPIVs) are exempt from reporting individual beneficial owners if they meet specific criteria. FPIVs are typically large investment funds where multiple investors pool their money to buy assets, often accessible only to accredited or large-scale investors.

If you’re unsure whether your company qualifies for an exemption, the FinCEN Small Entity Compliance Guide provides a detailed list of exempt entities.

Notably, most small businesses and e-commerce companies do not fall within these exemption categories, meaning they will likely need to file a BOI report.

Who Counts as a Beneficial Owner?

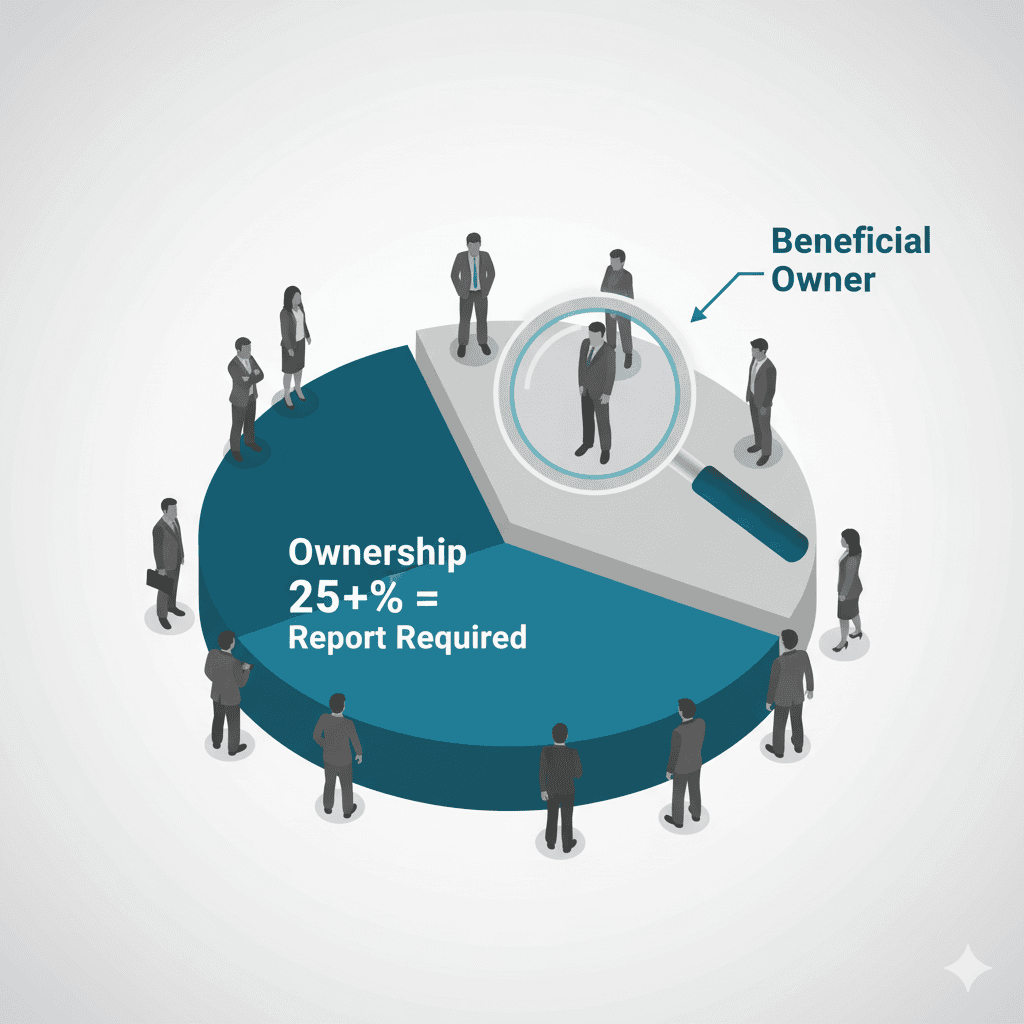

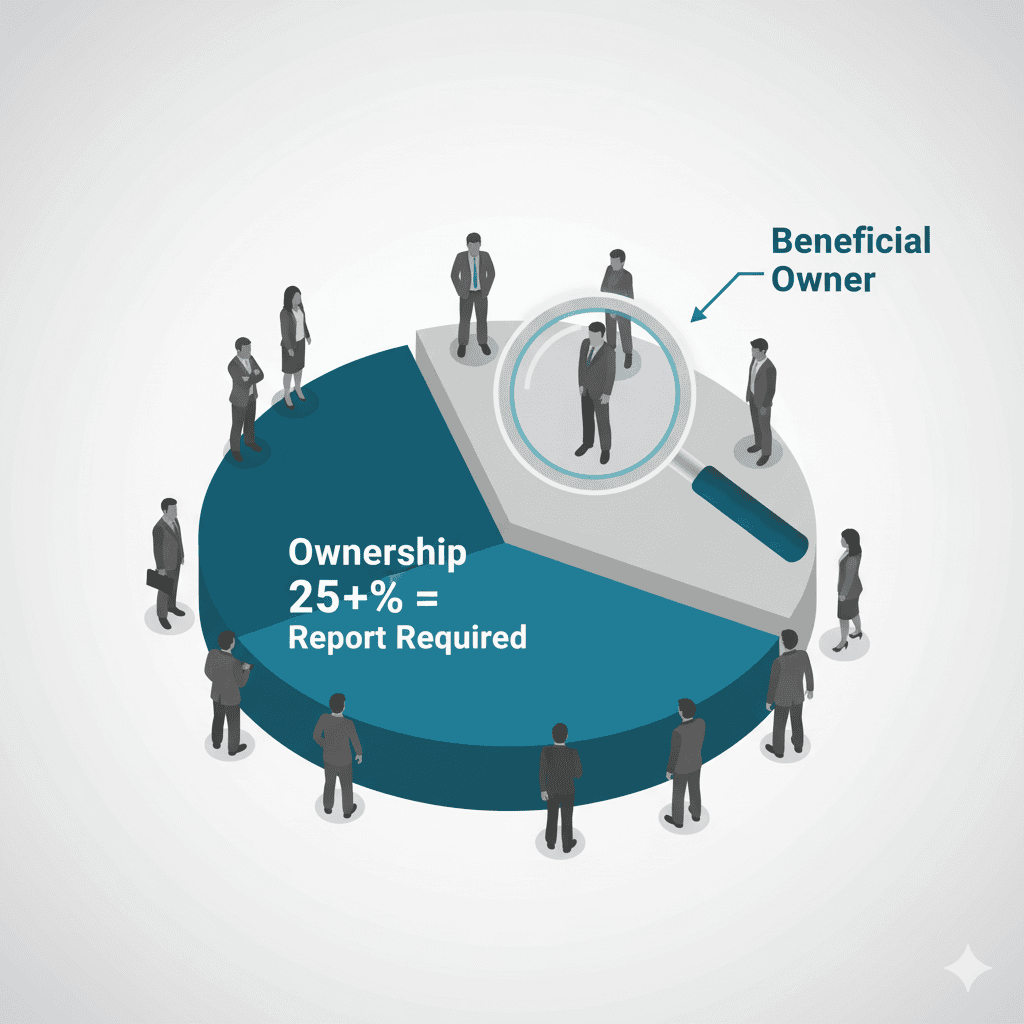

The term “beneficial owner” isn’t just a label for anyone who holds stock. It specifically refers to people who own at least 25% of a company or have significant control over its decision-making processes. This focuses on individuals who shape the company’s direction and strategy.

For instance, a major stakeholder who influences company decisions would be a beneficial owner. The CTA aims to identify these key figures to maintain a transparent business environment, ensuring that every owner and key decision-maker is identified.

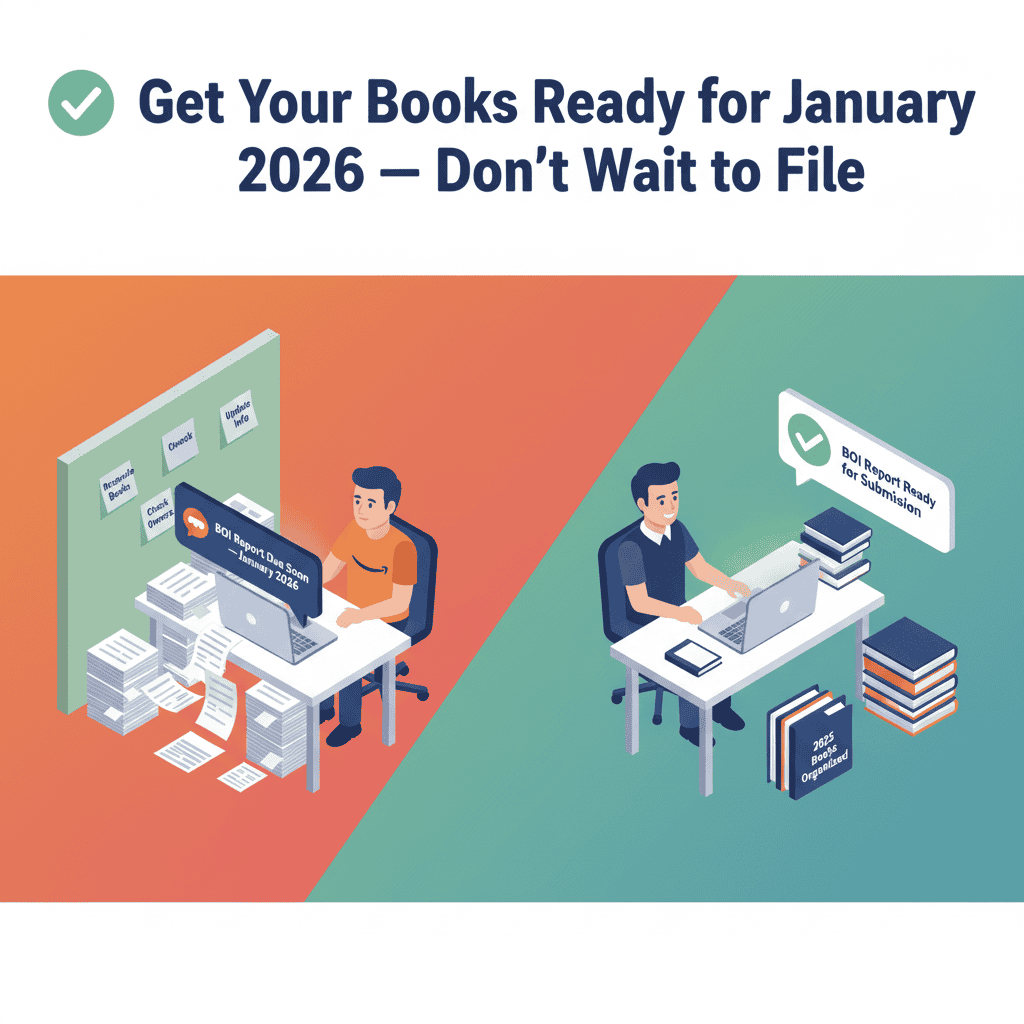

When Do You Need to File the BOI Report?

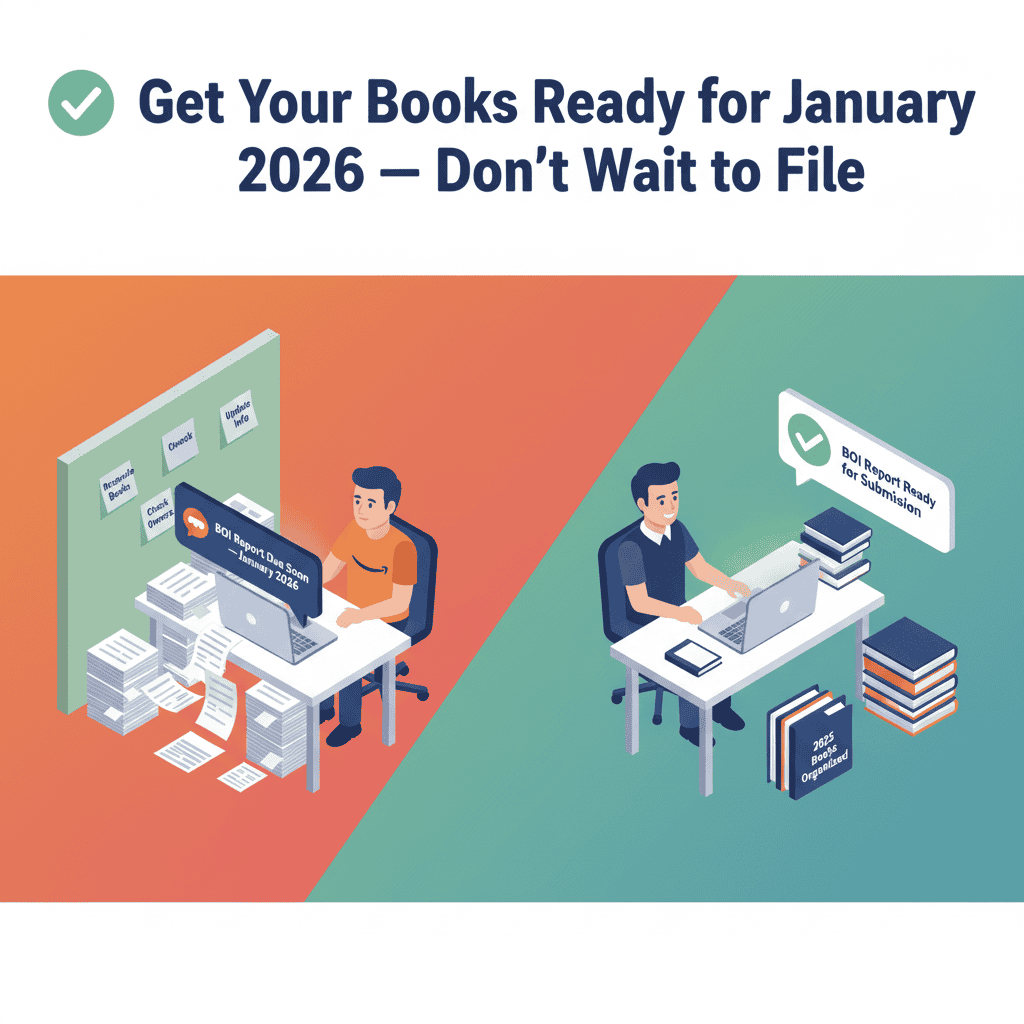

What changed? U.S. (domestic) companies are no longer required to file BOI reports. In March 2025, FinCEN issued an interim final rule that exempts entities formed in the United States from BOI reporting (initial, updates, and corrections). Only certain foreign entities registered to do business in the U.S. still have BOI obligations.

1) New U.S. Entities (formed in 2024, 2025, or 2026): No BOI filing is required under the current rule. Prior examples about 90-day or 30-day windows and the March 21, 2025 extension no longer apply to U.S. companies.

2) Existing U.S. Entities (formed before 2024): No BOI filing is required under the current rule, and there’s no need to submit updates/corrections, either.

3) Foreign Entities Registered to Do Business in the U.S.

These remain in scope:

-

If registered before March 26, 2025: Initial BOI report was due by April 25, 2025.

-

If registered on/after March 26, 2025 (including 2026): File the initial BOI report within 30 calendar days of the earlier of (a) actual notice of registration or (b) first public notice (e.g., state database).

-

Updates/Corrections: Foreign reporting companies must update or correct BOI within 30 days of the change or when the company becomes aware of (or has reason to know of) an inaccuracy.

-

U.S. persons do not need to be reported as beneficial owners of these foreign companies, and U.S. persons have no BOI reporting obligation with respect to these entities.

4) Disaster-area extensions: FinCEN continues to issue storm-related deadline extensions (six-month relief windows tied to FEMA/IRS designations). This relief now matters primarily for foreign reporting companies located in affected areas. Always check the current FinCEN notices to confirm eligibility.

Why Do Businesses Need to File the BOI Report?

The requirement for the BOI Report serves specific purposes. It isn’t just paperwork for paperwork’s sake. This report plays an important role in keeping businesses transparent and in line with U.S. financial regulations.

Promoting Transparency

The BOI Report provides honest businesses a chance to show they operate with integrity. It promotes transparency by ensuring the true owners are visible to regulators and the public. Transparency like this strengthens trust across the business world and adds credibility to companies that are clear about their ownership.

Preventing Financial Crimes

Crimes like money laundering, tax evasion, and fraud have a major economic impact. By requiring ownership information, the BOI Report adds a layer of transparency that helps the government trace financial activities. This extra measure makes it harder for bad actors to hide behind anonymous shell companies, adding an extra layer of accountability.

Increasing Accountability

The BOI Report also discourages criminal behavior by requiring owners to come forward. By keeping beneficial ownership in the open, it raises accountability and helps regulators monitor who is running each business. It’s a win-win for ethical companies, as they can show they follow the rules and meet industry standards.

What Happens if I Don’t File a BOI Report?

Failing to file a BOI Report on time can lead to serious consequences for your business:

- Financial Penalties: Non-compliance with BOI reporting requirements can result in fines of up to $500 per day, capped at a maximum of $10,000. This can quickly become a significant expense, especially for small business owners.

- Potential Jail Time: Persistent failure to file the BOI Report could lead to criminal charges, with penalties of up to two years in jail for willful non-compliance.

- Business Disruptions: Non-compliance could lead to flagged accounts or suspended services from platforms like Amazon, payment processors, or banks, all of whom may start requiring proof of BOI compliance. This could cut off income streams, create cash flow issues, and damage business relationships.

Staying compliant with BOI requirements helps avoid these disruptions and maintain steady operations

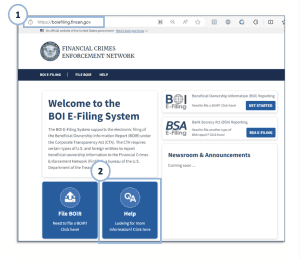

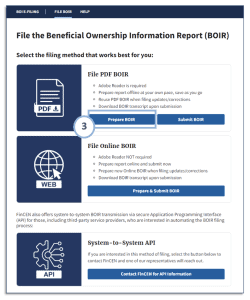

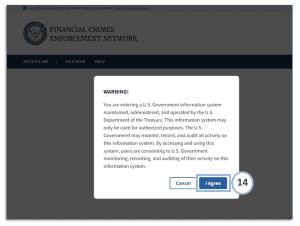

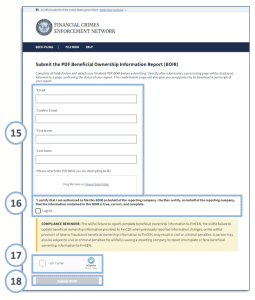

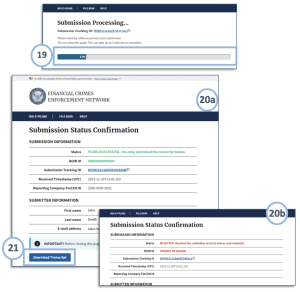

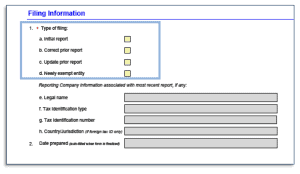

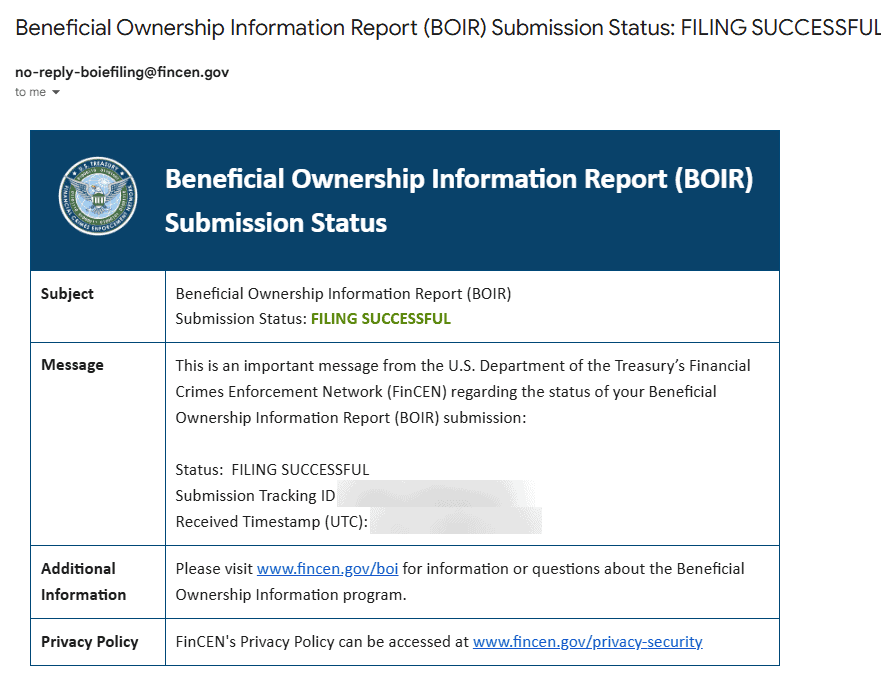

Step-by-Step Guide on How to Fill Out a BOI Report

With the background covered, let’s dive into the actual process of filling out a BOI Report. The following steps break down what’s needed to submit the form correctly.

Simplifying Your BOI Report Submission

Completing the BOI Report is an essential step for businesses operating under the Corporate Transparency Act. Following this guide simplifies the process, helping companies stay compliant and avoid the risks associated with errors or delays. Submitting an accurate BOI Report shows that the business values transparency, integrity, and accountability, allowing owners to focus on growth confidently.

Disclaimer: The information provided here is based on the Financial Crimes Enforcement Network (FinCEN) guidelines. This guide is for informational purposes only and should not be considered legal advice. Tall Oak Advisors is not a law firm; we do not provide legal services or advice. Please consult a qualified attorney for personalized assistance or legal advice on filing BOI Reports.

Frequently Asked Questions (FAQ)

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

12 Comments

Leave A Comment

Filing a BOI Report: What Every Small Business Owner Needs to Know

key points

Table of Contents

- What Is the BOI Report, and Why Does It Matter?

- Who Needs to File a BOI Report?

- When Do You Need to File the BOI Report?

- Why Do Businesses Need to File the BOI Report?

- What Happens if I Don’t File a BOI Report?

- Step-by-Step Guide on How to Fill Out a BOI Report

- Simplifying Your BOI Report Submission

- Frequently Asked Questions (FAQ)

Imagine running a thriving Amazon storefront. Inventory is stocked, orders are rolling in, and you’re heading into the year’s busiest season.

Everything is going smoothly until Amazon sends a request—a required form from the U.S. government: the Beneficial Ownership Information (BOI) Report. At first glance, it seems like just another form.

But this isn’t just paperwork; it’s a legal requirement under the Corporate Transparency Act (CTA) designed to uncover who truly owns and controls businesses across the U.S. For eCommerce owners, failing to file the BOI Report correctly could mean penalties, delays in financial processes, or even damage to your business’s credibility with key partners.

Amazon might give only three days to submit the report upon request, with the threat of suspending your account if you miss the deadline. This would not only shut off your income instantly but also trigger fines of $500 per day (up to $10,000) and could even lead to two years in jail.

As of late 2024, Amazon hasn’t started doing this check, but it will likely happen starting in 2025. But the federal fines are real and are here now.

For many eCommerce sellers, accurately completing the BOI Report is critical to avoiding setbacks like these. Imagine if Amazon flagged your account over BOI compliance issues—but with even higher stakes.

This story serves as a cautionary reminder of the serious financial and operational risks that can arise when compliance is neglected. This guide walks through each step to help you stay compliant, credible, and ready for growth without unnecessary interruptions.

What Is the BOI Report, and Why Does It Matter?

The BOI Report is more than just another government form. It’s the U.S. government’s way of uncovering who truly controls a business. The term “beneficial owner” refers to those individuals who, either by ownership or authority, hold significant influence within a company. This information helps the government track suspicious activity, prevent financial crimes like money laundering, and ensure businesses operate transparently.

For many businesses, the BOI Report isn’t just a checkbox. It’s a statement of credibility. The report communicates that the company has nothing to hide and operates with integrity. Transparency like this can build trust—not just with the government but also with clients, partners, and investors.

Who Needs to File a BOI Report?

Most small to mid-sized corporations, LLCs, and similar entities must file a BOI Report. Under the CTA, these businesses must disclose their beneficial owners to ensure full transparency.

If your company is set up as a corporation, LLC, or similar entity, chances are high that a BOI Report is required.

Exemptions in BOI Filling

Not every business is required to file a BOI report. Certain legal entities are exempt due to their existing regulatory obligations or specific operational structure. Currently, 23 types of legal entities are exempt from providing beneficial ownership information under the Corporate Transparency Act. Here’s a quick overview:

- Large Operating Companies: Companies with more than 20 employees and at least $5 million in revenue qualify for an exemption.

- Financial Institutions: Banks, credit unions, and certain accounting firms do not need to file since they’re already regulated under stringent financial reporting rules.

- Publicly Traded Companies and Tax-Exempt Organizations: These entities are already subject to rigorous public disclosure requirements, so they are excluded from the BOI filing requirement.

- Utility Companies: Certain public utility companies are also exempt.

Some foreign entities, such as foreign reporting companies that ceased operations and were formally dissolved before January 1, 2024, do not need to file a BOI report. Additionally, foreign pooled investment vehicles (FPIVs) are exempt from reporting individual beneficial owners if they meet specific criteria. FPIVs are typically large investment funds where multiple investors pool their money to buy assets, often accessible only to accredited or large-scale investors.

If you’re unsure whether your company qualifies for an exemption, the FinCEN Small Entity Compliance Guide provides a detailed list of exempt entities.

Notably, most small businesses and e-commerce companies do not fall within these exemption categories, meaning they will likely need to file a BOI report.

Who Counts as a Beneficial Owner?

The term “beneficial owner” isn’t just a label for anyone who holds stock. It specifically refers to people who own at least 25% of a company or have significant control over its decision-making processes. This focuses on individuals who shape the company’s direction and strategy.

For instance, a major stakeholder who influences company decisions would be a beneficial owner. The CTA aims to identify these key figures to maintain a transparent business environment, ensuring that every owner and key decision-maker is identified.

When Do You Need to File the BOI Report?

What changed? U.S. (domestic) companies are no longer required to file BOI reports. In March 2025, FinCEN issued an interim final rule that exempts entities formed in the United States from BOI reporting (initial, updates, and corrections). Only certain foreign entities registered to do business in the U.S. still have BOI obligations.

1) New U.S. Entities (formed in 2024, 2025, or 2026): No BOI filing is required under the current rule. Prior examples about 90-day or 30-day windows and the March 21, 2025 extension no longer apply to U.S. companies.

2) Existing U.S. Entities (formed before 2024): No BOI filing is required under the current rule, and there’s no need to submit updates/corrections, either.

3) Foreign Entities Registered to Do Business in the U.S.

These remain in scope:

-

If registered before March 26, 2025: Initial BOI report was due by April 25, 2025.

-

If registered on/after March 26, 2025 (including 2026): File the initial BOI report within 30 calendar days of the earlier of (a) actual notice of registration or (b) first public notice (e.g., state database).

-

Updates/Corrections: Foreign reporting companies must update or correct BOI within 30 days of the change or when the company becomes aware of (or has reason to know of) an inaccuracy.

-

U.S. persons do not need to be reported as beneficial owners of these foreign companies, and U.S. persons have no BOI reporting obligation with respect to these entities.

4) Disaster-area extensions: FinCEN continues to issue storm-related deadline extensions (six-month relief windows tied to FEMA/IRS designations). This relief now matters primarily for foreign reporting companies located in affected areas. Always check the current FinCEN notices to confirm eligibility.

Why Do Businesses Need to File the BOI Report?

The requirement for the BOI Report serves specific purposes. It isn’t just paperwork for paperwork’s sake. This report plays an important role in keeping businesses transparent and in line with U.S. financial regulations.

Promoting Transparency

The BOI Report provides honest businesses a chance to show they operate with integrity. It promotes transparency by ensuring the true owners are visible to regulators and the public. Transparency like this strengthens trust across the business world and adds credibility to companies that are clear about their ownership.

Preventing Financial Crimes

Crimes like money laundering, tax evasion, and fraud have a major economic impact. By requiring ownership information, the BOI Report adds a layer of transparency that helps the government trace financial activities. This extra measure makes it harder for bad actors to hide behind anonymous shell companies, adding an extra layer of accountability.

Increasing Accountability

The BOI Report also discourages criminal behavior by requiring owners to come forward. By keeping beneficial ownership in the open, it raises accountability and helps regulators monitor who is running each business. It’s a win-win for ethical companies, as they can show they follow the rules and meet industry standards.

What Happens if I Don’t File a BOI Report?

Failing to file a BOI Report on time can lead to serious consequences for your business:

- Financial Penalties: Non-compliance with BOI reporting requirements can result in fines of up to $500 per day, capped at a maximum of $10,000. This can quickly become a significant expense, especially for small business owners.

- Potential Jail Time: Persistent failure to file the BOI Report could lead to criminal charges, with penalties of up to two years in jail for willful non-compliance.

- Business Disruptions: Non-compliance could lead to flagged accounts or suspended services from platforms like Amazon, payment processors, or banks, all of whom may start requiring proof of BOI compliance. This could cut off income streams, create cash flow issues, and damage business relationships.

Staying compliant with BOI requirements helps avoid these disruptions and maintain steady operations

Step-by-Step Guide on How to Fill Out a BOI Report

With the background covered, let’s dive into the actual process of filling out a BOI Report. The following steps break down what’s needed to submit the form correctly.

Simplifying Your BOI Report Submission

Completing the BOI Report is an essential step for businesses operating under the Corporate Transparency Act. Following this guide simplifies the process, helping companies stay compliant and avoid the risks associated with errors or delays. Submitting an accurate BOI Report shows that the business values transparency, integrity, and accountability, allowing owners to focus on growth confidently.

Disclaimer: The information provided here is based on the Financial Crimes Enforcement Network (FinCEN) guidelines. This guide is for informational purposes only and should not be considered legal advice. Tall Oak Advisors is not a law firm; we do not provide legal services or advice. Please consult a qualified attorney for personalized assistance or legal advice on filing BOI Reports.

Frequently Asked Questions (FAQ)

Take Control of Your Finances Today!

Whether you’re a Reseller (Wholesale, Retail Arbitrage, Online Arbitrage, Dropshipping) or a Brand Owner, managing finances is key to your success. We support eCommerce businesses across major platforms like Amazon, Shopify, eBay, Walmart, Etsy, BigCommerce, and beyond.

See if you qualify for a free strategy session with our team to learn how Tall Oak Advisors can streamline your bookkeeping and ensure accurate tax preparation for your business.

Need a quick quote?

Or explore our range of free resources crafted specifically for eCommerce sellers:

- 7 Profit Crushing Mistakes That Will Destroy Your eCommerce Business

- Business Tax Worksheet

- Frequently Asked Questions About Taxes and Bookkeeping

- Tax Write-Offs Every Amazon and Shopify Seller Should Know

Take the first step toward a stronger financial future and position your business for long-term success.

12 Comments

-

okay, but how long does filling out a BOI report actually take?

-

took me like 10 mins, not too bad

-

-

Imagine not filing and getting that surprise fine. Lol, will be real spooky.

-

I have a sole prop. Do I have to do this?

-

Makes sense, better get on that.

-

Love how easy this article made it seem. I just did it – took me less than 15 mins.

okay, but how long does filling out a BOI report actually take?

took me like 10 mins, not too bad

Imagine not filing and getting that surprise fine. Lol, will be real spooky.

Yeah, with margins so tight, no one needs this!

I have a sole prop. Do I have to do this?

No. Sole Proprietors do not need to do this.

Makes sense, better get on that.

Definitely!

Love how easy this article made it seem. I just did it – took me less than 15 mins.

It is easy! Glad it didn’t take you too long.